- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Thor Explorations (TSXV:THX) Is Up 17.6% After High-Grade Drill Hits at Guitry Gold Project

Reviewed by Simply Wall St

- Thor Explorations Ltd. recently reported initial assay results from its maiden drilling campaign at the 100% owned Guitry Gold Project in Côte d'Ivoire, including several intercepts such as 14 metres at 2.59 g/t gold from surface and 5 metres at 12.65 g/t gold from 69 metres.

- This marks the company's first exploration update at Guitry following its acquisition from Endeavour Mining in 2024, highlighting the project's position on a highly prospective greenstone belt known to host significant West African gold deposits.

- We will assess how these early high-grade drill results at Guitry could reshape Thor Explorations' investment narrative and growth outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Thor Explorations Investment Narrative Recap

To be a shareholder in Thor Explorations, you’d want conviction in the company’s ability to translate exploration success across West Africa into sustainable production growth and cash flow, particularly as expansion projects like Guitry progress. The latest high-grade drill results from Guitry could accelerate near-term diversification beyond Segilola, potentially supporting the most important short-term catalyst: validation of revenue growth from new assets. However, the biggest risk, an overreliance on a single producing mine, remains only partly addressed by these early-stage results.

A recent earnings announcement on August 12, 2025, revealed robust profit growth and higher margins, directly underpinned by current production from Segilola. These results remain highly relevant as the success of expansion and new exploration, like the Guitry campaign, will be critical to sustaining such profitability once Segilola’s relative contribution begins to decline.

In contrast, investors should be aware that early-stage exploration results, while promising, do not eliminate the underlying concentration risk if project development at Guitry or other assets falters...

Read the full narrative on Thor Explorations (it's free!)

Thor Explorations' outlook projects $128.9 million in revenue and $65.3 million in earnings by 2028. This assumes a 20.1% annual revenue decline and a $72.1 million decrease from current earnings of $137.4 million.

Uncover how Thor Explorations' forecasts yield a CA$1.04 fair value, a 13% downside to its current price.

Exploring Other Perspectives

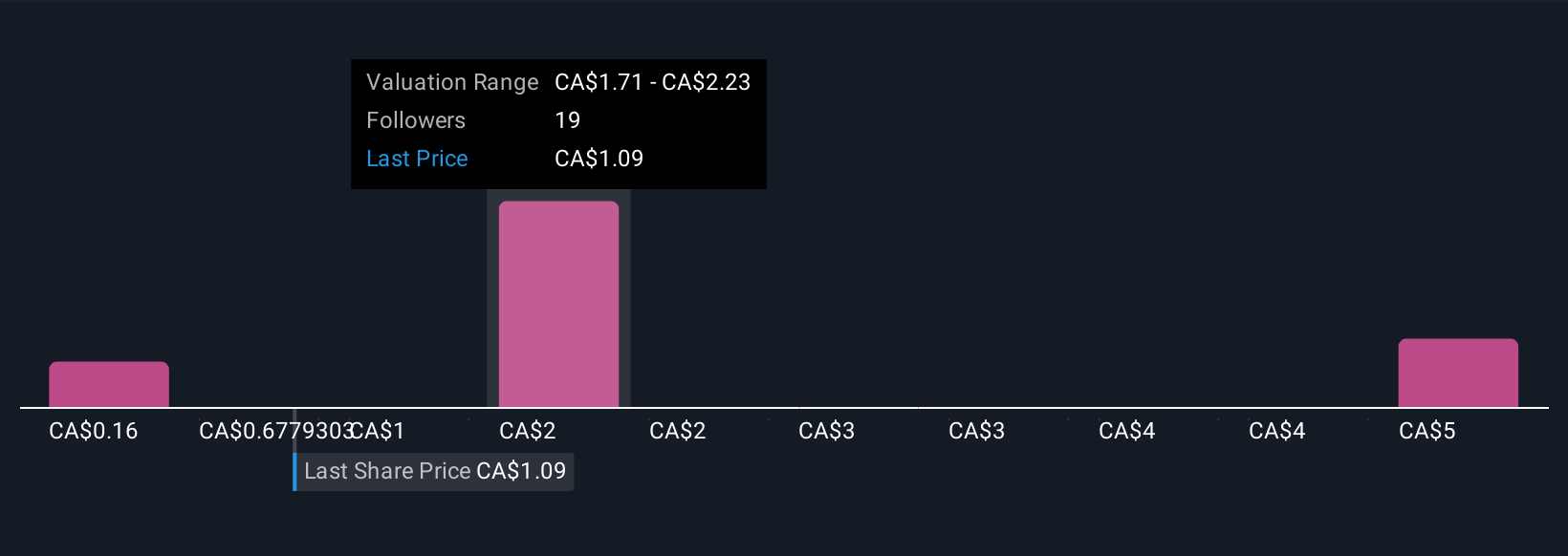

Simply Wall St Community fair value estimates for Thor Explorations range from CA$0.16 to CA$4.07 across 7 independent valuations, signaling varied outlooks on the stock. While many see strong upside, continued overreliance on Segilola raises questions about sustaining earnings if diversification is slower than expected, inviting you to explore several alternative viewpoints.

Explore 7 other fair value estimates on Thor Explorations - why the stock might be worth less than half the current price!

Build Your Own Thor Explorations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thor Explorations research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thor Explorations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thor Explorations' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives