- Canada

- /

- Oil and Gas

- /

- TSX:TVE

Three Canadian Hidden Gems with Promising Potential

Reviewed by Simply Wall St

The Canadian market has experienced significant volatility in the first half of 2025, with the TSX reaching all-time highs despite earlier declines driven by U.S. policy shifts and trade tensions. In this dynamic environment, identifying promising stocks involves looking for companies that can navigate economic uncertainties and leverage growth opportunities, making them potential hidden gems in the Canadian landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Cannara Biotech | 51.29% | 49.88% | 73.18% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aris Mining Corporation is involved in the acquisition, exploration, development, and operation of gold properties across Canada, Colombia, and Guyana with a market capitalization of CA$1.69 billion.

Operations: Aris Mining generates revenue primarily from its Marmato and Segovia segments, with Segovia contributing significantly more at $497.75 million compared to Marmato's $62.76 million.

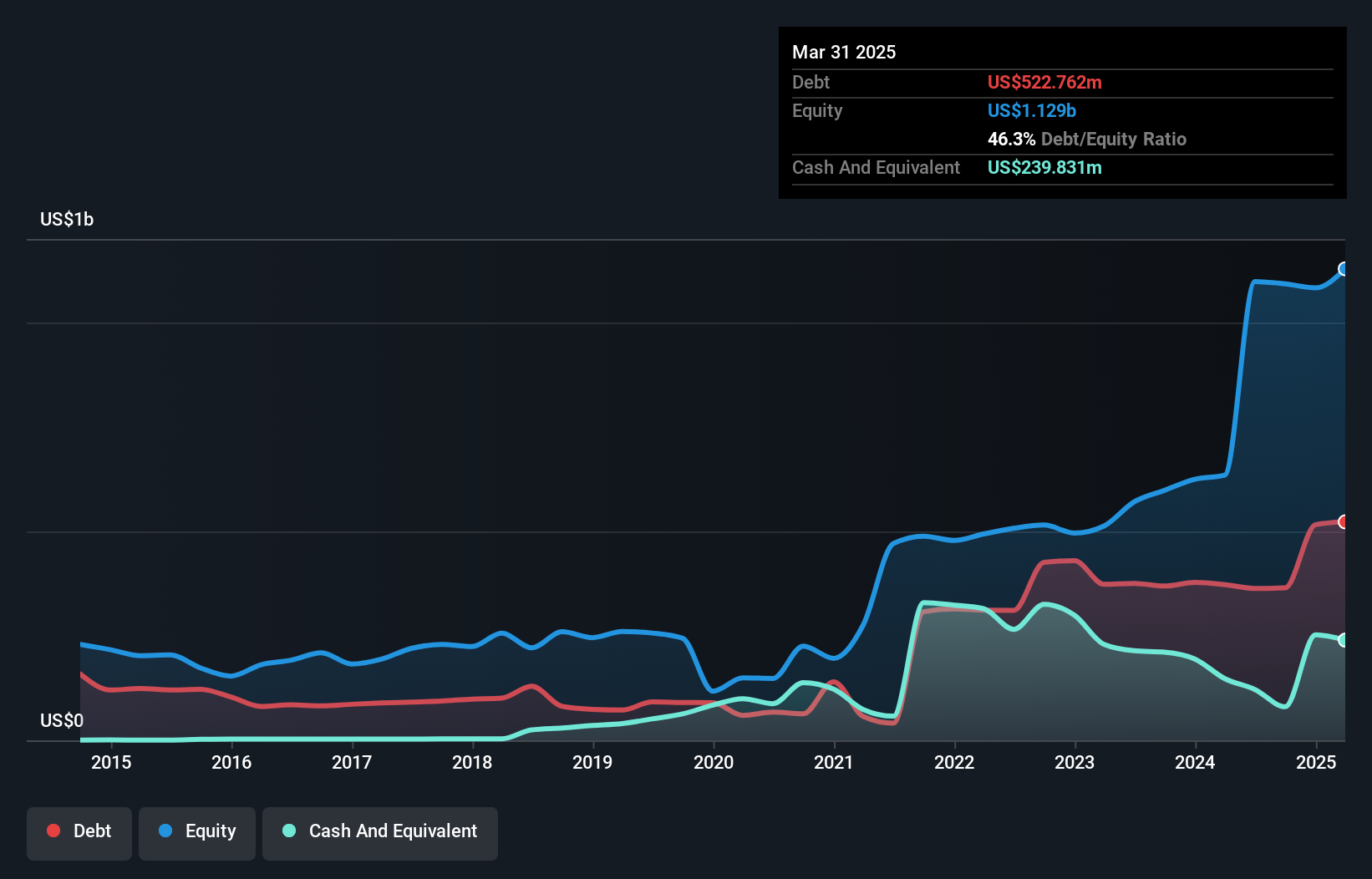

Aris Mining, a nimble player in the mining sector, has shown impressive earnings growth of 62.5% over the past year, outpacing its industry peers. With its debt to equity ratio rising from 39.8% to 46.3% over five years, managing leverage is crucial as it embarks on ambitious projects like the Segovia expansion that boosts processing capacity by 50%. Trading at a discount of 28.2% below estimated fair value and with interest payments well covered by EBIT at a multiple of 6.4x, Aris seems poised for potential growth despite recent challenges in free cash flow generation.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tamarack Valley Energy Ltd. is involved in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids within the Western Canadian sedimentary basin and has a market cap of approximately CA$2.45 billion.

Operations: Tamarack Valley Energy generates revenue primarily from its oil and gas exploration and production activities, with reported revenues of CA$1.44 billion.

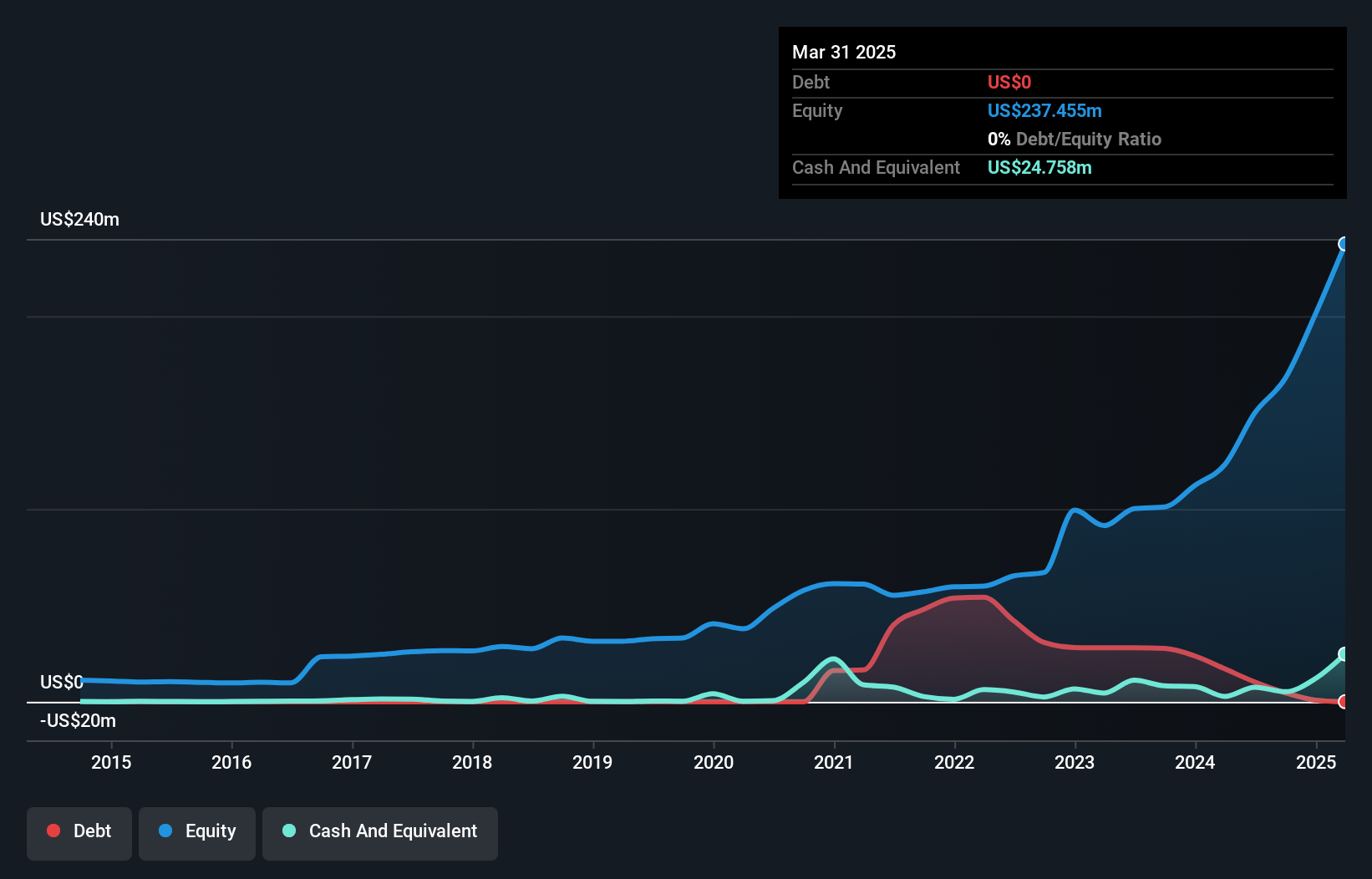

Tamarack Valley Energy, a Canadian energy player, has shown impressive earnings growth of 340% over the past year, outpacing the industry average significantly. Its debt management appears solid with a net debt to equity ratio at 37%, considered satisfactory. The company also boasts high-quality earnings and trades at a discount of 31.5% below its estimated fair value. Despite these strengths, Tamarack faces challenges ahead with earnings expected to decline by an average of 32.8% annually over the next three years. Recent strategic moves include extending its credit facility maturity and repurchasing shares worth CAD 145 million this year.

Thor Explorations (TSXV:THX)

Simply Wall St Value Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market capitalization of CA$512.28 million.

Operations: Thor Explorations generates revenue primarily from its Segilola Mine Project, contributing $223.88 million.

Thor Explorations is making strides in the mining industry with a focus on West Africa, particularly Nigeria and Senegal. The company reported a remarkable earnings growth of 457% last year, showcasing its capability to outperform the industry average of 37%. With no debt on its books, Thor has improved financial flexibility, allowing for increased exploration budgets. Recent production guidance estimates gold output between 85,000 and 95,000 ounces at an all-in sustaining cost (AISC) of US$800 to US$1,000 per ounce. Despite geopolitical challenges and forecasted revenue dips over the next few years, profit margins are expected to rise significantly.

Next Steps

- Explore the 46 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Solid track record and good value.

Market Insights

Community Narratives