Potential Upside For IM Cannabis Corp. (CSE:IMCC) Not Without Risk

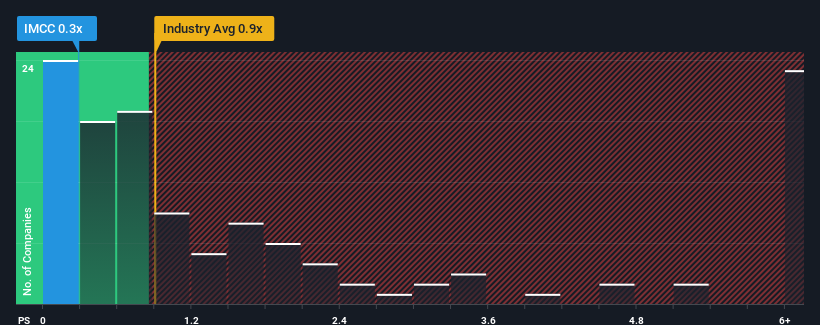

With a price-to-sales (or "P/S") ratio of 0.3x IM Cannabis Corp. (CSE:IMCC) may be sending bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in Canada have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for IM Cannabis

What Does IM Cannabis' P/S Mean For Shareholders?

IM Cannabis could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on IM Cannabis will help you uncover what's on the horizon.How Is IM Cannabis' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as IM Cannabis' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 5.2% as estimated by the two analysts watching the company. That's shaping up to be similar to the 6.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that IM Cannabis' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for IM Cannabis remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

And what about other risks? Every company has them, and we've spotted 5 warning signs for IM Cannabis (of which 3 are significant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:IMCC

IM Cannabis

Engages in breeding, growing, and supply of medical cannabis products in Israel and Germany.

Good value slight.

Similar Companies

Market Insights

Community Narratives