Despite rising tariff rates, the Canadian market has shown resilience, with inflation and economic data remaining stable. Penny stocks, often considered relics of past trading days, still hold relevance as they offer opportunities in smaller or newer companies that can yield significant returns when backed by solid financials. This article will explore three such penny stocks on the TSX that combine balance sheet strength with potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.77 | CA$173.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$515.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.62 | CA$179.67M | ✅ 2 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.86 | CA$163.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.15M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.60 | CA$9.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 457 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients across the United States, Canada, Europe, and internationally, with a market cap of CA$61.41 million.

Operations: The company's revenue is primarily derived from online sales, totaling $30.43 million, with a minor contribution of $0.03 million from other operations.

Market Cap: CA$61.41M

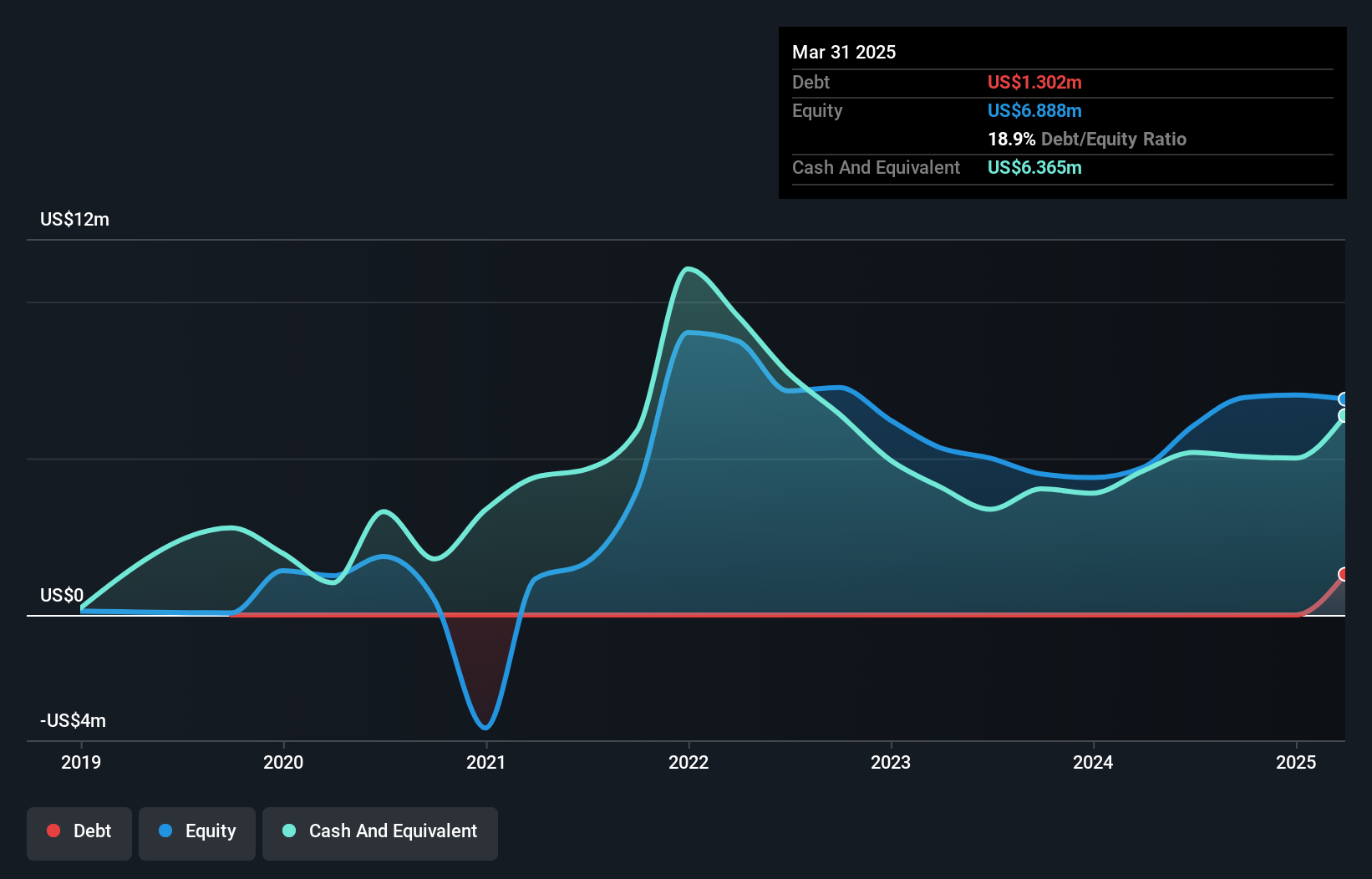

InnoCan Pharma, with a market cap of CA$61.41 million, is pre-revenue but shows promising potential in the pharmaceutical technology sector. The company has a strong cash position, exceeding its total debt and covering both short- and long-term liabilities. Despite being unprofitable, it has reduced losses by 22.9% annually over five years and maintains a cash runway for over three years based on current free cash flow. Recent developments include positive research results on their LPT-CBD product for pain management and strategic patent allowances enhancing market access in Latin America, positioning InnoCan favorably within the innovative CBD space.

- Click to explore a detailed breakdown of our findings in InnoCan Pharma's financial health report.

- Review our historical performance report to gain insights into InnoCan Pharma's track record.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., is engaged in the production of copper and molybdenum concentrates in Chile, with a market cap of CA$389.19 million.

Operations: The company generates revenue of $192.03 million from producing copper concentrates through a tolling agreement with DET.

Market Cap: CA$389.19M

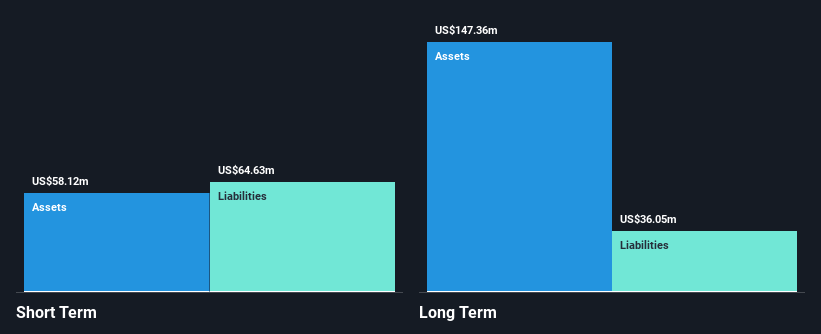

Amerigo Resources, with a market cap of CA$389.19 million, is engaged in copper and molybdenum production, showing stable operational performance. The company produced 15.5 million pounds of copper in Q2 2025 and maintains high plant availability at 99%. Financially, Amerigo has become profitable recently with earnings growth challenging to compare historically due to this transition. It trades significantly below its estimated fair value and has a strong cash position exceeding total debt. However, short-term liabilities surpass current assets slightly. Recent strategic moves include share buybacks and appointing Ignacio Cruz to the board, enhancing governance with his extensive mining sector experience.

- Navigate through the intricacies of Amerigo Resources with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Amerigo Resources' future.

Graphite One (TSXV:GPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Graphite One Inc. is a mineral exploration company operating in the United States with a market cap of CA$164.37 million.

Operations: Graphite One Inc. has not reported any specific revenue segments at this time.

