FP Newspapers Inc. (CVE:FP) Stock Catapults 29% Though Its Price And Business Still Lag The Market

FP Newspapers Inc. (CVE:FP) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 89% in the last year.

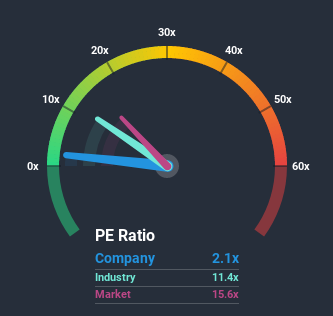

Even after such a large jump in price, FP Newspapers may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.1x, since almost half of all companies in Canada have P/E ratios greater than 16x and even P/E's higher than 35x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for FP Newspapers as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FP Newspapers

Is There Any Growth For FP Newspapers?

There's an inherent assumption that a company should far underperform the market for P/E ratios like FP Newspapers' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 68% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that FP Newspapers' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Shares in FP Newspapers are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of FP Newspapers revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware FP Newspapers is showing 4 warning signs in our investment analysis, and 3 of those are significant.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you’re looking to trade FP Newspapers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:FP

FP Newspapers

FP Newspapers Inc. publishes, prints, and distributes daily and weekly newspapers, and specialty publications in Manitoba.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026