Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets saw major indexes like the Nasdaq Composite and S&P MidCap 400 reach record intraday highs before retreating, while small-cap stocks showed resilience compared to their larger counterparts. Amid these market dynamics, investors are increasingly focused on identifying high-growth tech stocks that demonstrate robust fundamentals and can navigate the current economic landscape effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Hitevision (SZSE:002955)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hitevision Co., Ltd. focuses on the research, design, development, production, and sale of interactive display products in China and has a market cap of CN¥6.10 billion.

Operations: Hitevision Co., Ltd. specializes in interactive display products, leveraging its expertise in research, design, development, and production to generate revenue within the Chinese market.

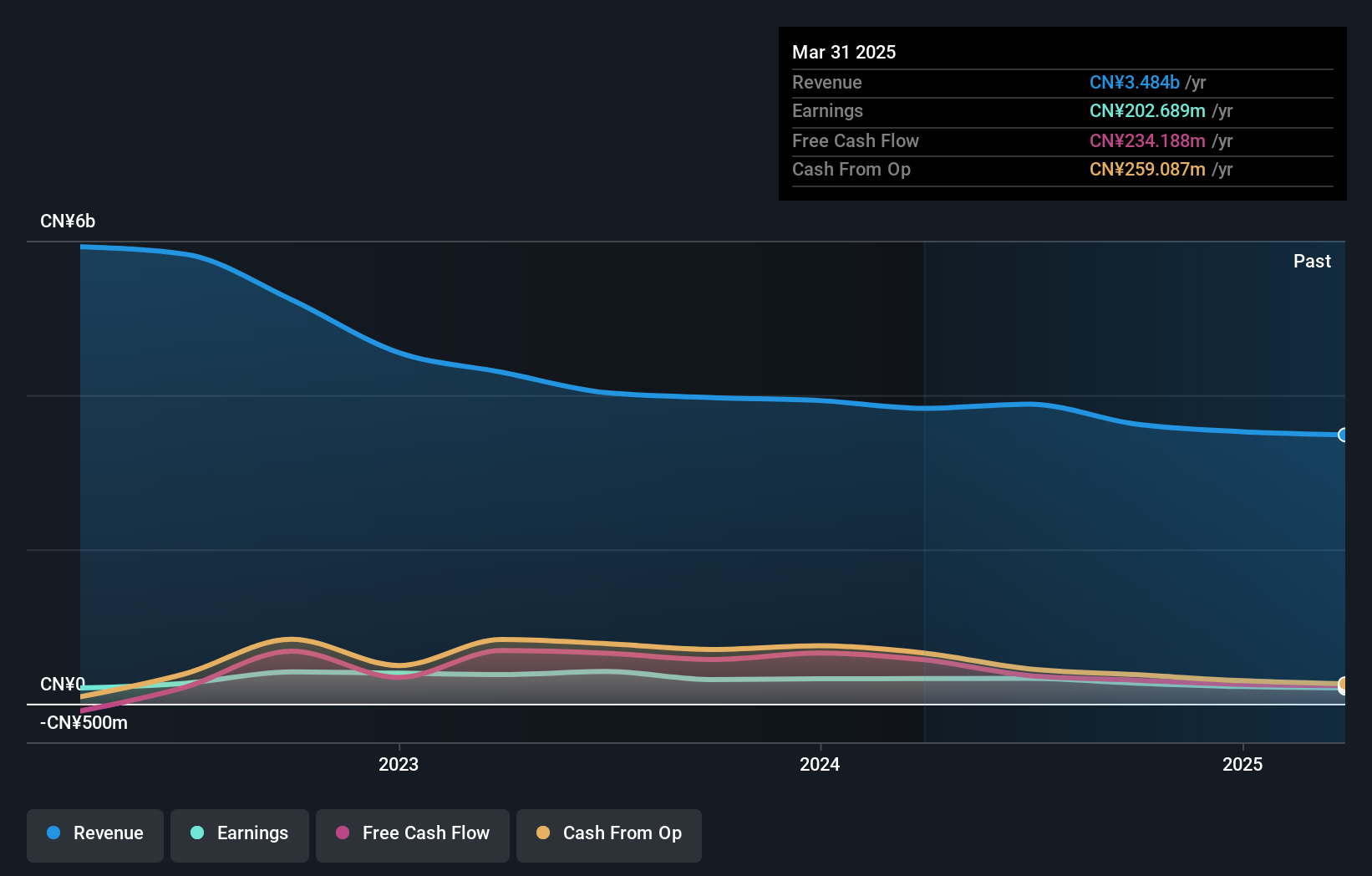

Hitevision's recent financial performance reflects a challenging environment, with a reported decline in sales to CNY 2.76 billion and net income falling to CNY 245.02 million over the past nine months, compared to higher figures last year. Despite these hurdles, the company is actively managing its capital through share repurchases, buying back 2.4 million shares for CNY 51.07 million recently. Looking ahead, Hitevision is poised for recovery with anticipated revenue growth of 18% per year and earnings forecasted to surge by 30% annually. This growth trajectory is notably above the Chinese market average, underpinned by strategic R&D investments aimed at fostering innovation and maintaining competitive advantage in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Hitevision.

Gain insights into Hitevision's historical performance by reviewing our past performance report.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of CN¥5.13 billion.

Operations: Acrobiosystems Co., Ltd. focuses on the production of recombinant proteins and antibodies, catering to pharmaceutical and biotechnology sectors along with scientific research bodies.

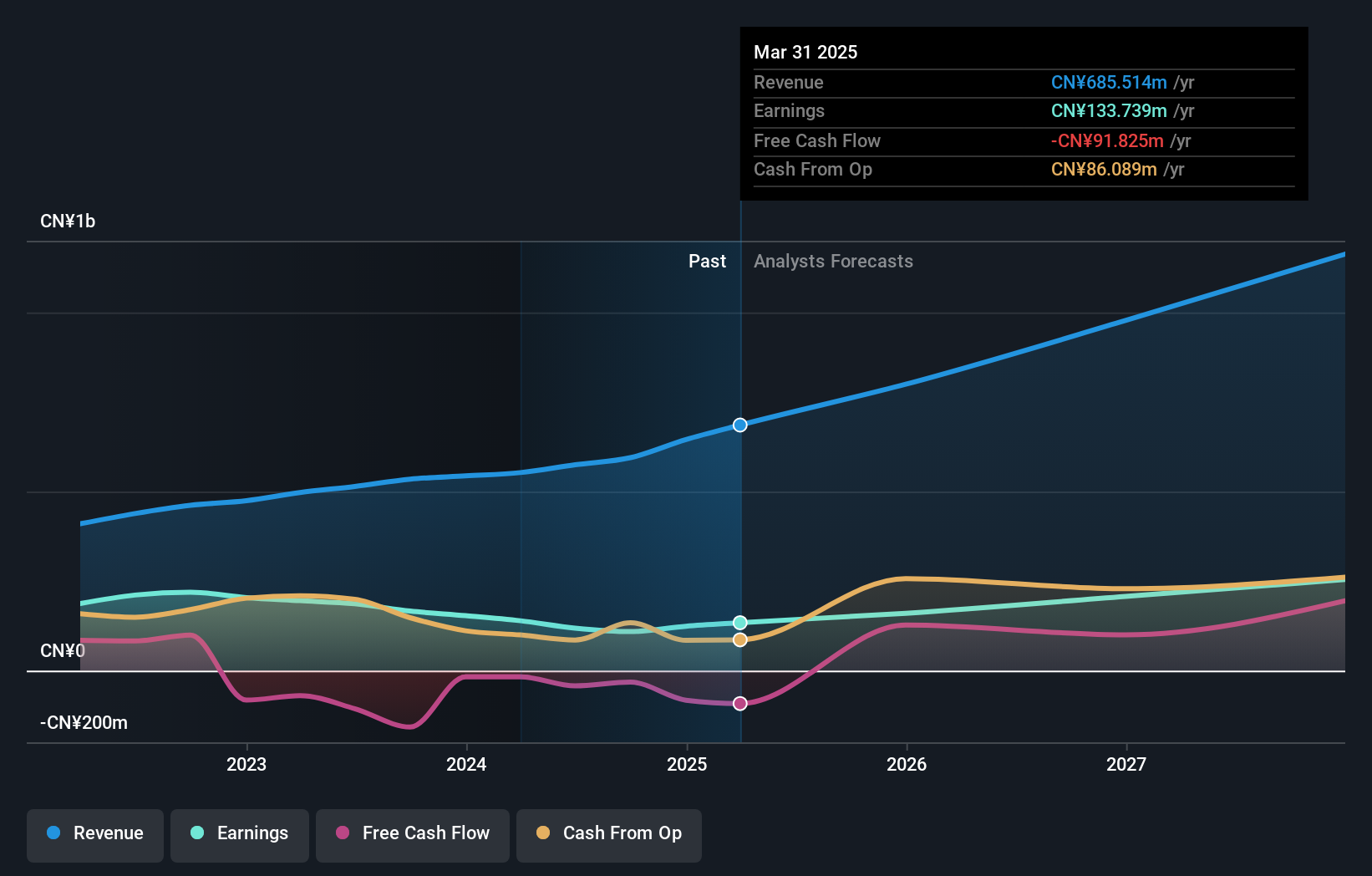

Despite a challenging year with net income dropping to CNY 83.49 million from CNY 128.16 million, Acrobiosystems has maintained a robust sales increase of 12.3% year-over-year, demonstrating resilience in its market segment. The company's commitment to innovation is evident in its R&D spending, crucial for staying competitive in the fast-evolving biotech sector. With earnings expected to grow at an impressive rate of 29.4% annually, surpassing the Chinese market forecast of 25.9%, Acrobiosystems appears well-positioned for future growth, supported by strategic share repurchases aimed at enhancing shareholder value.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$515.53 million.

Operations: The company generates revenue primarily from its Broadcasting and Commercial Music segment, which contributes CA$201.10 million, followed by the Radio segment at CA$154.41 million.

Stingray Group's recent performance underscores its strategic focus despite a mixed financial picture, with Q2 sales rising to CAD 93.59 million from CAD 82.49 million year-over-year, though net income fell to CAD 5.81 million from CAD 9.39 million in the same period. This dip reflects broader industry challenges yet highlights a resilient revenue growth trajectory at 4.9% annually, slightly underperforming against the Canadian market's average of 6.9%. Notably, Stingray's commitment to innovation is evident in its R&D spending which remains robust; however, specific figures were not disclosed in the latest reports. The launch of the Stingray Karaoke app on VIZIO and expansion into content-rich TV channels like Stingray Naturescape and ZenLIFE on Amazon Fire TV Channels illustrate how product diversification continues to drive its market presence, appealing broadly across different consumer segments.

- Click here to discover the nuances of Stingray Group with our detailed analytical health report.

Examine Stingray Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Delve into our full catalog of 1289 High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301080

AcrobiosystemsLtd

Engages in the development and manufacture of recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies, and scientific research institutions.

Excellent balance sheet with reasonable growth potential.