- Canada

- /

- Interactive Media and Services

- /

- TSXV:ATW

Shareholders Will Probably Hold Off On Increasing ATW Tech Inc.'s (CVE:ATW) CEO Compensation For The Time Being

Despite positive share price growth of 5.6% for ATW Tech Inc. (CVE:ATW) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 29 June 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for ATW Tech

How Does Total Compensation For Michel Guay Compare With Other Companies In The Industry?

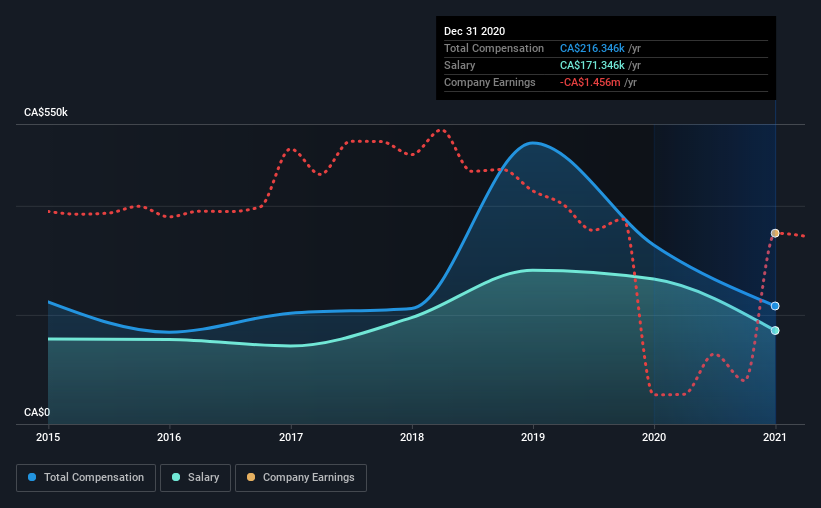

According to our data, ATW Tech Inc. has a market capitalization of CA$21m, and paid its CEO total annual compensation worth CA$216k over the year to December 2020. Notably, that's a decrease of 34% over the year before. We note that the salary portion, which stands at CA$171.3k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below CA$247m, reported a median total CEO compensation of CA$131k. Hence, we can conclude that Michel Guay is remunerated higher than the industry median. Moreover, Michel Guay also holds CA$1.6m worth of ATW Tech stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$171k | CA$266k | 79% |

| Other | CA$45k | CA$63k | 21% |

| Total Compensation | CA$216k | CA$328k | 100% |

Speaking on an industry level, nearly 94% of total compensation represents salary, while the remainder of 6% is other remuneration. ATW Tech sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ATW Tech Inc.'s Growth

Over the last three years, ATW Tech Inc. has shrunk its earnings per share by 40% per year. In the last year, its revenue is down 45%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has ATW Tech Inc. Been A Good Investment?

With a total shareholder return of 5.6% over three years, ATW Tech Inc. has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 2 which can't be ignored) in ATW Tech we think you should know about.

Important note: ATW Tech is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ATW

Overvalued with worrying balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)