We're Not Counting On Glacier Media (TSE:GVC) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Glacier Media's (TSE:GVC) statutory profits are a good guide to its underlying earnings.

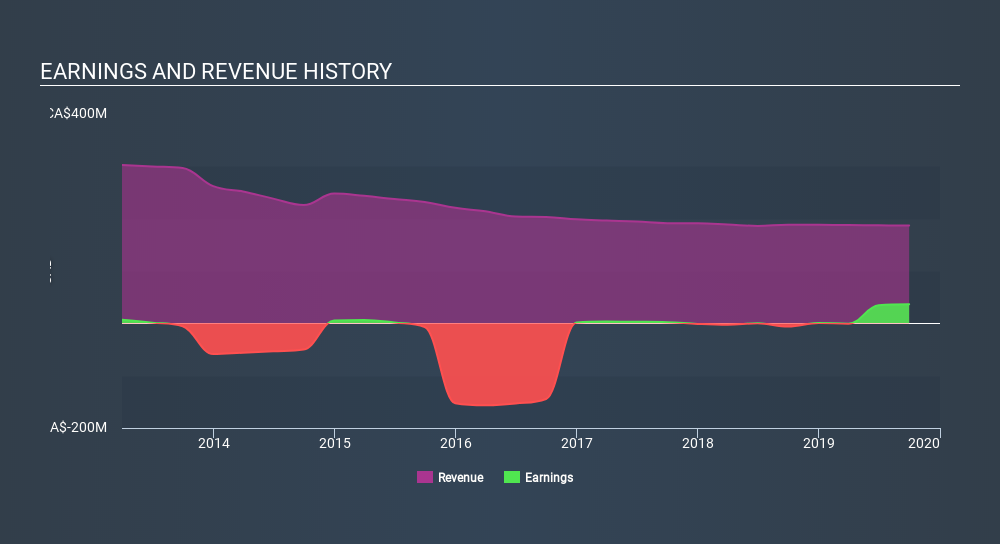

It's good to see that over the last twelve months Glacier Media made a profit of CA$36.3m on revenue of CA$186.8m. The chart below shows that while revenue has fallen over the last three years, the company has moved from unprofitable to profitable.

View our latest analysis for Glacier Media

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll look at what Glacier Media's cashflow and unusual items tell us about the quality of its earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Glacier Media.

A Closer Look At Glacier Media's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to September 2019, Glacier Media had an accrual ratio of 0.22. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Even though it reported a profit of CA$36.3m, a look at free cash flow indicates it actually burnt through CA$8.6m in the last year. Unfortunately, we don't have data on Glacier Media's free cash flow for the prior year; that's not necessarily a bad thing, though we do generally prefer to be able to see a bit of a company's history.

However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. One positive for Glacier Media shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Glacier Media's profit was boosted by unusual items worth CA$44m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Glacier Media's positive unusual items were quite significant relative to its profit in the year to September 2019. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Glacier Media's Profit Performance

Summing up, Glacier Media received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Glacier Media's profits probably give an overly generous impression of its sustainable level of profitability. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. If you want to,you can see our take on Glacier Media's balance sheet by clicking here.

Our examination of Glacier Media has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:GVC

Glacier Media

Operates as an information and marketing solutions company in Canada and the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)