Market Cap: CA$164.37M

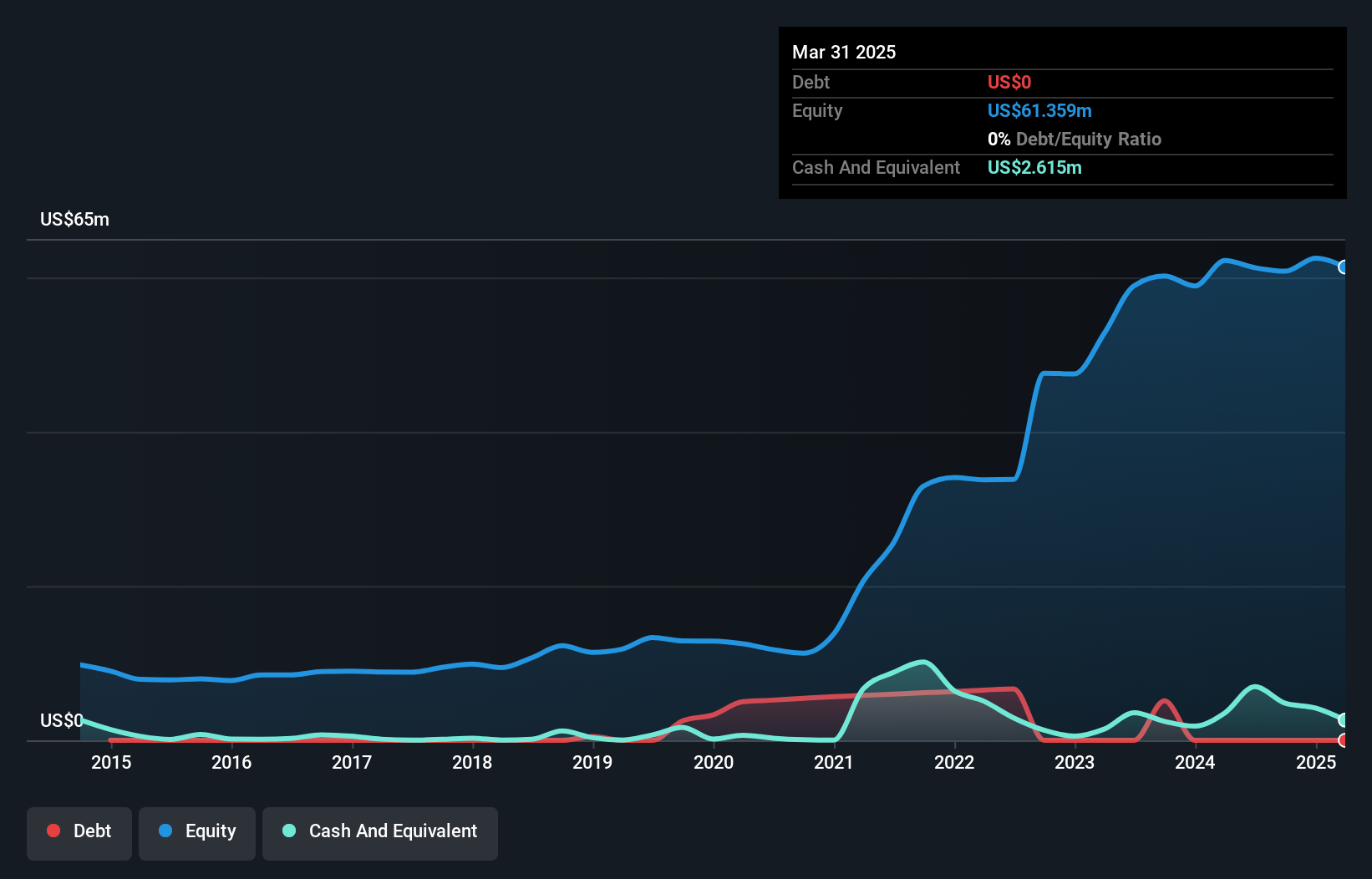

Graphite One Inc., with a market cap of CA$164.37 million, is pre-revenue and currently unprofitable. The company has recently secured a private placement agreement to raise CA$18 million, which may extend its cash runway beyond the current one-month projection. Graphite One's strategic focus is on developing a U.S.-based graphite supply chain, anchored by the Graphite Creek deposit in Alaska and planned facilities in Ohio for manufacturing battery materials. Despite being dropped from the S&P/TSX Venture Composite Index, its recent non-binding supply agreements with Lucid Group highlight potential future demand for its products once production begins.

- Take a closer look at Graphite One's potential here in our financial health report.

- Gain insights into Graphite One's historical outcomes by reviewing our past performance report.

Where To Now?

- Jump into our full catalog of 457 TSX Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:INNO

InnoCan Pharma

A pharmaceutical technology company, focuses on the development of various drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients in the United States, Canada, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives