While shareholders of Ayr Wellness (CSE:AYR.A) are in the black over 1 year, those who bought a week ago aren't so fortunate

It hasn't been the best quarter for Ayr Wellness Inc. (CSE:AYR.A) shareholders, since the share price has fallen 15% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 136% in that time. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Ayr Wellness

Ayr Wellness wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Ayr Wellness saw its revenue grow by 1.6%. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 136%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

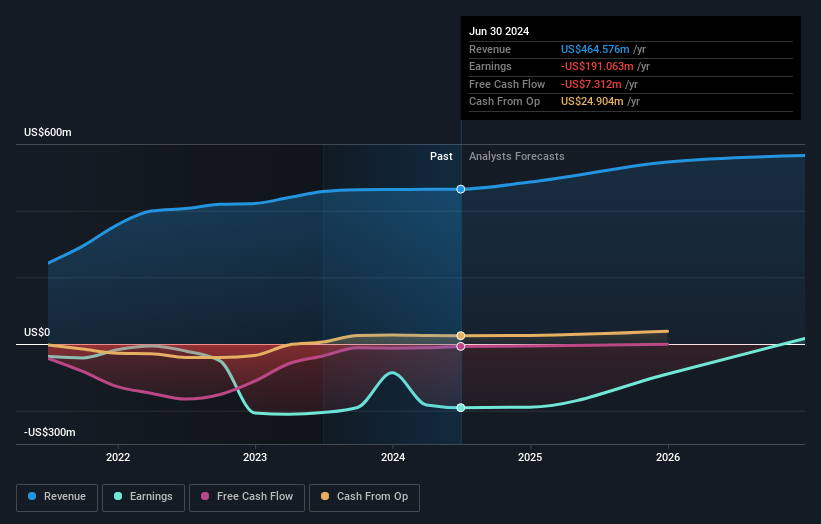

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Ayr Wellness shareholders have received a total shareholder return of 136% over the last year. That certainly beats the loss of about 13% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Ayr Wellness better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Ayr Wellness you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AYR.A

Ayr Wellness

Ayr Wellness Inc. cultivates, manufactures, and retails cannabis products and branded cannabis packaged goods.

Undervalued low.

Similar Companies

Market Insights

Community Narratives