- Canada

- /

- Interactive Media and Services

- /

- TSX:EGLX

Little Excitement Around Enthusiast Gaming Holdings Inc.'s (TSE:EGLX) Revenues As Shares Take 29% Pounding

Unfortunately for some shareholders, the Enthusiast Gaming Holdings Inc. (TSE:EGLX) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

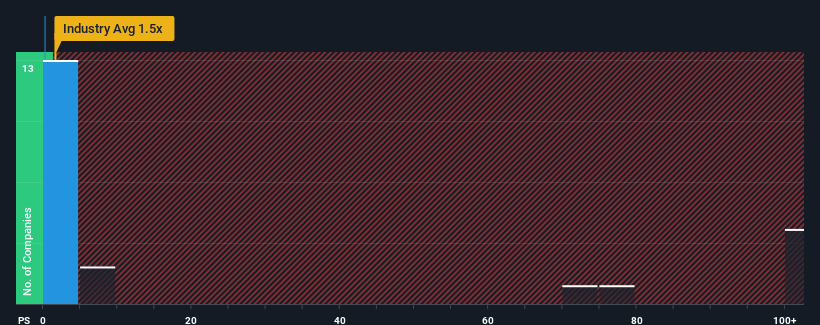

Since its price has dipped substantially, Enthusiast Gaming Holdings' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Interactive Media and Services industry in Canada, where around half of the companies have P/S ratios above 1.1x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Enthusiast Gaming Holdings

What Does Enthusiast Gaming Holdings' P/S Mean For Shareholders?

Enthusiast Gaming Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Enthusiast Gaming Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Enthusiast Gaming Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 11% over the next year. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Enthusiast Gaming Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Enthusiast Gaming Holdings' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Enthusiast Gaming Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 5 warning signs for Enthusiast Gaming Holdings you should be aware of, and 1 of them is significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Enthusiast Gaming Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EGLX

Enthusiast Gaming Holdings

An integrated gaming entertainment company, engages in media and content, esports and entertainment, and subscription businesses in the United States, Canada, England and Wales, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives