- Canada

- /

- Metals and Mining

- /

- TSXV:WAM

3 TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

The Canadian stock market has recently reached new heights, with large-cap stocks hitting all-time highs, showcasing resilience amid global economic uncertainties. For investors interested in exploring beyond the well-known names, penny stocks—typically smaller or newer companies—present intriguing possibilities. Despite the term's somewhat outdated ring, these stocks can offer surprising value and potential returns when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.34 | CA$103.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.22 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.67 | CA$445.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.08 | CA$567.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.84 | CA$452.49M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.65 | CA$3.71M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$549.02M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.53 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Lithium Inc. focuses on acquiring, exploring, and developing mining properties in North America, with a market cap of CA$125.41 million.

Operations: Frontier Lithium Inc. does not report any specific revenue segments.

Market Cap: CA$125.41M

Frontier Lithium Inc., with a market cap of CA$125.41 million, is pre-revenue and currently unprofitable, facing an average annual earnings decline forecast of 54.3% over the next three years. Despite this, the company has secured government support for its planned Lithium Conversion Facility in Thunder Bay, Ontario—a significant development for Canada's critical minerals strategy. The facility aims to process lithium from Frontier's PAK project and other sources, potentially bolstering North America's energy supply chain. Frontier's short-term assets cover both short-term and long-term liabilities, providing some financial stability amid its growth plans.

- Unlock comprehensive insights into our analysis of Frontier Lithium stock in this financial health report.

- Gain insights into Frontier Lithium's outlook and expected performance with our report on the company's earnings estimates.

Intrepid Metals (TSXV:INTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intrepid Metals Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties, with a market cap of CA$23.30 million.

Operations: No revenue segments have been reported.

Market Cap: CA$23.3M

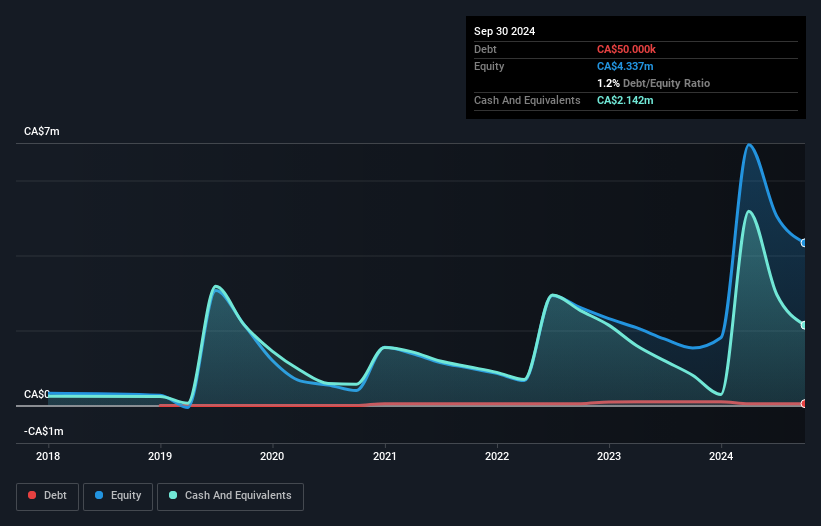

Intrepid Metals Corp., with a market cap of CA$23.30 million, is pre-revenue and focused on mineral exploration in Arizona's Turquoise District. Recent drilling at the Corral Copper Property has shown promising copper-gold-silver intercepts, enhancing its potential as an exploration target. Despite a net loss of CA$5.88 million for 2024, Intrepid has secured additional funding through an oversubscribed private placement, bolstering its cash position temporarily. The management team and board are relatively new, with short tenures suggesting fresh leadership perspectives. However, limited cash runway underscores the importance of successful exploration outcomes to sustain operations longer-term.

- Dive into the specifics of Intrepid Metals here with our thorough balance sheet health report.

- Explore historical data to track Intrepid Metals' performance over time in our past results report.

Alaska Silver (TSXV:WAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alaska Silver Corp. focuses on acquiring, exploring, and developing mineral properties in the United States with a market cap of CA$49.80 million.

Operations: No revenue segments have been reported.

Market Cap: CA$49.8M

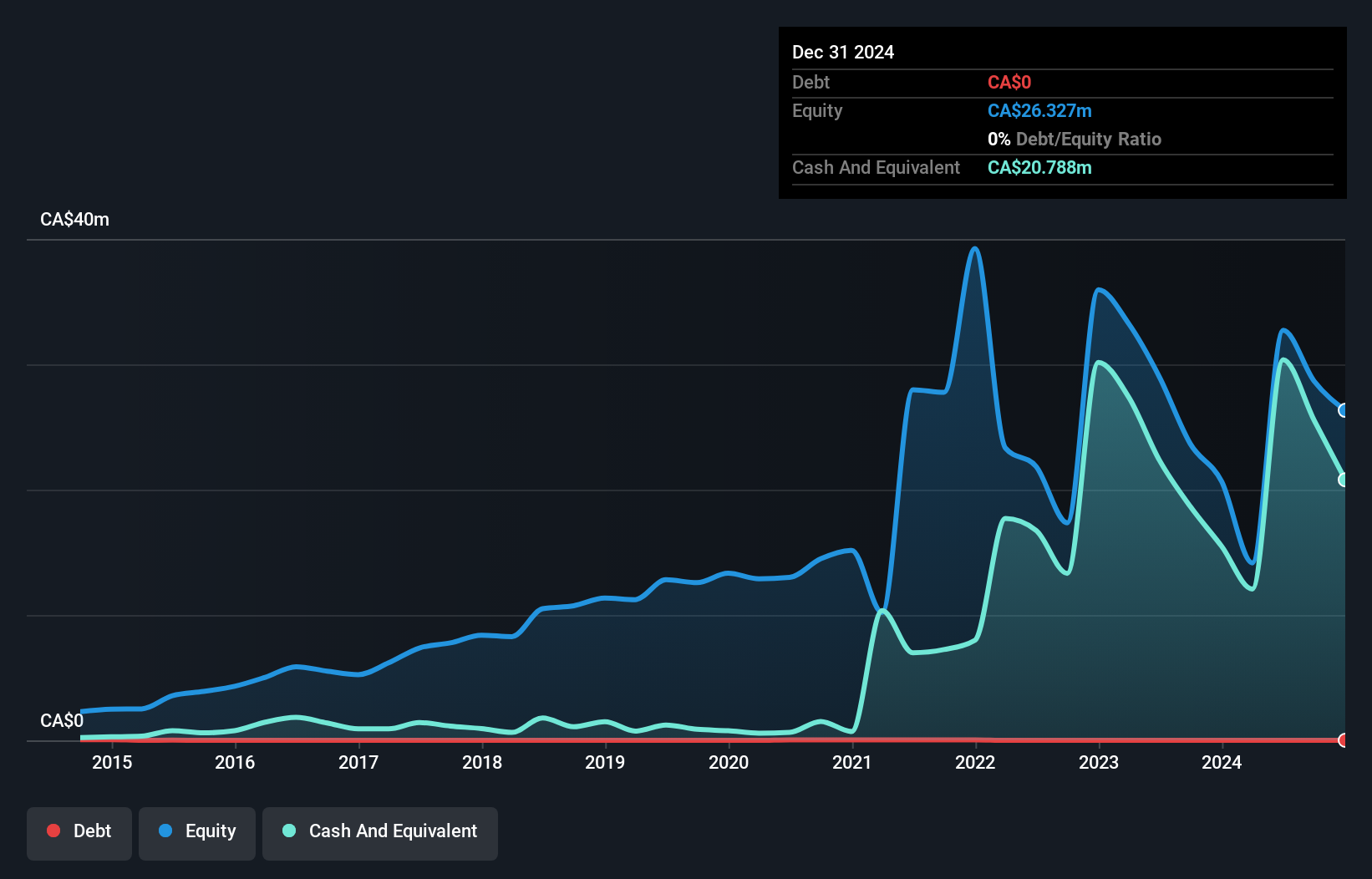

Alaska Silver Corp., with a market cap of CA$49.80 million, is pre-revenue and focused on mineral exploration in the United States. The company recently presented at a major investor conference, indicating active engagement with potential investors. Despite reporting a net loss of US$3.31 million for 2024, losses have narrowed compared to the previous year. Alaska Silver's short-term assets exceed its liabilities, providing some financial stability; however, long-term liabilities remain uncovered by current assets. The company has not experienced significant shareholder dilution recently but faces challenges with limited cash runway despite recent capital raises.

- Click to explore a detailed breakdown of our findings in Alaska Silver's financial health report.

- Assess Alaska Silver's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 905 TSX Penny Stocks by clicking here.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WAM

Alaska Silver

Engages in the acquisition, exploration, and evaluation of mineral properties in the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives