Do Grown Rogue International's (CSE:GRIN) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Grown Rogue International (CSE:GRIN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Grown Rogue International

Grown Rogue International's Improving Profits

Grown Rogue International has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Grown Rogue International's EPS catapulted from US$0.0034 to US$0.0069, over the last year. Year on year growth of 103% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

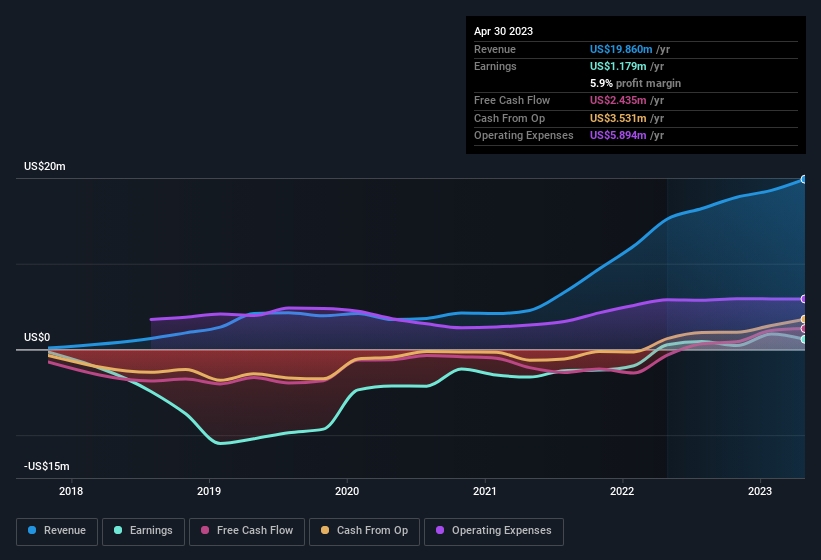

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, Grown Rogue International has done well over the past year, growing revenue by 30% to US$20m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Grown Rogue International isn't a huge company, given its market capitalisation of CA$49m. That makes it extra important to check on its balance sheet strength.

Are Grown Rogue International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Grown Rogue International insiders refrain from selling stock during the year, but they also spent US$165k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Senior Vice President of Grown Rogue Unlimited LLC, Adam August, who made the biggest single acquisition, paying CA$57k for shares at about CA$0.14 each.

Does Grown Rogue International Deserve A Spot On Your Watchlist?

Grown Rogue International's earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And may very well signal a significant inflection point for the business. If this these factors intrigue you, then an addition of Grown Rogue International to your watchlist won't go amiss. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Grown Rogue International , and understanding this should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Grown Rogue International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:GRIN

Grown Rogue International

A craft cannabis company, focuses on premium flower and flower-derived products.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026