- Canada

- /

- Interactive Media and Services

- /

- TSX:FORA

Some Shareholders Feeling Restless Over VerticalScope Holdings Inc.'s (TSE:FORA) P/S Ratio

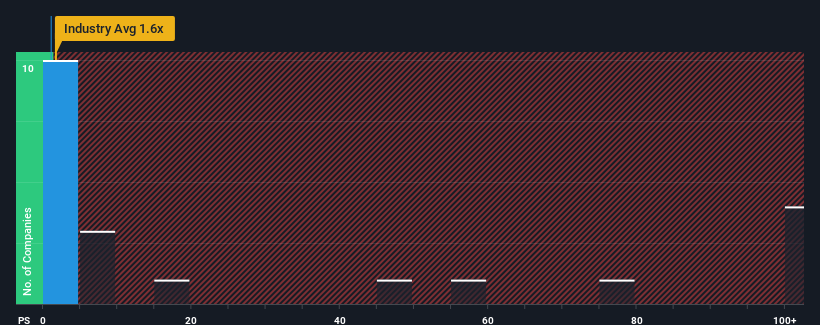

It's not a stretch to say that VerticalScope Holdings Inc.'s (TSE:FORA) price-to-sales (or "P/S") ratio of 1x seems quite "middle-of-the-road" for Interactive Media and Services companies in Canada, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for VerticalScope Holdings

What Does VerticalScope Holdings' Recent Performance Look Like?

VerticalScope Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on VerticalScope Holdings.How Is VerticalScope Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, VerticalScope Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.2% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.5% per annum as estimated by the eight analysts watching the company. With the industry predicted to deliver 12% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's curious that VerticalScope Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of VerticalScope Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with VerticalScope Holdings, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FORA

VerticalScope Holdings

A technology company, operates a cloud-based digital community platform for online enthusiast communities in the United States, Canada, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026