- Canada

- /

- Entertainment

- /

- TSXV:OAM

OverActive Media Corp.'s (CVE:OAM) Share Price Is Still Matching Investor Opinion Despite 26% Slump

OverActive Media Corp. (CVE:OAM) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 7.7% in the last year.

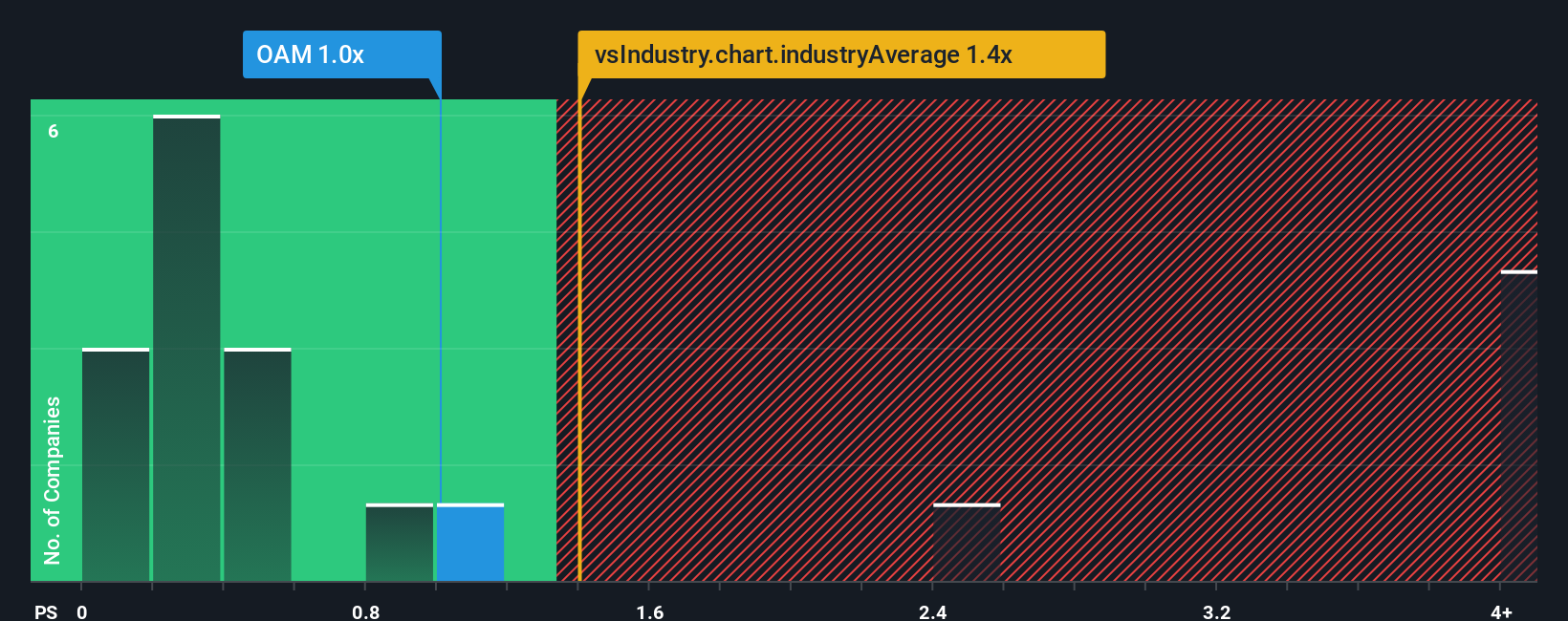

Even after such a large drop in price, given close to half the companies operating in Canada's Entertainment industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider OverActive Media as a stock to potentially avoid with its 1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for OverActive Media

How OverActive Media Has Been Performing

Recent times have been quite advantageous for OverActive Media as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for OverActive Media, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is OverActive Media's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like OverActive Media's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. Pleasingly, revenue has also lifted 98% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 21% shows it's noticeably more attractive.

With this information, we can see why OverActive Media is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

There's still some elevation in OverActive Media's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that OverActive Media can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Having said that, be aware OverActive Media is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:OAM

OverActive Media

Operates as an esports and entertainment company in Canada, the United States, and Europe.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives