Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Quebecor Inc. (TSE:QBR.B) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Quebecor

What Is Quebecor's Debt?

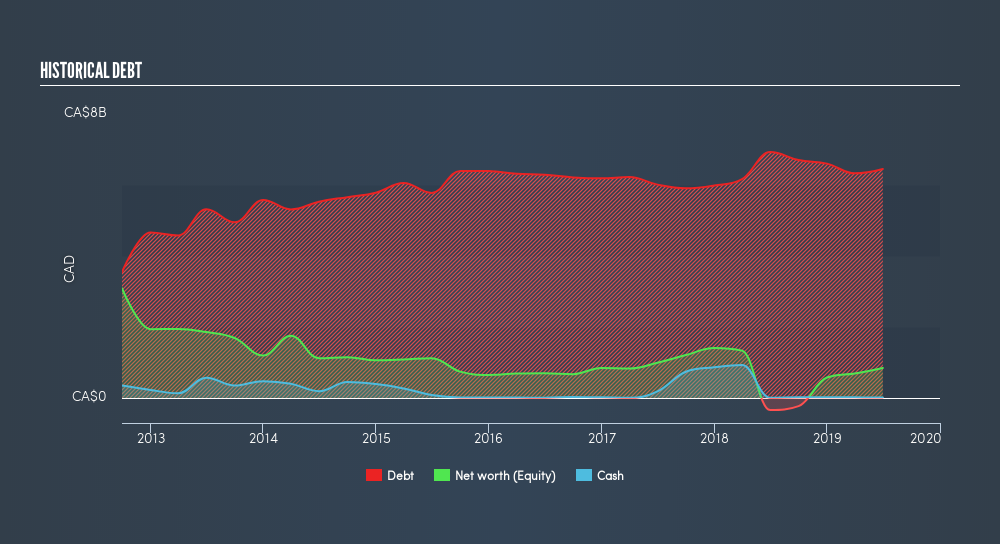

As you can see below, Quebecor had CA$6.45b of debt at June 2019, down from CA$6.93b a year prior. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Quebecor's Balance Sheet?

According to the last reported balance sheet, Quebecor had liabilities of CA$1.28b due within 12 months, and liabilities of CA$7.56b due beyond 12 months. Offsetting this, it had CA$17.2m in cash and CA$708.7m in receivables that were due within 12 months. So its liabilities total CA$8.11b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's CA$7.74b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Quebecor has a debt to EBITDA ratio of 3.9 and its EBIT covered its interest expense 3.2 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, one redeeming factor is that Quebecor grew its EBIT at 10% over the last 12 months, boosting its ability to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Quebecor's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Quebecor produced sturdy free cash flow equating to 63% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

While Quebecor's interest cover makes us cautious about it, its track record of staying on top of its total liabilities is no better. But its not so bad at converting EBIT to free cash flow. Taking the abovementioned factors together we do think Quebecor's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Given our hesitation about the stock, it would be good to know if Quebecor insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:QBR.B

Quebecor

Operates in the telecommunications, media, and sports and entertainment businesses in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives