- Canada

- /

- Metals and Mining

- /

- TSXV:WGO

Will White Gold’s (TSXV:WGO) Exploration Funding Drive a New Phase in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- White Gold Corp. recently announced a brokered private placement to raise funds for exploration, offering premium flow-through units, flow-through shares, and standard units, each with associated pricing and warrant terms, and subject to regulatory approval.

- This fundraising effort follows an updated mineral resource estimate showing a 44% increase in indicated gold ounces, enhancing the company's potential for further economic assessments.

- We'll explore how the significant increase in indicated gold ounces shapes White Gold's overall investment narrative and future exploration plans.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is White Gold's Investment Narrative?

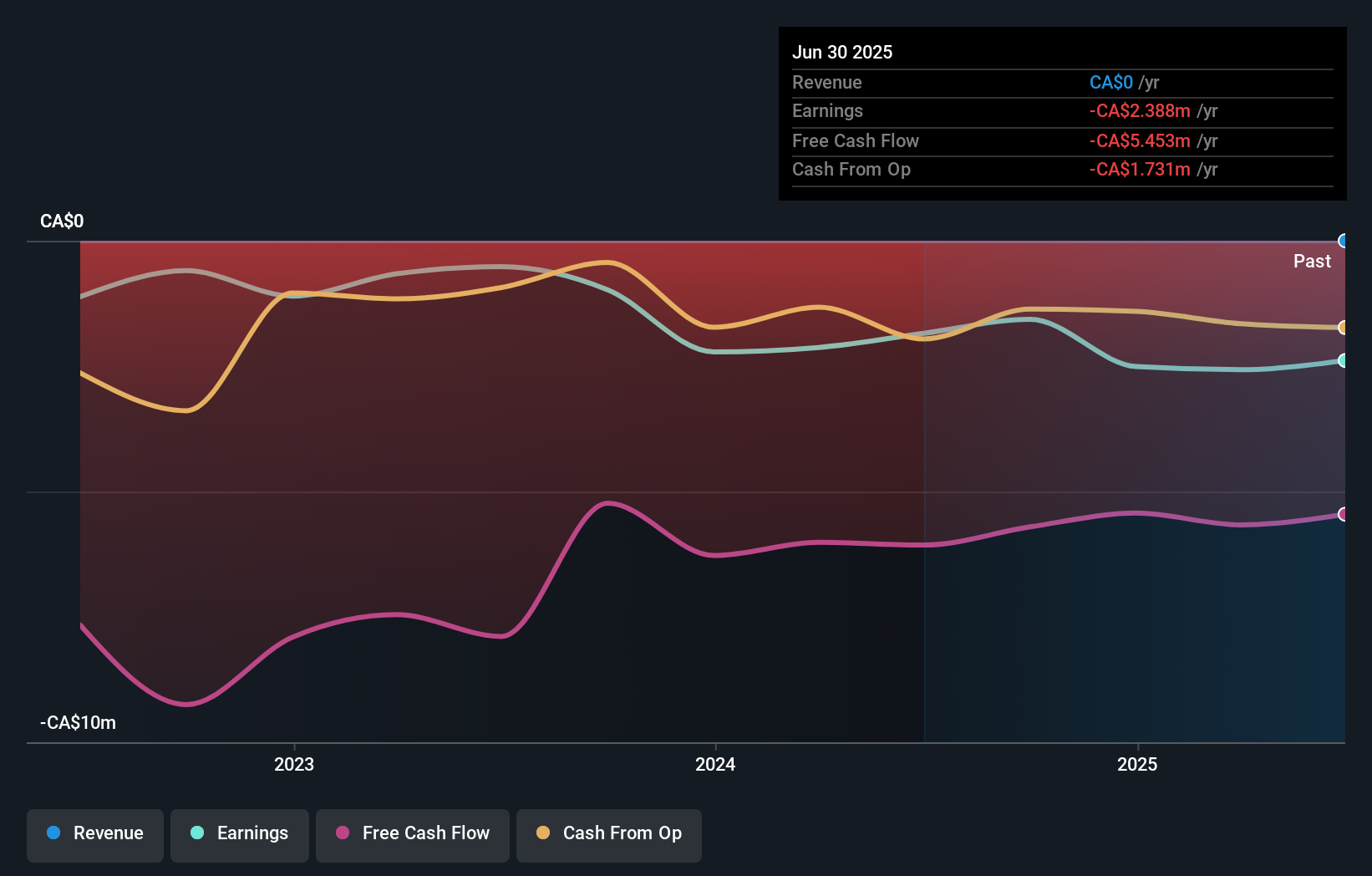

Being a shareholder in White Gold Corp. means buying into the idea that large-scale gold discoveries in the Yukon, paired with active exploration, can translate into economic returns, even in the face of ongoing losses and zero revenue. The recent brokered private placement, designed to raise up to CA$3,000,000, is a direct response to the company’s updated mineral resource estimate, which showed a 44% jump in indicated gold ounces. This extra funding supports new drills and studies, raising the profile of White Gold’s assets. In the near term, the ability to successfully close the placement and deploy fresh capital becomes the main catalyst to watch, potentially drawing new attention from the market. However, dilution risk from frequent share issuances and unproven economics remain prominent hurdles. The latest price moves suggest the market sees potential, but the company is still unprofitable and depends heavily on ongoing access to funding, more so now, as ambitions grow with resource upgrades. In contrast, frequent capital raises and dilution risks should be on every shareholder's radar.

The valuation report we've compiled suggests that White Gold's current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on White Gold - why the stock might be worth just CA$1.50!

Build Your Own White Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Gold research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free White Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Gold's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WGO

White Gold

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.