- Canada

- /

- Metals and Mining

- /

- TSXV:NRC

3 TSX Penny Stocks With Market Caps Under CA$200M To Consider

Reviewed by Simply Wall St

As the Canadian market continues to navigate trade tensions and economic uncertainties, the TSX has shown resilience with a 67% gain since October 2022. Amidst this backdrop, investors often seek opportunities in smaller or newer companies that can offer growth potential at lower price points. Penny stocks, despite their somewhat outdated name, represent such opportunities and can be valuable additions to a diversified portfolio when they possess strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$68M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.32 | CA$251.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.37 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.09 | CA$718.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.62M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.02 | CA$155.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.18 | CA$204.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

VerticalScope Holdings (TSX:FORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VerticalScope Holdings Inc. is a technology company that operates a cloud-based digital community platform for online enthusiast communities across the United States, Canada, the United Kingdom, and internationally, with a market cap of CA$82.81 million.

Operations: VerticalScope Holdings generates its revenue primarily from the United States ($52.76 million), followed by Canada ($6.76 million) and the United Kingdom ($1.92 million).

Market Cap: CA$82.81M

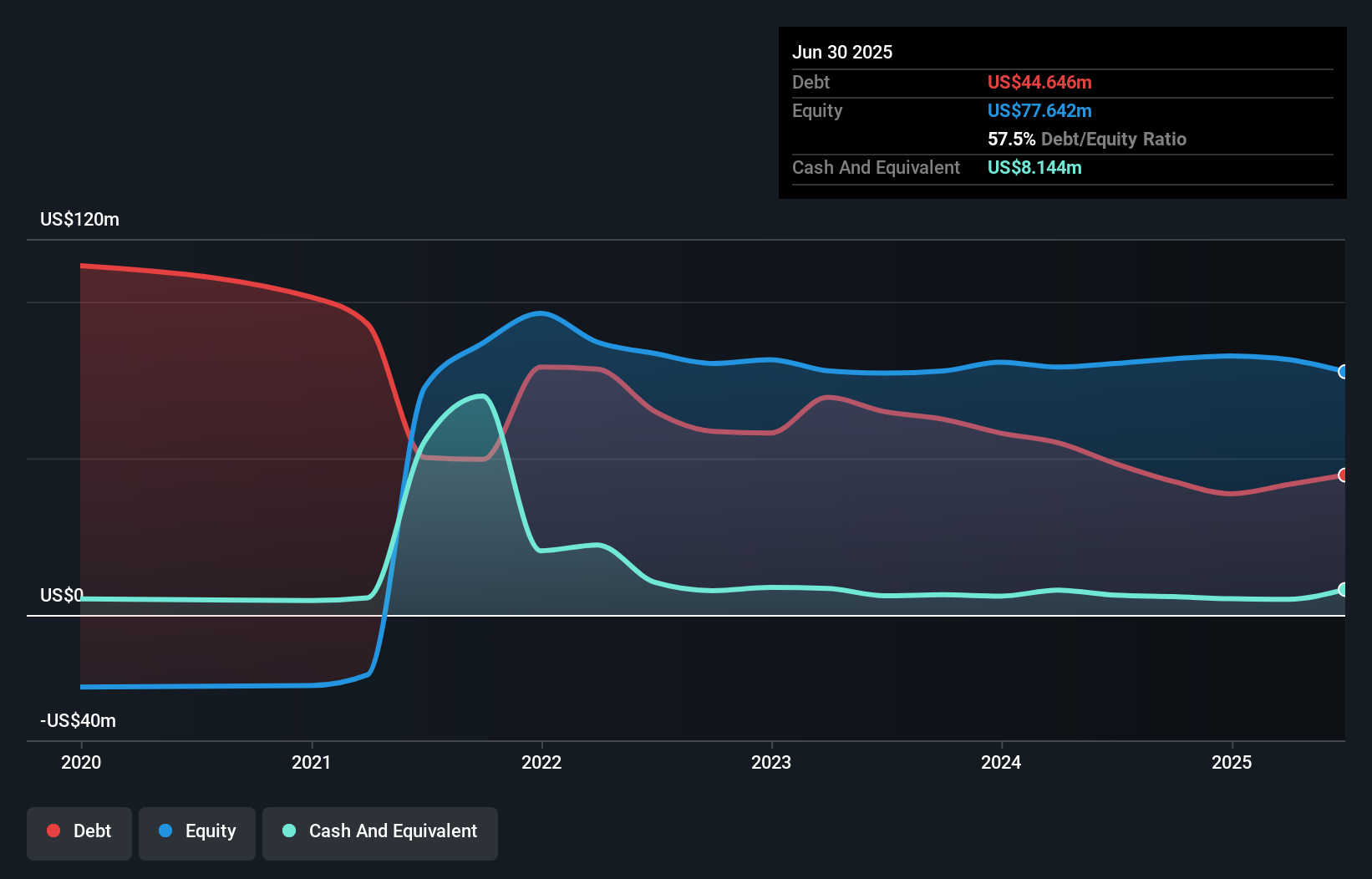

VerticalScope Holdings Inc. presents a mixed picture for penny stock investors. The company operates with a market cap of CA$82.81 million and primarily generates revenue from the United States, totaling US$52.76 million annually. Despite trading at 76% below its estimated fair value, VerticalScope is currently unprofitable with a negative return on equity of -4.72%. However, it has managed to maintain positive free cash flow and possesses sufficient cash runway for over three years, even as it faces challenges covering long-term liabilities with short-term assets of US$21.6 million against US$45 million in liabilities.

- Unlock comprehensive insights into our analysis of VerticalScope Holdings stock in this financial health report.

- Explore VerticalScope Holdings' analyst forecasts in our growth report.

Empress Royalty (TSXV:EMPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Empress Royalty Corp. is involved in creating and investing in a portfolio of precious metal royalty and streaming interests in Canada, with a market cap of CA$110.07 million.

Operations: The company generates revenue primarily through the acquisition of mining royalty and streaming interests, amounting to $12.56 million.

Market Cap: CA$110.07M

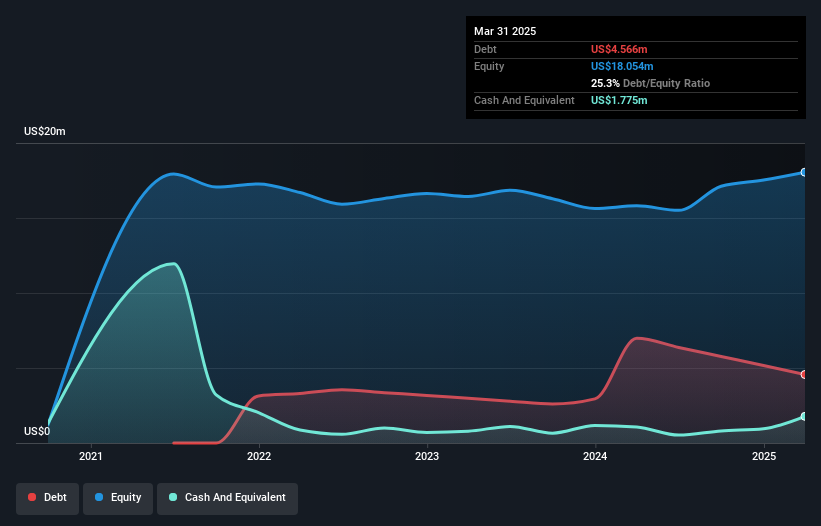

Empress Royalty Corp. has recently achieved profitability, reporting a net income of US$1.14 million for Q2 2025, marking a turnaround from previous losses. The company’s financial health is supported by strong interest coverage and operating cash flow that comfortably covers its debt obligations. Empress's short-term assets of $6.5 million exceed both its short-term and long-term liabilities, indicating sound liquidity management. The recent addition to the S&P/TSX Venture Composite Index may enhance visibility among investors, while the appointment of Daniel Burns to the board brings seasoned governance expertise that could support strategic growth initiatives in the royalty sector.

- Navigate through the intricacies of Empress Royalty with our comprehensive balance sheet health report here.

- Understand Empress Royalty's earnings outlook by examining our growth report.

Nations Royalty (TSXV:NRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nations Royalty Corp. is a royalty company that acquires royalties in the Canadian resource sector, with a market cap of CA$130.28 million.

Operations: The company generates revenue from the acquisition, exploration, and development of mineral properties amounting to CA$0.91 million.

Market Cap: CA$130.28M

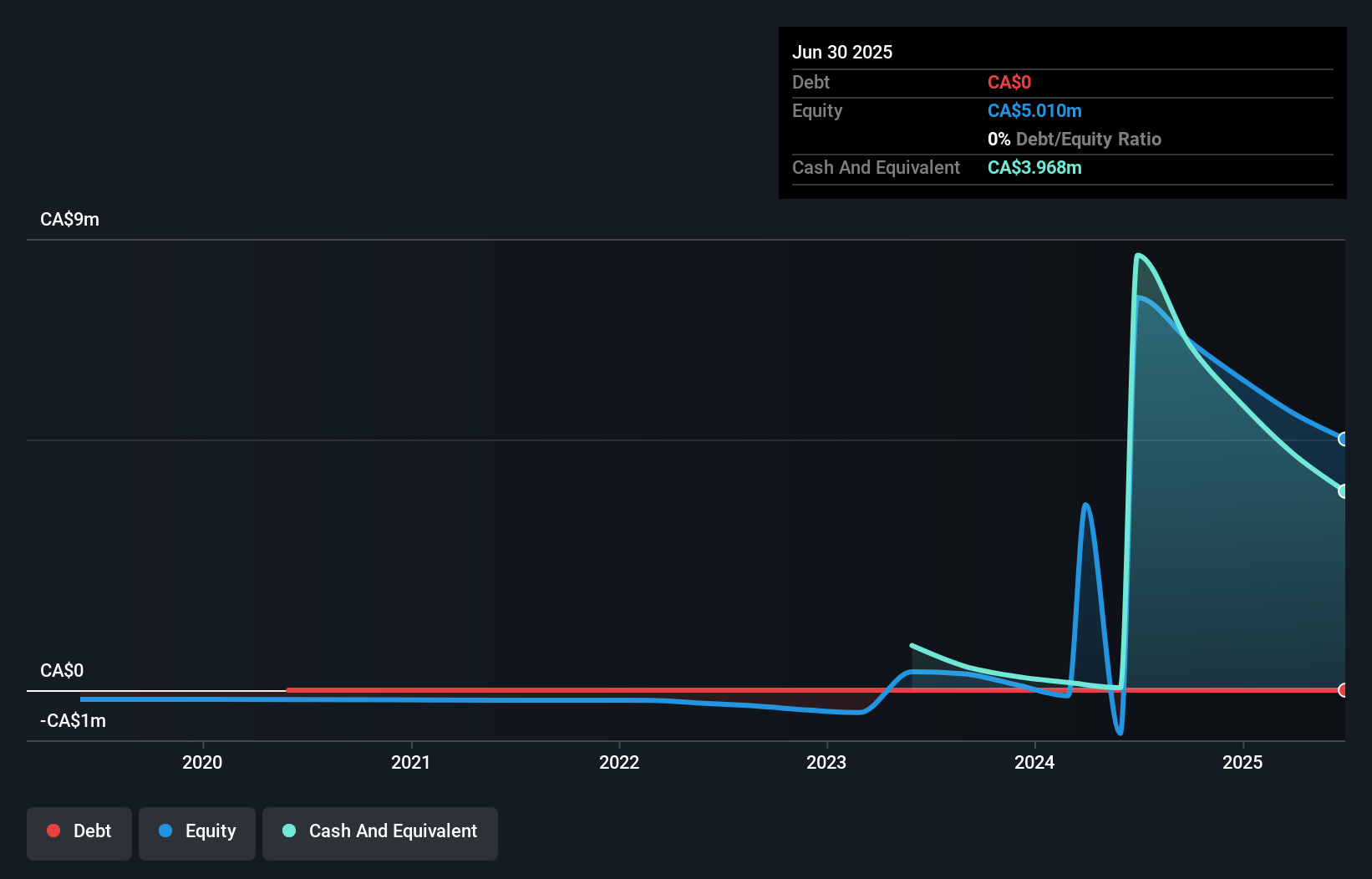

Nations Royalty Corp. operates with a market cap of CA$130.28 million and remains pre-revenue, generating only CA$0.91 million in revenue from its mineral properties. The company reported a net loss of CA$1.06 million for Q1 2025, an improvement from the previous year's larger losses. Despite being debt-free, Nations Royalty faces challenges with less than a year of cash runway and an inexperienced management team averaging 1.4 years in tenure. While short-term assets cover liabilities comfortably, the lack of significant revenue streams underscores the financial vulnerability typical in penny stocks within resource sectors.

- Take a closer look at Nations Royalty's potential here in our financial health report.

- Evaluate Nations Royalty's historical performance by accessing our past performance report.

Next Steps

- Dive into all 412 of the TSX Penny Stocks we have identified here.

- Interested In Other Possibilities? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nations Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NRC

Nations Royalty

A royalty company, focuses on acquiring royalties in the resource sector in Canada.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives