- Canada

- /

- Metals and Mining

- /

- CNSX:STWO

November 2024's Top Picks: Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market has been experiencing significant shifts following the decisive U.S. election outcome, which removed a major source of uncertainty and led to a strong rally in stocks, including record highs for the TSX. In such an evolving landscape, investors often look beyond established giants to explore opportunities in lesser-known areas like penny stocks. Although the term "penny stocks" might seem outdated, these investments can still offer potential growth by focusing on smaller or newer companies with robust financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$611.45M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.65 | CA$276.89M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$179.38M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$117.05M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.18M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$311.11M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

S2 Minerals (CNSX:STWO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: S2 Minerals Inc. is involved in the exploration of mineral properties in Canada and has a market cap of CA$3.79 million.

Operations: No revenue segments have been reported for the company.

Market Cap: CA$3.79M

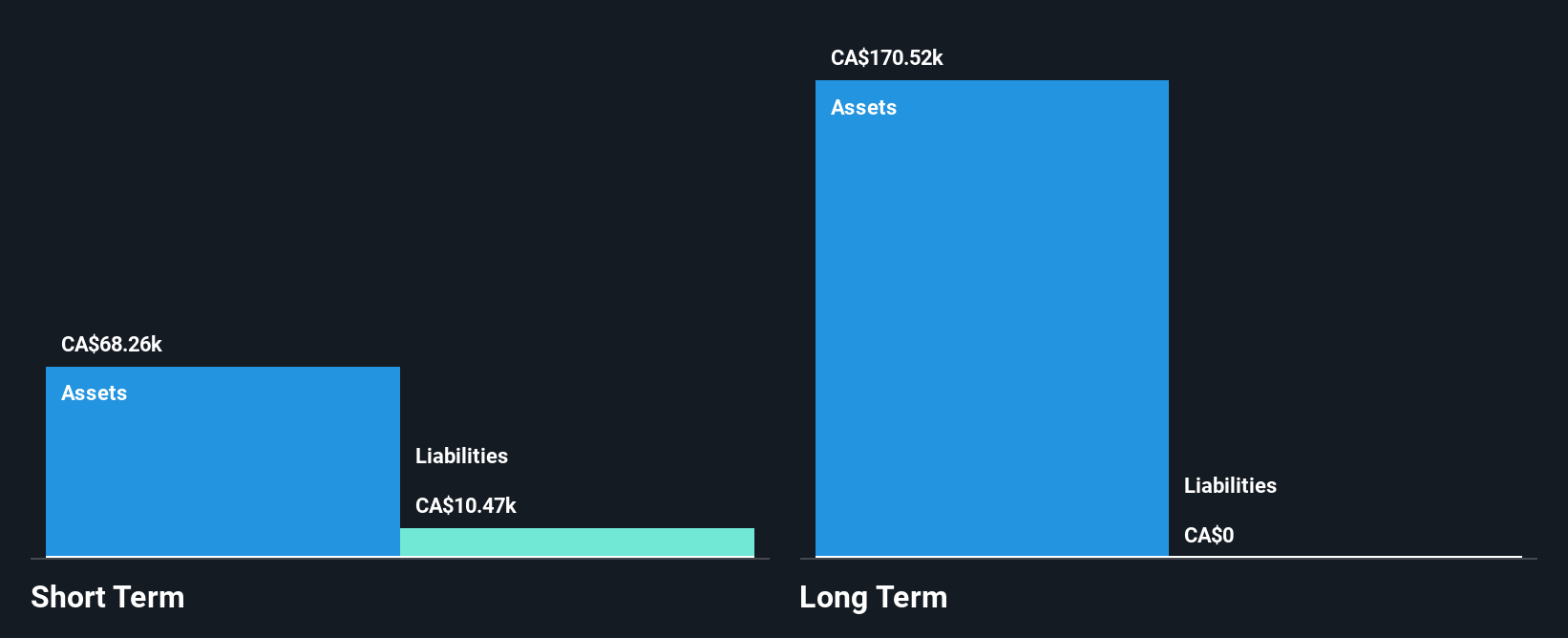

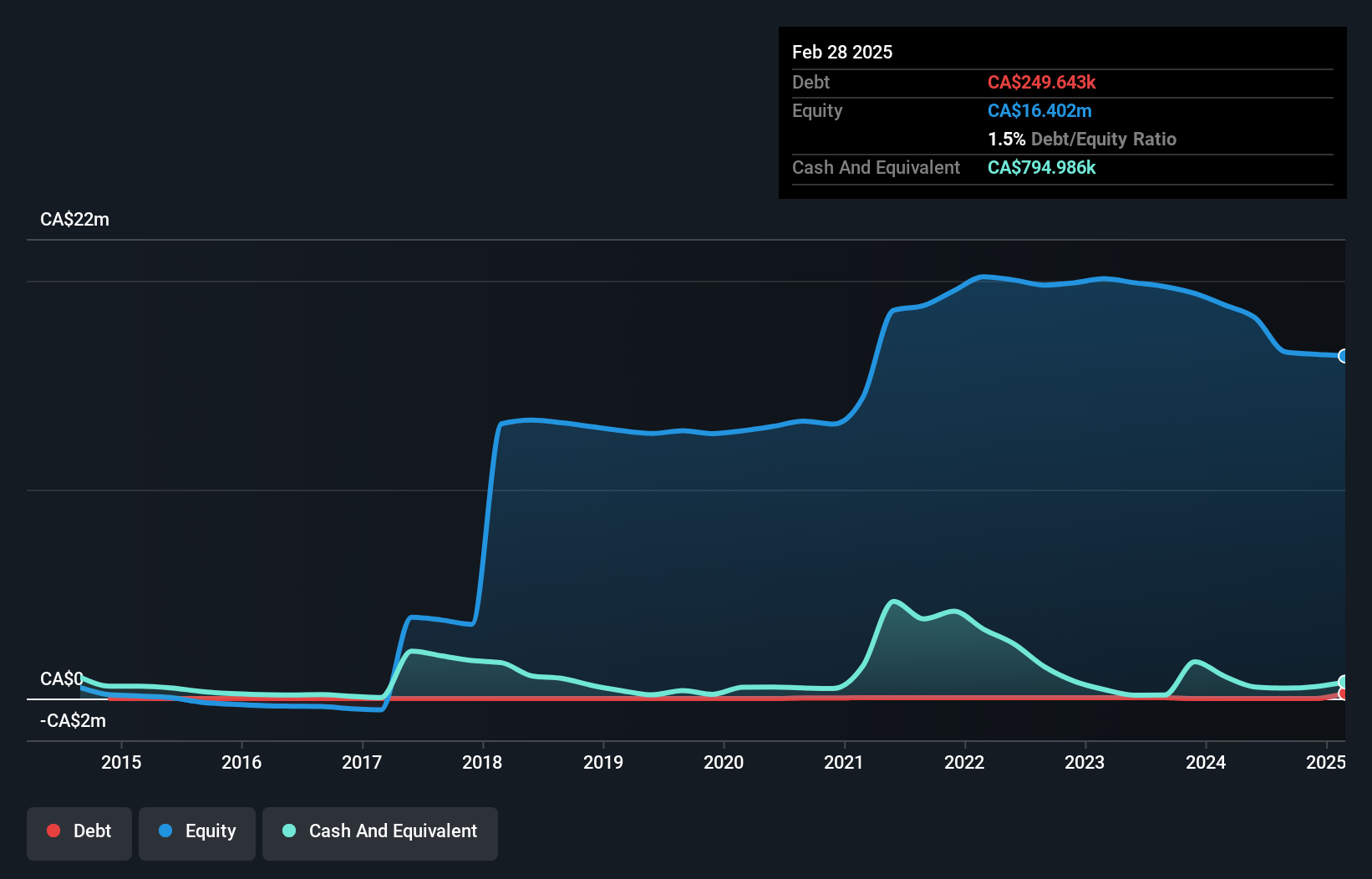

S2 Minerals Inc., with a market cap of CA$3.79 million, is a pre-revenue company focused on mineral exploration in Canada. Despite being unprofitable, it has managed to reduce its losses by 67.5% annually over the past five years, indicating some financial improvement. The company has no debt and no long-term liabilities, but it faces challenges with less than a year of cash runway based on current free cash flow trends. Short-term assets exceed short-term liabilities significantly, which provides some financial stability amidst its ongoing exploration activities.

- Dive into the specifics of S2 Minerals here with our thorough balance sheet health report.

- Learn about S2 Minerals' historical performance here.

Jericho Energy Ventures (TSXV:JEV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jericho Energy Ventures Inc. is involved in the acquisition, exploration, development, and production of crude oil and natural gas in the United States with a market cap of CA$33.77 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to $0.06 million.

