- Canada

- /

- Entertainment

- /

- TSX:WILD

WildBrain (TSE:WILD) shareholder returns have been notable, earning 71% in 5 years

Passive investing in index funds can generate returns that roughly match the overall market. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the WildBrain Ltd. (TSE:WILD) share price is up 71% in the last five years, slightly above the market return. It's also good to see a healthy gain of 44% in the last year.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

WildBrain wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, WildBrain can boast revenue growth at a rate of 2.6% per year. That's not a very high growth rate considering the bottom line. While it's hard to say just how much value the company added over five years, the annualised share price gain of 11% seems about right. We'd be looking for the underlying business to grow revenue a bit faster.

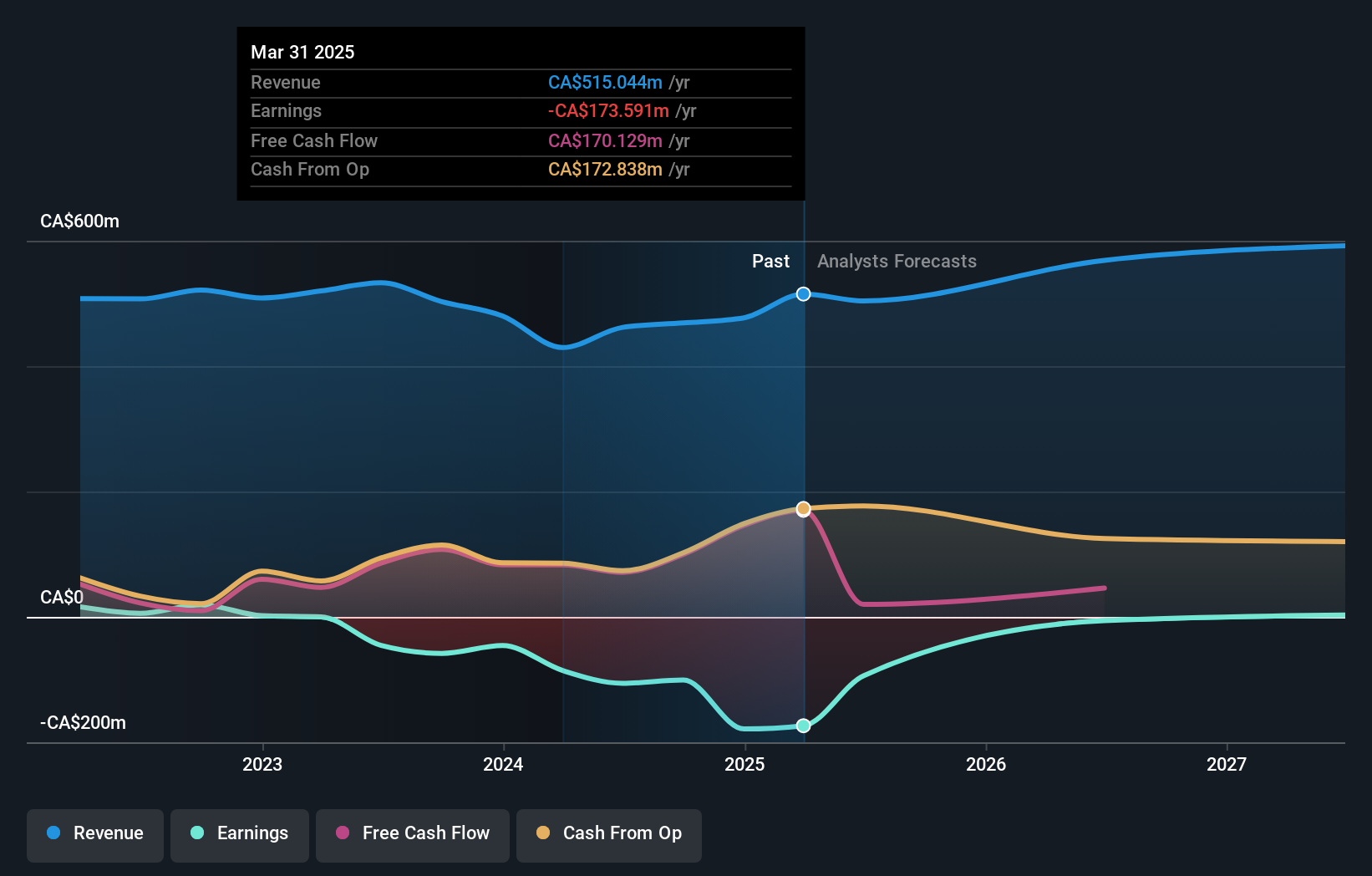

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at WildBrain's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that WildBrain has rewarded shareholders with a total shareholder return of 44% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 11% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You could get a better understanding of WildBrain's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course WildBrain may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WildBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WILD

WildBrain

Develops, produces, and distributes films and television programs in Canada, the United States, the United Kingdom, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives