Investors Aren't Entirely Convinced By PopReach Corporation's (CVE:INIK) Revenues

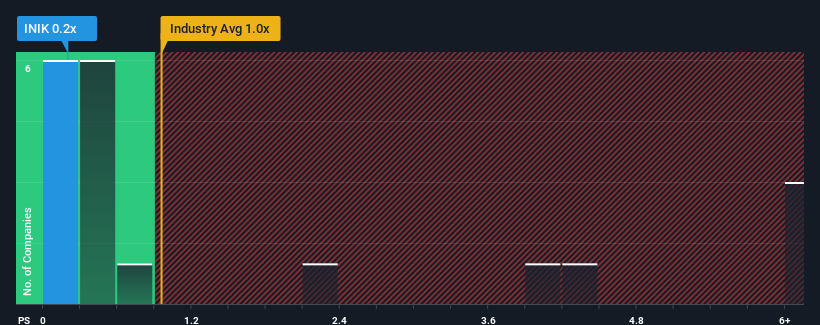

It's not a stretch to say that PopReach Corporation's (CVE:INIK) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Entertainment industry in Canada, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for PopReach

What Does PopReach's Recent Performance Look Like?

Recent times have been advantageous for PopReach as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PopReach will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

PopReach's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 84%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's curious that PopReach's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On PopReach's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, PopReach's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with PopReach (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If you're unsure about the strength of PopReach's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:INIK

Ionik

Operates as a multi-platform technology company in the United States and internationally.

Medium-low risk and good value.

Similar Companies

Market Insights

Community Narratives