Market Cap: CA$33.77M

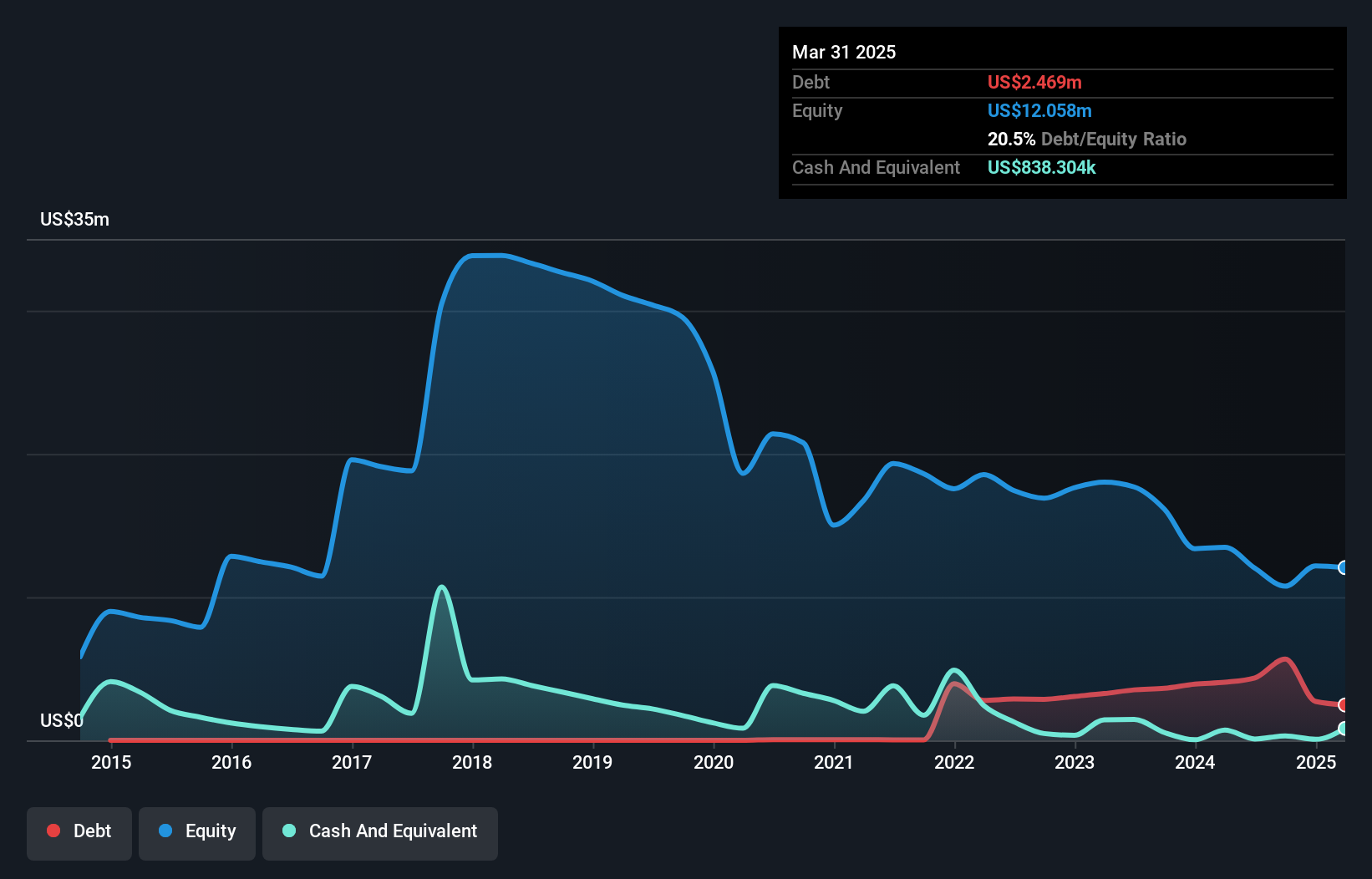

Jericho Energy Ventures Inc., with a market cap of CA$33.77 million, is pre-revenue and unprofitable but has been reducing losses by 9% annually over the past five years. The company recently announced a strategic collaboration with Aurea Holdings to advance green energy solutions in Europe, alongside a private placement raising CA$2 million to support its initiatives. Despite an increase in debt-to-equity ratio to 36.3%, Jericho's short-term assets fall short of covering its liabilities, indicating financial challenges ahead. Shareholder dilution occurred last year, yet management remains experienced with an average tenure of 6.6 years.

- Navigate through the intricacies of Jericho Energy Ventures with our comprehensive balance sheet health report here.

- Assess Jericho Energy Ventures' previous results with our detailed historical performance reports.

Vision Lithium (TSXV:VLI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vision Lithium Inc. is a Canadian company focused on mineral resource exploration, with a market cap of CA$6.56 million.

Operations: Vision Lithium Inc. has not reported any revenue segments.

Market Cap: CA$6.56M

Vision Lithium Inc., with a market cap of CA$6.56 million, is pre-revenue and unprofitable, experiencing increased losses at a rate of 36.3% annually over the past five years. The company has no debt and its short-term assets of CA$860.3K exceed both its short-term and long-term liabilities, indicating some financial stability despite having less than a year of cash runway if free cash flow continues to decline. Shareholders have faced dilution with shares outstanding increasing by 2.1% in the past year, while the board maintains an average tenure of 7.5 years, suggesting experienced oversight amidst volatility challenges.

- Take a closer look at Vision Lithium's potential here in our financial health report.

- Explore historical data to track Vision Lithium's performance over time in our past results report.

Turning Ideas Into Actions

- Access the full spectrum of 962 TSX Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:STWO

Flawless balance sheet slight.

Market Insights

Community Narratives