- Canada

- /

- Oil and Gas

- /

- TSX:LAM

Laramide Resources And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

Despite rising tariff rates, the Canadian market has shown resilience, with inflation and economic data remaining stable. For investors willing to explore beyond established names, penny stocks—often representing smaller or newer companies—offer intriguing opportunities. While the term may seem outdated, these stocks can still provide a mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.69 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.11 | CA$108.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.51 | CA$427.48M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.47 | CA$176.12M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.53 | CA$153.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$186.11M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.56 | CA$8.91M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 450 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Laramide Resources (TSX:LAM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Laramide Resources Ltd. is involved in the mining, exploration, and development of uranium assets with a market cap of CA$166.08 million.

Operations: Laramide Resources Ltd. currently does not report any revenue segments.

Market Cap: CA$166.08M

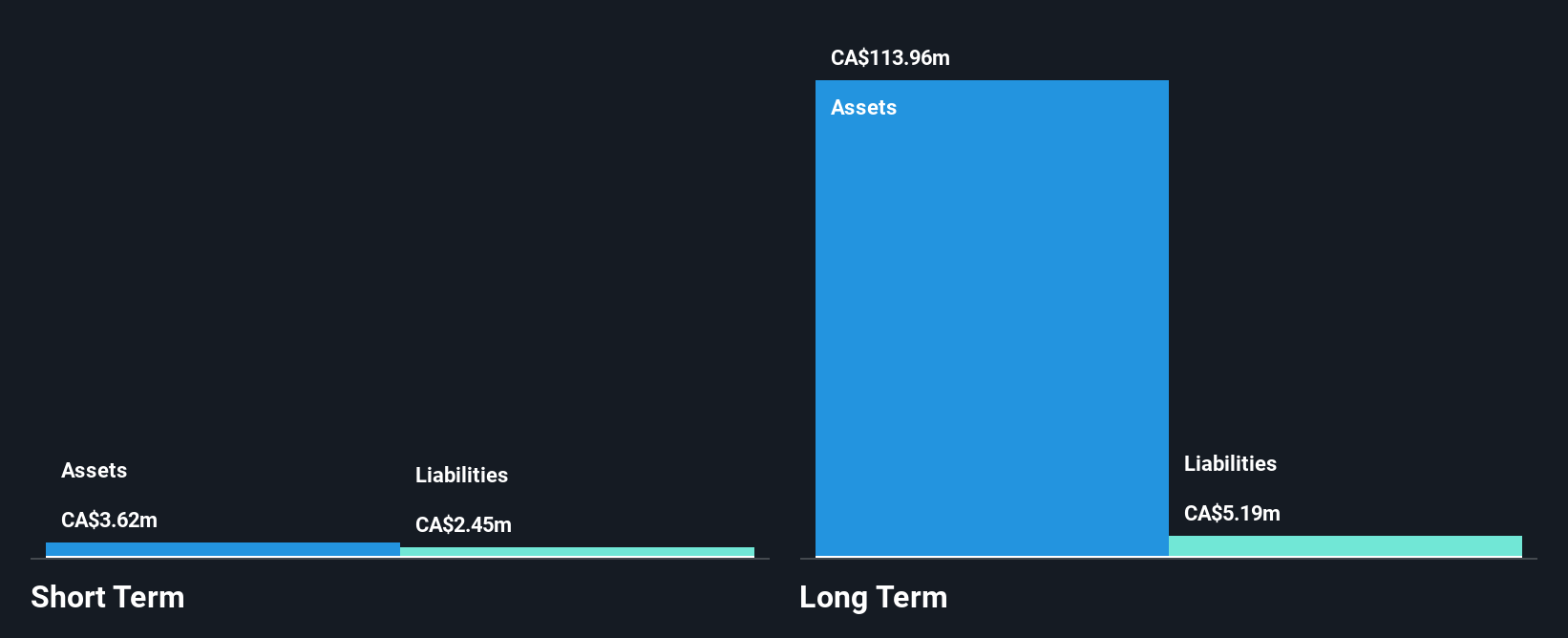

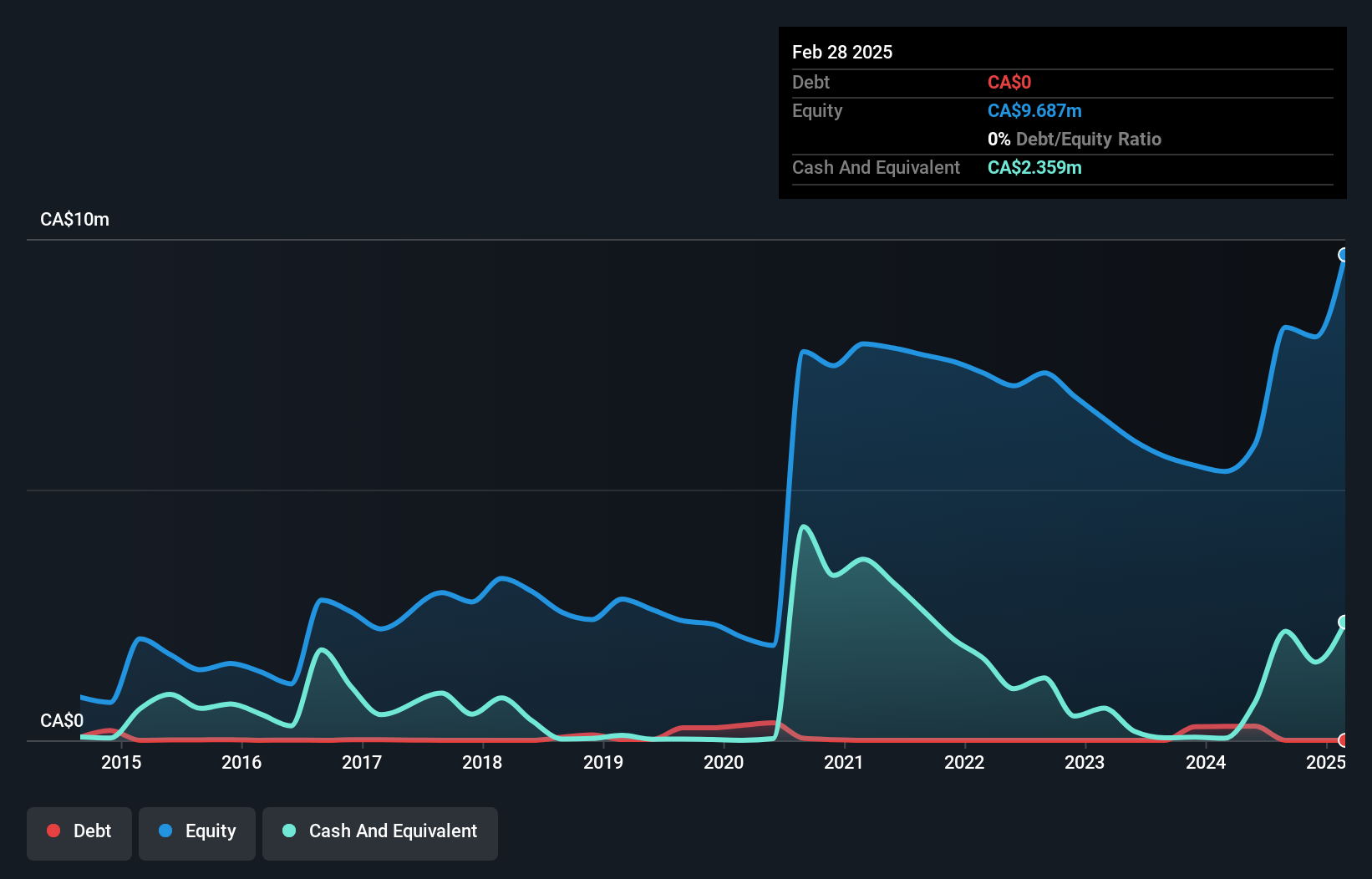

Laramide Resources Ltd., with a market cap of CA$166.08 million, is currently pre-revenue and unprofitable. The company recently announced a non-brokered private placement to raise up to CA$10 million, indicating efforts to bolster its financial position. Its advanced-stage uranium projects in New Mexico have gained strategic importance with FAST-41 designation, potentially streamlining federal review processes. While short-term assets cover liabilities and debt levels are manageable, the cash runway was limited but has since improved due to new capital inflow. Analysts anticipate significant stock price appreciation despite current profitability challenges.

- Dive into the specifics of Laramide Resources here with our thorough balance sheet health report.

- Assess Laramide Resources' future earnings estimates with our detailed growth reports.

Atha Energy (TSXV:SASK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atha Energy Corp. is a mineral company focused on acquiring, exploring, and evaluating mineral resources in Canada with a market cap of CA$175.90 million.

Operations: Atha Energy Corp. does not have any reported revenue segments.

Market Cap: CA$175.9M

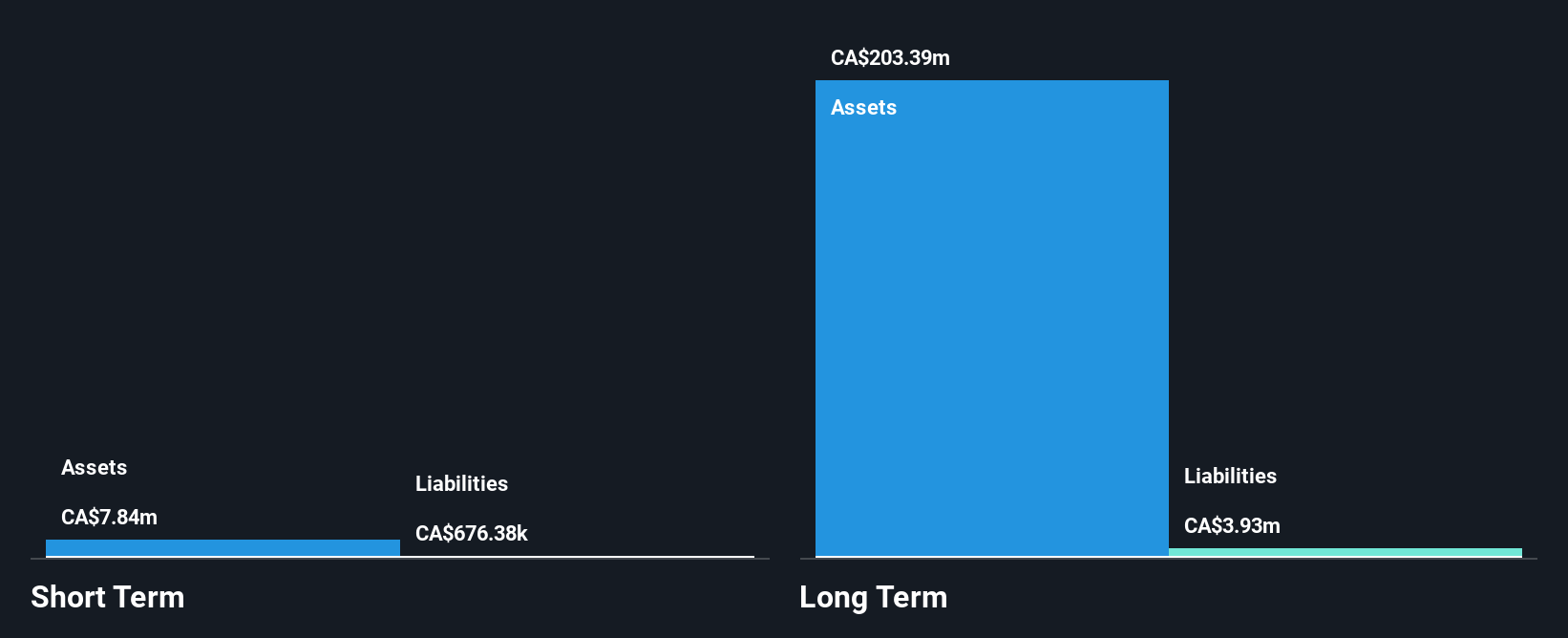

Atha Energy Corp., with a market cap of CA$175.90 million, is pre-revenue and has recently raised CA$10 million through private placements to support its exploration activities. The company focuses on uranium exploration at its Angilak Project in Nunavut, where recent drilling intersected high-grade mineralization, reinforcing the project's potential. Despite a short cash runway and unprofitable status, Atha's strategic initiatives include extensive ground surveys and drilling programs aimed at unlocking significant uranium deposits within the Rib-Nine Iron Trend. The addition of Suraj Ahuja to the board brings valuable expertise as Atha advances its projects in this emerging district.

- Unlock comprehensive insights into our analysis of Atha Energy stock in this financial health report.

- Learn about Atha Energy's future growth trajectory here.

Viscount Mining (TSXV:VML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscount Mining Corp. is involved in the evaluation and exploration of mineral properties in the United States, with a market cap of CA$96.76 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$96.76M

Viscount Mining Corp., with a market cap of CA$96.76 million, remains pre-revenue and unprofitable, though it has managed to reduce losses over the past five years. The company is debt-free and its short-term assets exceed liabilities, but it faces a cash runway of less than a year. Recent board changes include the addition of geologist Christina Ricks, who brings extensive experience in mineral exploration across North America. Her involvement is pivotal as Viscount advances its Passiflora Project in Colorado, where initial drilling has shown promising continuous sulphide mineralization indicative of copper porphyry systems.

- Click here to discover the nuances of Viscount Mining with our detailed analytical financial health report.

- Examine Viscount Mining's past performance report to understand how it has performed in prior years.

Where To Now?

- Reveal the 450 hidden gems among our TSX Penny Stocks screener with a single click here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAM

Laramide Resources

Engages in mining, exploration, and development of uranium assets.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives