- Canada

- /

- Metals and Mining

- /

- TSXV:AZS

TSX Penny Stocks To Consider In October 2024

Reviewed by Simply Wall St

The Canadian market has seen a notable upswing, with a 1.0% increase over the last week and an impressive 27% rise in the past year, alongside forecasts of annual earnings growth at 16%. In light of these conditions, identifying stocks with strong fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks may be considered a dated term, but they continue to represent viable investment options by offering access to smaller or newer companies that could capitalize on current market momentum.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PharmaTher Holdings (CNSX:PHRM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PharmaTher Holdings Ltd. is a specialty pharmaceutical company focused on developing and commercializing pharmaceuticals with novel delivery methods to improve patient outcomes, with a market cap of CA$25.67 million.

Operations: PharmaTher Holdings Ltd. has not reported any distinct revenue segments.

Market Cap: CA$25.67M

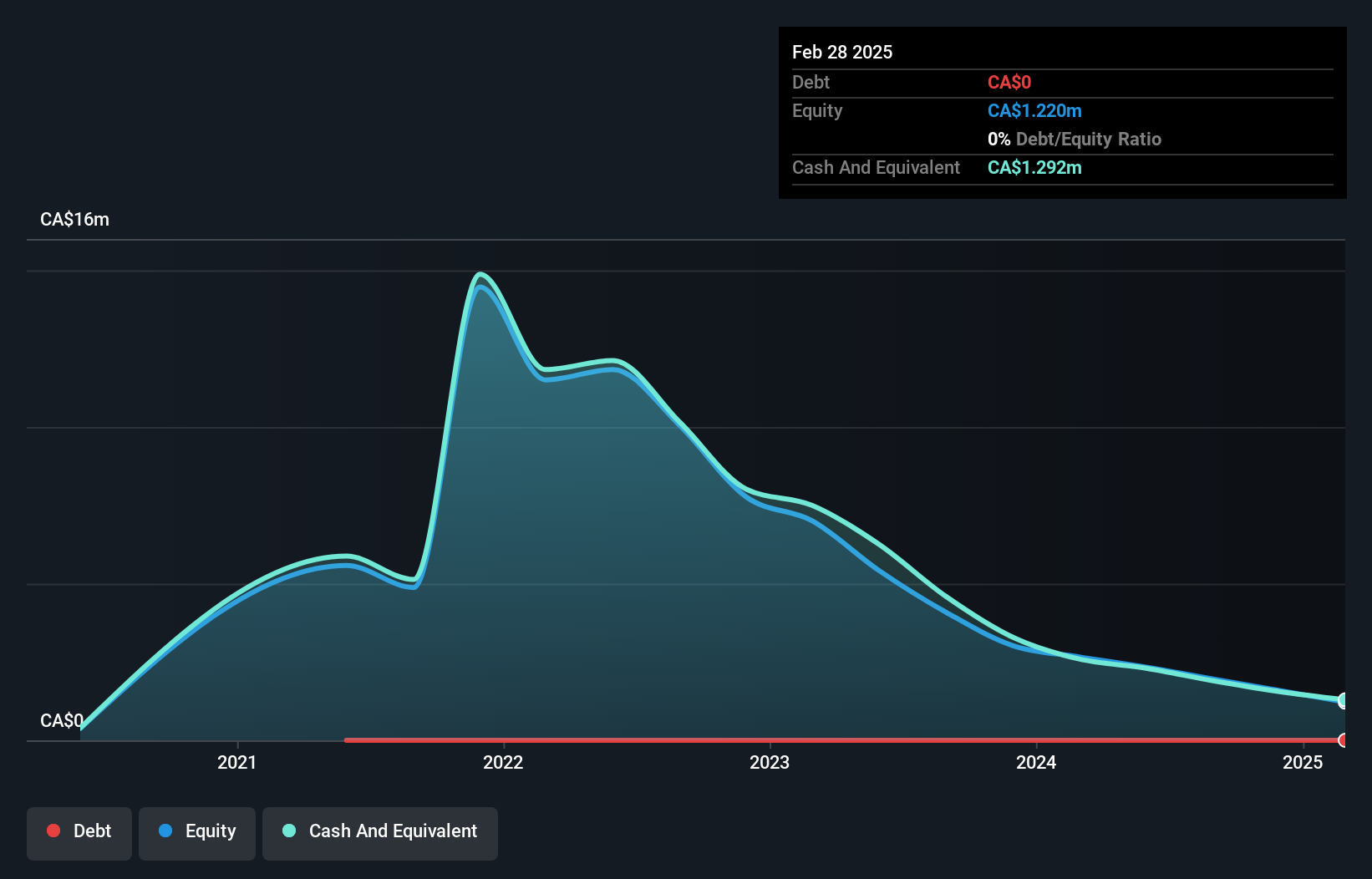

PharmaTher Holdings Ltd., with a market cap of CA$25.67 million, is pre-revenue and debt-free, though it faces financial constraints with less than a year of cash runway. The company reported a reduced net loss of CA$3.12 million for the year ended May 31, 2024, down from CA$6.42 million the previous year. Its strategic focus on ketamine development is underscored by an ongoing FDA review for its New Drug Application, targeting Parkinson's Disease and addressing U.S. ketamine shortages. Despite high volatility in share price and negative return on equity, no significant shareholder dilution occurred recently.

- Dive into the specifics of PharmaTher Holdings here with our thorough balance sheet health report.

- Gain insights into PharmaTher Holdings' historical outcomes by reviewing our past performance report.

Arizona Gold & Silver (TSXV:AZS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arizona Gold & Silver Inc. is involved in acquiring and exploring mineral properties in the United States, with a market cap of CA$35.51 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$35.51M

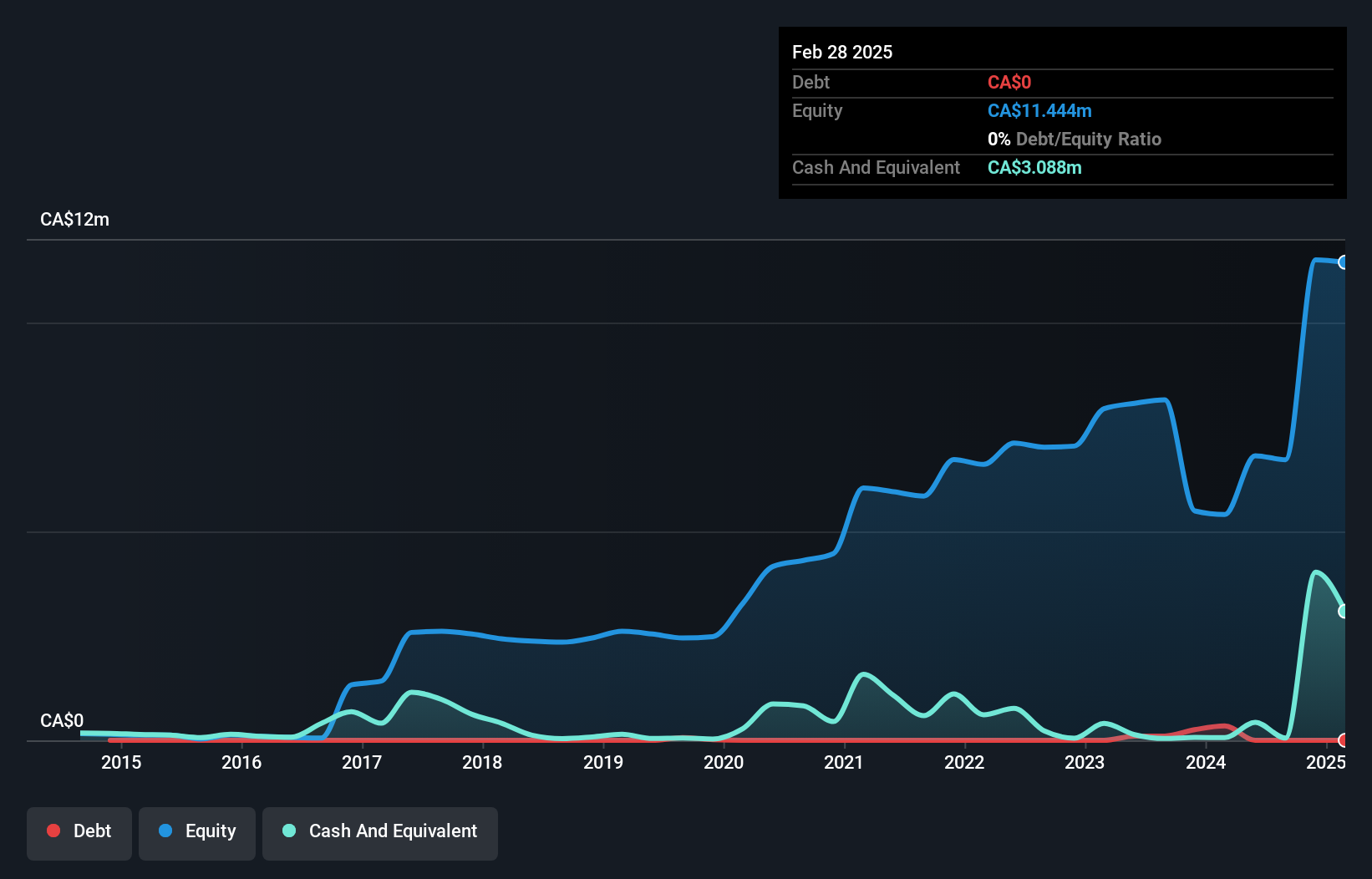

Arizona Gold & Silver Inc., with a market cap of CA$35.51 million, is pre-revenue and debt-free, but faces financial challenges with only a short cash runway despite recent capital raises. The company has seen shareholder dilution, issuing new shares in private placements to fund operations. It recently advanced its Philadelphia Gold-Silver property project by preparing for diamond core drilling at Red Hills, aiming to explore mineralization extensions. The board has undergone changes with the appointment of experienced directors like John McVey, bringing substantial mining sector expertise. Despite stable weekly volatility, the company remains unprofitable with increasing losses over five years.

- Get an in-depth perspective on Arizona Gold & Silver's performance by reading our balance sheet health report here.

- Evaluate Arizona Gold & Silver's historical performance by accessing our past performance report.

Benz Mining (TSXV:BZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Benz Mining Corp. focuses on the acquisition, exploration, and exploitation of mineral properties in the Americas and has a market cap of CA$38.06 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$38.06M

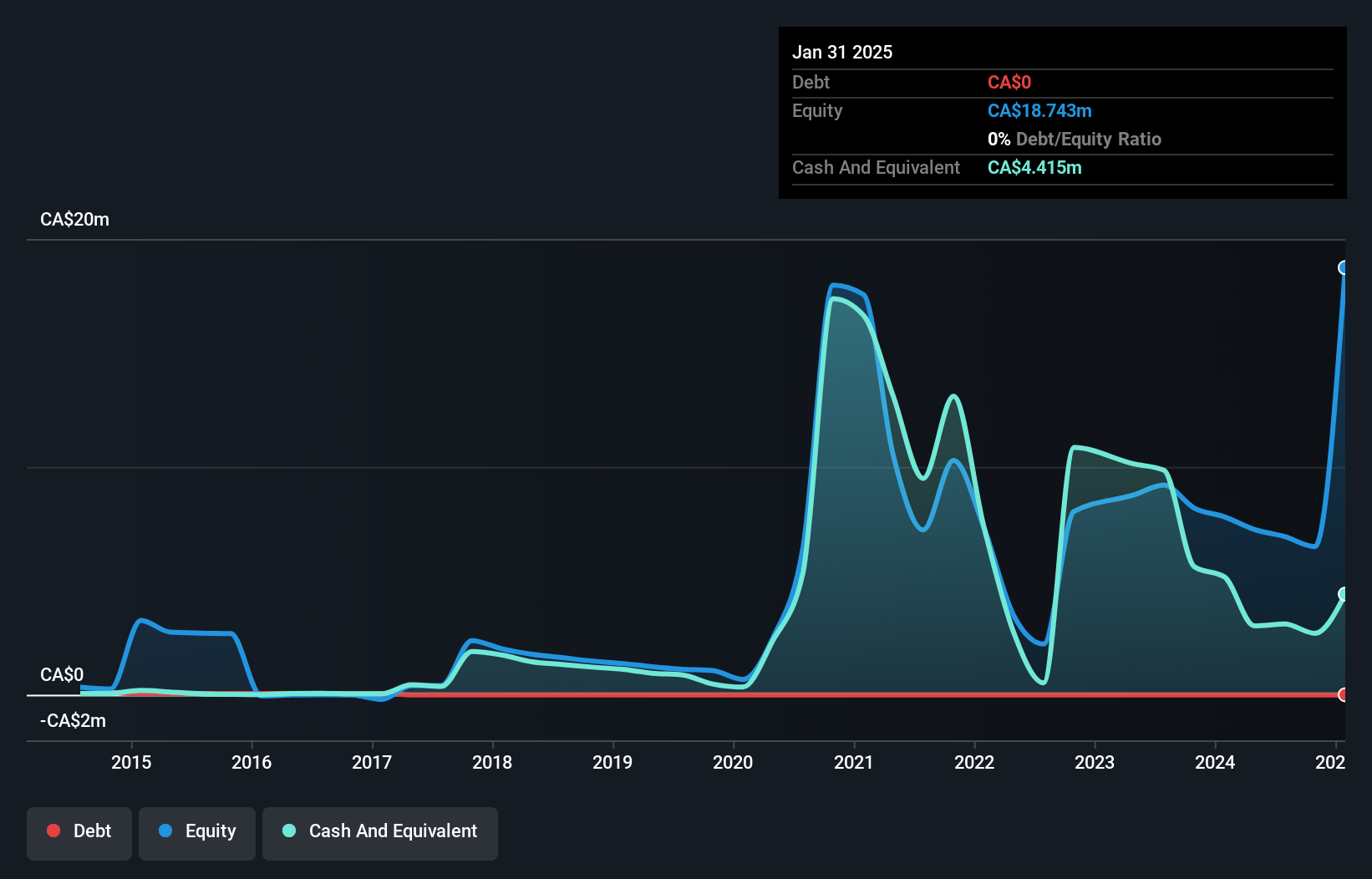

Benz Mining Corp., with a market cap of CA$38.06 million, is pre-revenue and debt-free, yet faces financial pressures with less than a year of cash runway as free cash flow continues to decline. The company has not diluted shareholders recently and maintains an experienced management team and board. Despite its unprofitability, Benz Mining's net loss decreased to CA$0.37527 million for the quarter ended July 31, 2024, from CA$1.39 million the previous year. However, it remains highly volatile compared to most Canadian stocks and continues to experience increasing losses over five years at 9.8% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Benz Mining.

- Examine Benz Mining's past performance report to understand how it has performed in prior years.

Make It Happen

- Click here to access our complete index of 947 TSX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AZS

Arizona Gold & Silver

Engages in the acquisition and exploration of mineral properties in the United States.

Excellent balance sheet moderate.

Market Insights

Community Narratives