Green Thumb Industries Inc. (CSE:GTII) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Green Thumb Industries Inc. (CSE:GTII) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 98% in the last year.

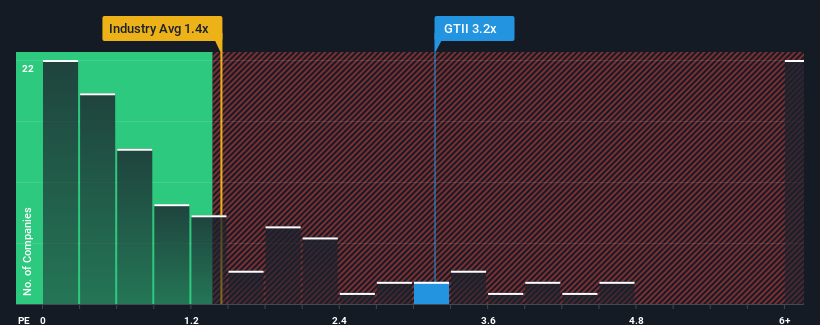

Following the firm bounce in price, when almost half of the companies in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Green Thumb Industries as a stock probably not worth researching with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Green Thumb Industries

How Has Green Thumb Industries Performed Recently?

Recent times haven't been great for Green Thumb Industries as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Green Thumb Industries.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Green Thumb Industries' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.7%. This was backed up an excellent period prior to see revenue up by 89% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 8.7% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 8.4% each year, which is not materially different.

With this in consideration, we find it intriguing that Green Thumb Industries' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Green Thumb Industries' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Green Thumb Industries currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Green Thumb Industries with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Green Thumb Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives