- Canada

- /

- Metals and Mining

- /

- CNSX:MIS

3 TSX Penny Stocks With Market Caps Over CA$7M To Watch

Reviewed by Simply Wall St

As the Canadian economy shows signs of cooling, with a softening labor market and potential rate cuts from the Bank of Canada, investors are keeping a close eye on opportunities within the stock market. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those seeking growth potential beyond traditional large-cap investments. Despite their outdated moniker, these stocks can offer hidden value when backed by strong financial health and resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.07 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Mistango River Resources (CNSX:MIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mistango River Resources Inc. is involved in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$7.13 million.

Operations: Mistango River Resources Inc. does not report any specific revenue segments.

Market Cap: CA$7.13M

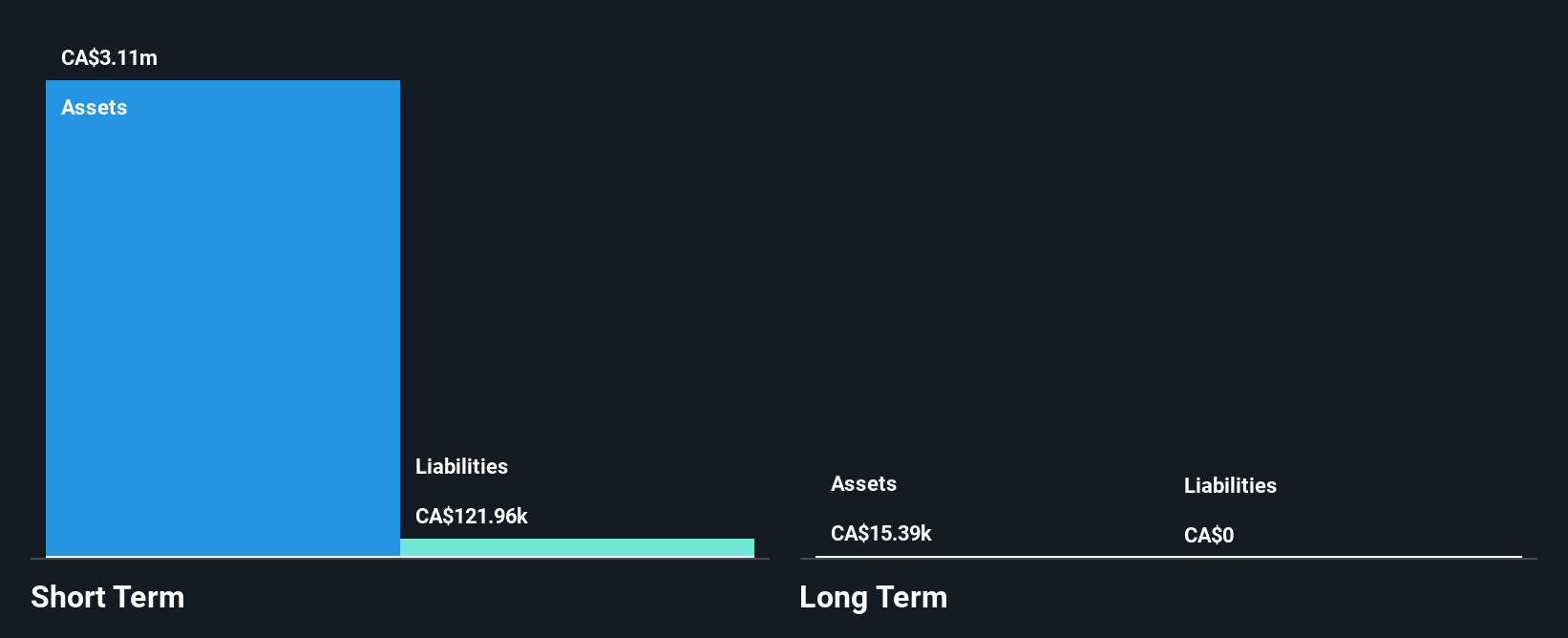

Mistango River Resources, with a market cap of CA$7.13 million, is currently pre-revenue and unprofitable. Despite this, the company has a cash runway exceeding three years, suggesting financial stability in the short term. Recent developments include an ambitious 28-hole drill program at its Omega Gold Project in Kirkland Lake aimed at expanding known mineralization zones. This exploration could potentially enhance asset value if successful results are achieved and reported by Q4 2024. The company's share price remains volatile but shareholders have not faced significant dilution recently, which may be appealing to investors seeking speculative opportunities in the mining sector.

- Get an in-depth perspective on Mistango River Resources' performance by reading our balance sheet health report here.

- Gain insights into Mistango River Resources' past trends and performance with our report on the company's historical track record.

Givex (TSX:GIVX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Givex Corp. offers omnichannel gift cards, loyalty programs, data analytics, stored value tickets, payment processing, and cloud-based point of sale solutions across Canada, the United States, Australia, the United Kingdom and internationally with a market cap of CA$198.48 million.

Operations: The company generates CA$83.84 million in revenue from its computer services segment.

Market Cap: CA$198.48M

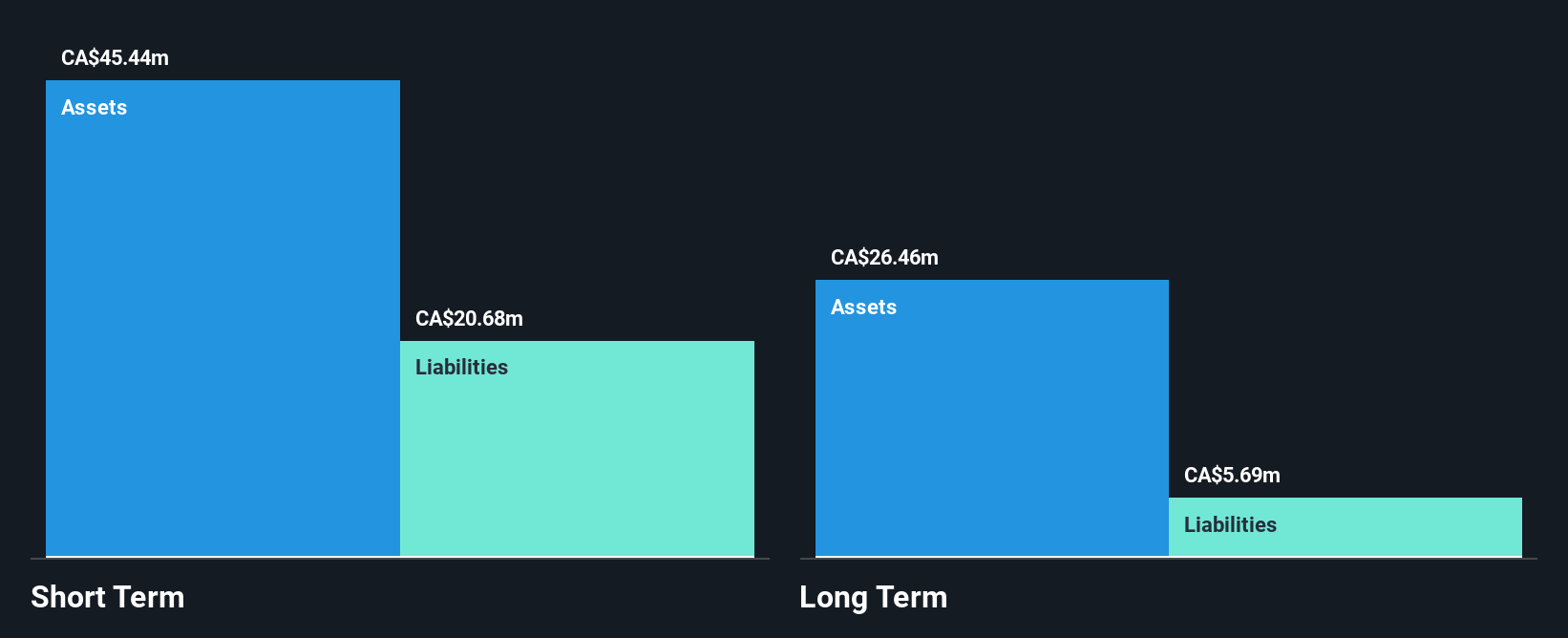

Givex Corp., with a market cap of CA$198.48 million, is navigating a transformative phase as it partners with Bridge to digitize gift cards, enhancing consumer engagement and merchant growth opportunities. Despite being unprofitable and experiencing increased losses over the past five years, Givex maintains a robust cash position exceeding its debt, offering financial resilience. The company's short-term assets surpass both short- and long-term liabilities, ensuring liquidity. However, shareholders have faced dilution recently. The impending acquisition by Shift4 Payments Inc., valued at approximately CA$200 million, is expected to close soon following shareholder approval.

- Dive into the specifics of Givex here with our thorough balance sheet health report.

- Examine Givex's past performance report to understand how it has performed in prior years.

Tribeca Resources (TSXV:TRBC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribeca Resources Corporation is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile, with a market cap of CA$21.29 million.

Operations: Currently, there are no reported revenue segments for this copper exploration company focused on assets in northern Chile.

Market Cap: CA$21.29M

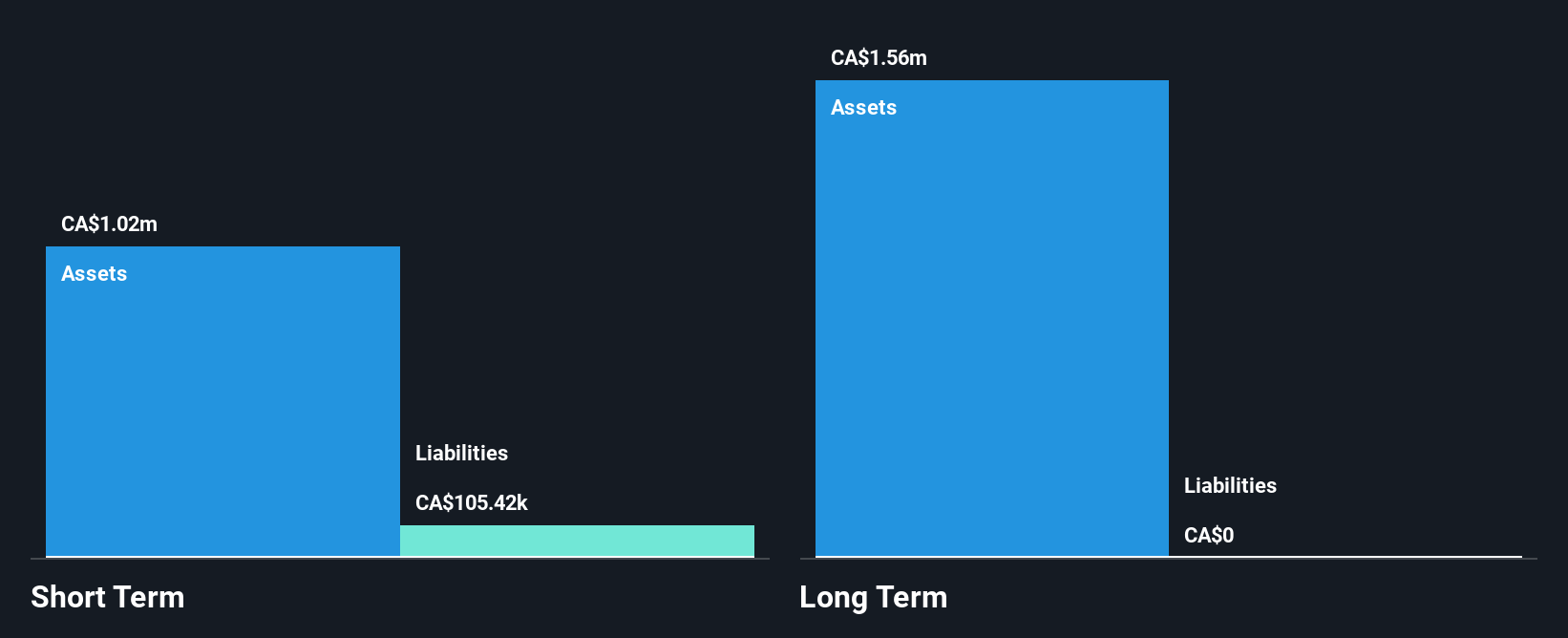

Tribeca Resources Corporation, a copper exploration company with a market cap of CA$21.29 million, remains pre-revenue and debt-free. Recent geological mapping and geophysical surveys at its Chiricuto IOCG project in northern Chile have identified significant chargeability anomalies, guiding future drilling efforts. The company has secured funding for an upcoming 1,500-meter diamond drilling program through recent capital raises. Despite ongoing net losses—CA$0.24 million for Q2 2024—the focus on exploration advancements highlights potential growth avenues within the Coastal IOCG Belt while maintaining financial maneuverability with adequate short-term assets covering liabilities.

- Click here to discover the nuances of Tribeca Resources with our detailed analytical financial health report.

- Gain insights into Tribeca Resources' historical outcomes by reviewing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 959 TSX Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:MIS

Mistango River Resources

Engages in the acquisition and exploration of mineral properties in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives