Is Liberty Leaf Holdings (CSE:LIB) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Liberty Leaf Holdings (CSE:LIB) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Liberty Leaf Holdings

When Might Liberty Leaf Holdings Run Out Of Money?

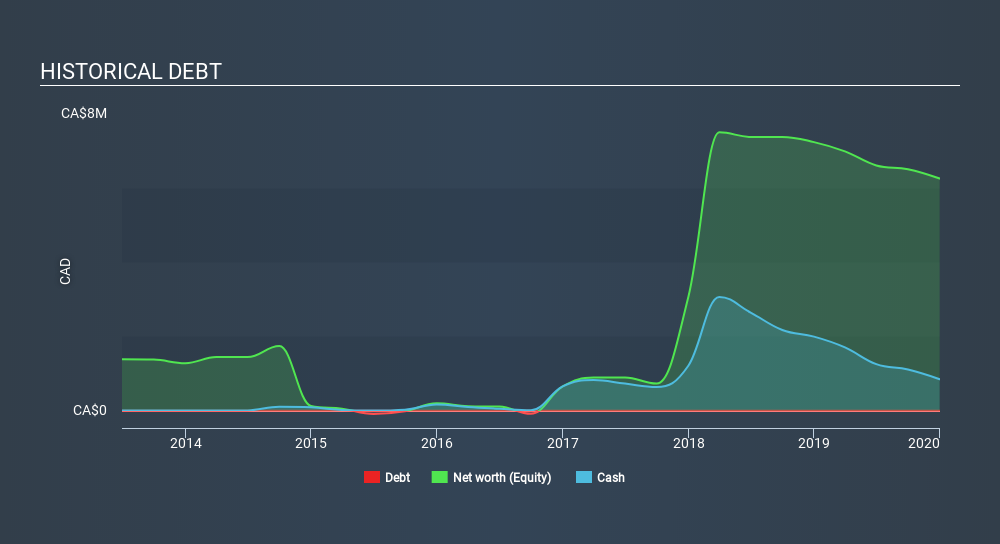

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2019, Liberty Leaf Holdings had cash of CA$847k and no debt. Importantly, its cash burn was CA$879k over the trailing twelve months. So it had a cash runway of approximately 12 months from December 2019. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Liberty Leaf Holdings's Cash Burn Changing Over Time?

Whilst it's great to see that Liberty Leaf Holdings has already begun generating revenue from operations, last year it only produced CA$7.2k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Given the length of the cash runway, we'd interpret the 38% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Admittedly, we're a bit cautious of Liberty Leaf Holdings due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Liberty Leaf Holdings To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Liberty Leaf Holdings to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CA$8.4m, Liberty Leaf Holdings's CA$879k in cash burn equates to about 11% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Liberty Leaf Holdings's Cash Burn?

On this analysis of Liberty Leaf Holdings's cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Liberty Leaf Holdings's situation. Separately, we looked at different risks affecting the company and spotted 5 warning signs for Liberty Leaf Holdings (of which 4 are potentially serious!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About CNSX:HEAL

Restart Life Sciences

Through its subsidiaries, operates as a biotechnology company worldwide.

Medium-low risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)