Positive Sentiment Still Eludes PopReach Corporation (CVE:INIK) Following 39% Share Price Slump

PopReach Corporation (CVE:INIK) shareholders that were waiting for something to happen have been dealt a blow with a 39% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

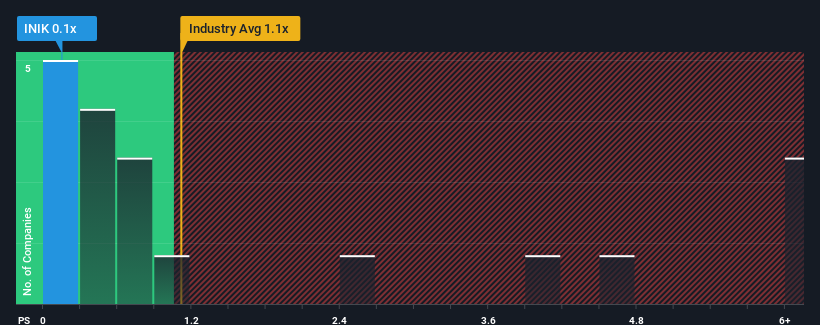

In spite of the heavy fall in price, it's still not a stretch to say that PopReach's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Canada, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for PopReach

What Does PopReach's P/S Mean For Shareholders?

PopReach certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PopReach.Is There Some Revenue Growth Forecasted For PopReach?

There's an inherent assumption that a company should be matching the industry for P/S ratios like PopReach's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 84% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.0%, which is noticeably less attractive.

With this information, we find it interesting that PopReach is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for PopReach looks to be in line with the rest of the Entertainment industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, PopReach's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for PopReach (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:INIK

Ionik

Operates as a multi-platform technology company in the United States and internationally.

Medium-low risk and good value.

Similar Companies

Market Insights

Community Narratives