- Canada

- /

- Metals and Mining

- /

- TSXV:WEC

3 TSX Penny Stocks With Over CA$0 Market Cap

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with investors keenly observing economic trends and seeking strategies that align with their long-term financial goals. In this context, penny stocks—though the term might seem dated—remain relevant for those interested in smaller or newer companies. These stocks can offer a unique blend of affordability and potential growth, especially when supported by strong financials, making them an intriguing option for investors looking to explore under-the-radar opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.24 | CA$115M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$13.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$33.04M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.64 | CA$302.67M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.92 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 939 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Condor Resources (TSXV:CN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$16.23 million.

Operations: Condor Resources Inc. currently does not report any revenue segments, as it is an exploration stage company focused on mineral properties in Canada and Peru.

Market Cap: CA$16.23M

Condor Resources, a pre-revenue exploration company, is actively expanding its mineral property portfolio in Peru. Recent developments include the successful completion of the Consulta Previa process and acquisition of additional concessions at the Huiñac Punta project, which shows promise for high-grade silver and polymetallic mineralization. The company's financial health appears stable with no long-term liabilities and short-term assets covering liabilities. However, it remains unprofitable with recent net losses reported. A non-brokered private placement aims to raise up to CA$1.5 million to support ongoing exploration activities while maintaining shareholder value without significant dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Condor Resources.

- Gain insights into Condor Resources' historical outcomes by reviewing our past performance report.

Nio Strategic Metals (TSXV:NIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nio Strategic Metals Inc. is a development stage company focused on the exploration and development of mineral properties in Quebec, with a market cap of CA$4.25 million.

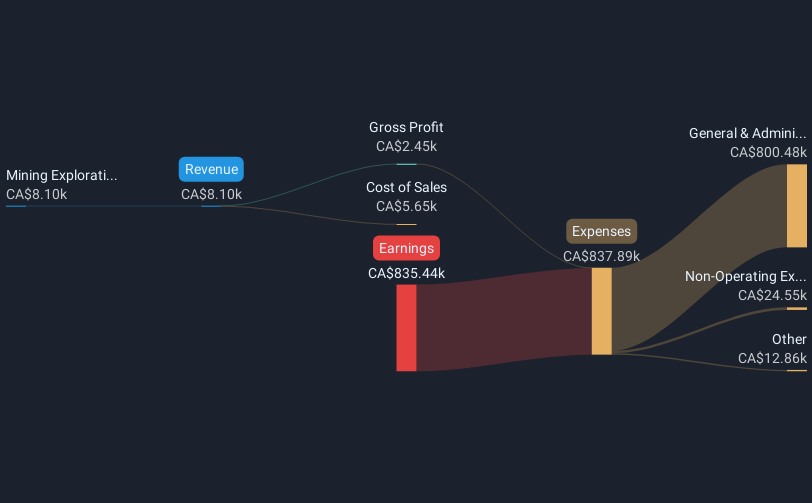

Operations: The company generates revenue from its mining exploration activities, totaling CA$0.0081 million.

Market Cap: CA$4.25M

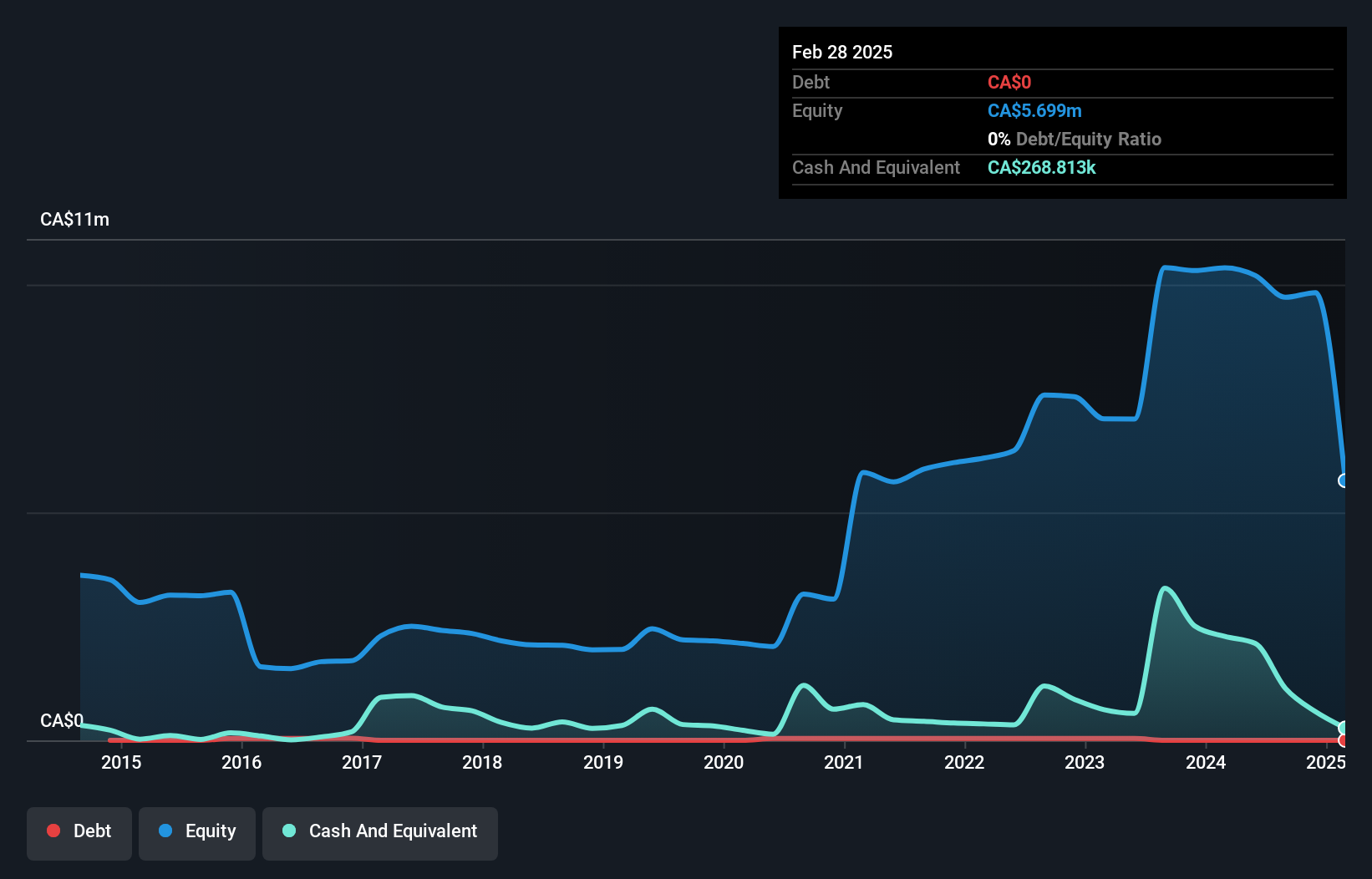

Nio Strategic Metals Inc., a pre-revenue company, focuses on mineral exploration in Quebec with a market cap of CA$4.25 million. Despite generating minimal revenue (CA$0.0081 million), the company has improved its financial position by eliminating negative shareholder equity over five years and maintaining more cash than debt. However, it remains unprofitable with increasing losses and recent shareholder dilution of 6.4%. The acquisition of additional hectares near its Fafnir Project could enhance resource potential, but high volatility persists in its share price, posing risks for investors seeking stability in penny stocks.

- Navigate through the intricacies of Nio Strategic Metals with our comprehensive balance sheet health report here.

- Evaluate Nio Strategic Metals' historical performance by accessing our past performance report.

Three Valley Copper (TSXV:TVC.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Three Valley Copper Corp. is engaged in the exploration and production of copper, with a market cap of CA$562,319.

Operations: Three Valley Copper Corp. has not reported any revenue segments.

Market Cap: CA$562.32k

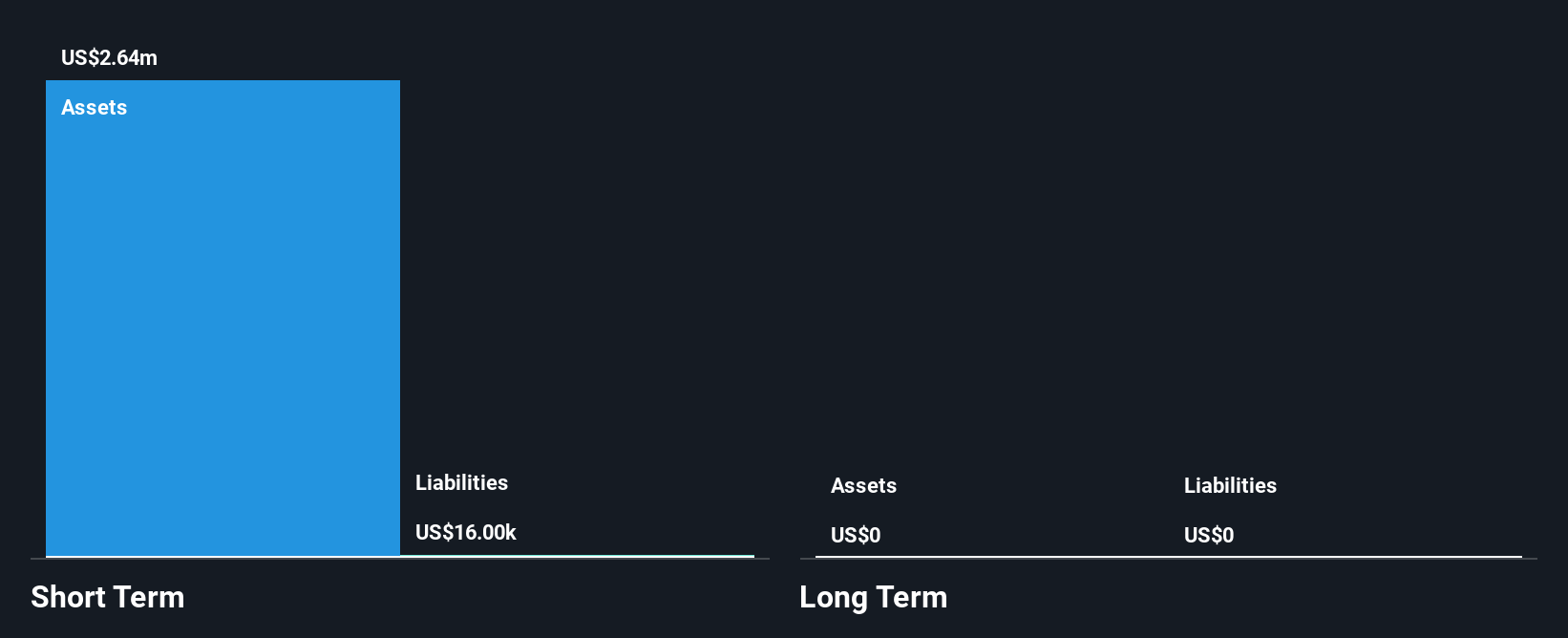

Three Valley Copper Corp., with a market cap of CA$562,319, is a pre-revenue entity focused on copper exploration. Despite being debt-free and having short-term assets of US$3.1 million exceeding its liabilities, the company faces challenges such as low return on equity (5.3%) and high non-cash earnings. Recent earnings reports show slight profitability improvements, but negative earnings growth over the past year presents concerns. The company's share price has been highly volatile recently, indicating potential risks for investors seeking stability in penny stocks. Lack of experienced management and board members may further impact strategic direction.

- Click here to discover the nuances of Three Valley Copper with our detailed analytical financial health report.

- Assess Three Valley Copper's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 939 TSX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Winchester Equity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WEC

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion