- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Exploring Aris Mining And 2 Hidden Canadian Small Caps With Strong Potential

Reviewed by Simply Wall St

In recent months, the Canadian market has experienced a moderate inflation impact, with services inflation showing signs of moderation despite pressures from elevated tariffs on goods. This economic backdrop presents both challenges and opportunities for small-cap companies, which often thrive when they demonstrate resilience and adaptability in changing markets. In this article, we explore Aris Mining alongside two lesser-known Canadian small caps that exhibit strong potential amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| TWC Enterprises | 4.26% | 13.21% | 11.52% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.21% | 62.25% | 64.39% | ★★★★★★ |

| Heliostar Metals | NA | 106.15% | 25.32% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aris Mining Corporation is involved in the acquisition, exploration, development, and operation of gold properties across Canada, Colombia, and Guyana with a market capitalization of approximately CA$1.75 billion.

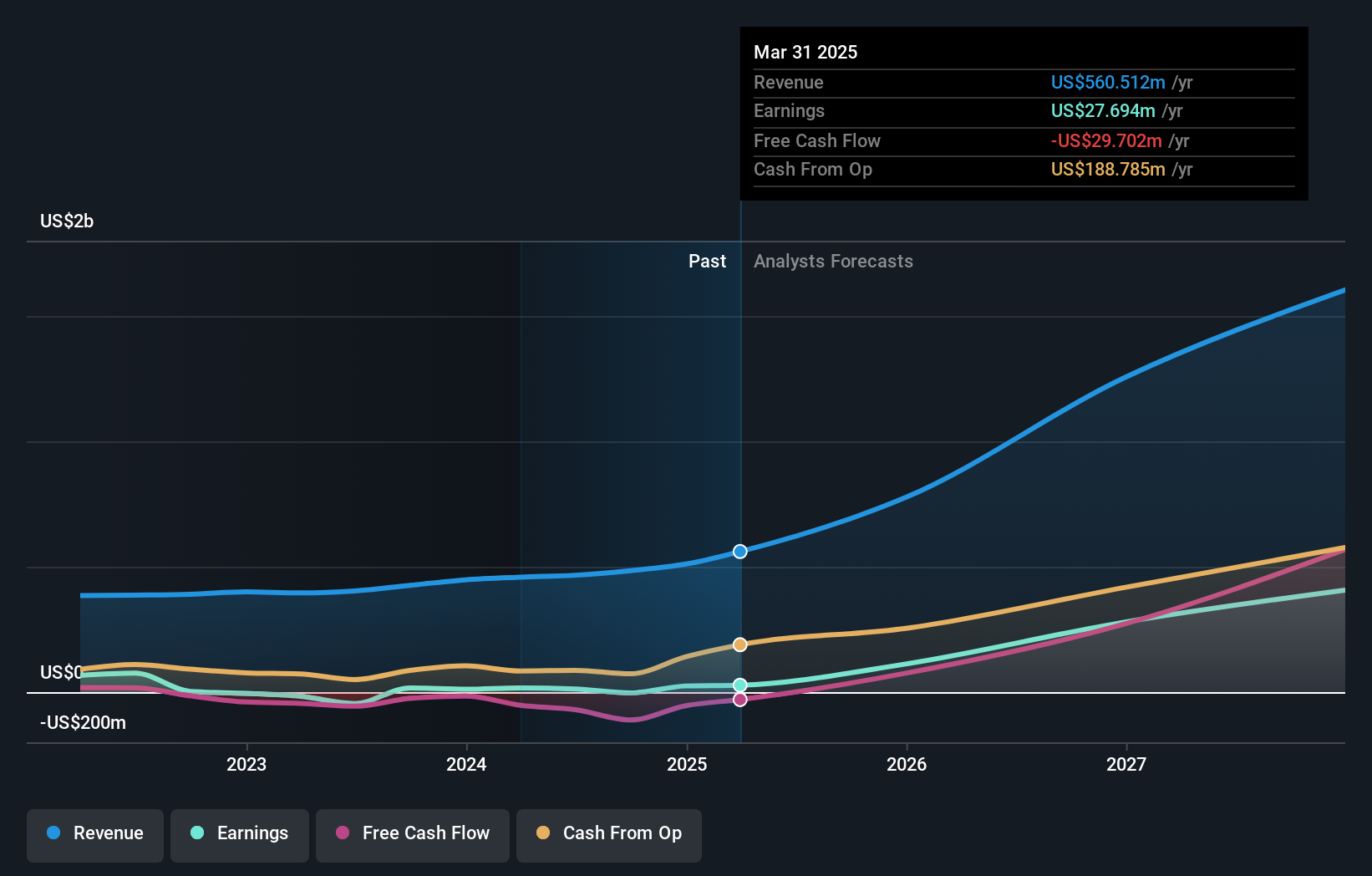

Operations: Aris Mining generates revenue primarily from its Marmato and Segovia operations, amounting to $62.76 million and $497.75 million, respectively.

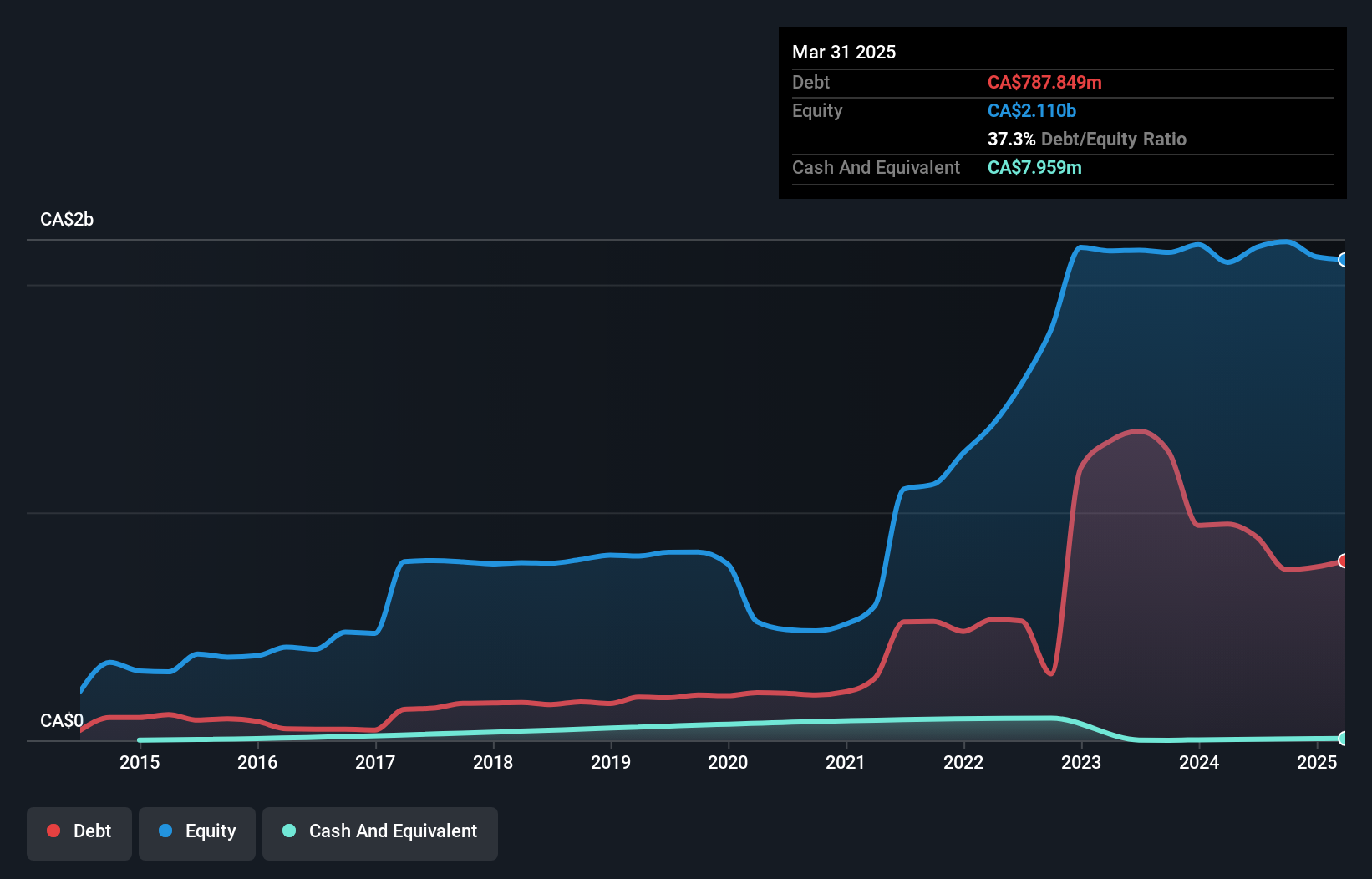

Aris Mining, a dynamic player in the Canadian mining scene, has shown impressive growth with earnings surging 62.5% over the past year, outpacing its industry peers. Despite a rise in debt to equity from 39.8% to 46.3% over five years, it maintains satisfactory net debt levels at 25.1%. The company trades at an attractive valuation, currently sitting 28.4% below its estimated fair value and boasts well-covered interest payments at 6.4 times EBIT coverage. Recent developments include expanding Segovia's processing capacity by 50%, positioning Aris for increased production and potential future gains as it explores strategic partnerships in Colombia’s rich gold landscape.

- Take a closer look at Aris Mining's potential here in our health report.

Evaluate Aris Mining's historical performance by accessing our past performance report.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tamarack Valley Energy Ltd. operates in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids within the Western Canadian sedimentary basin with a market capitalization of approximately CA$2.64 billion.

Operations: Tamarack Valley Energy generates revenue primarily from its oil and gas exploration and production activities, with reported revenues of CA$1.40 billion. The company's financial performance is influenced by its ability to manage costs associated with these operations, impacting its overall profitability.

Tamarack Valley Energy, a notable player in Canada's energy sector, is leveraging waterflooding techniques to boost production and cut costs. Recent acquisitions have expanded its footprint in Clearwater, enhancing development potential. Despite a satisfactory net debt to equity ratio of 34.5%, the company faces challenges from oil price volatility and regulatory risks. Earnings surged by 95.6% last year, outpacing the industry average of -1.1%. With interest payments well covered at 5.6x EBIT, Tamarack's financial health appears robust despite anticipated profit margin declines over the next three years amidst modest revenue growth projections of 4.8% annually.

Thor Explorations (TSXV:THX)

Simply Wall St Value Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, is engaged in gold production and exploration, with a market capitalization of CA$488.99 million.

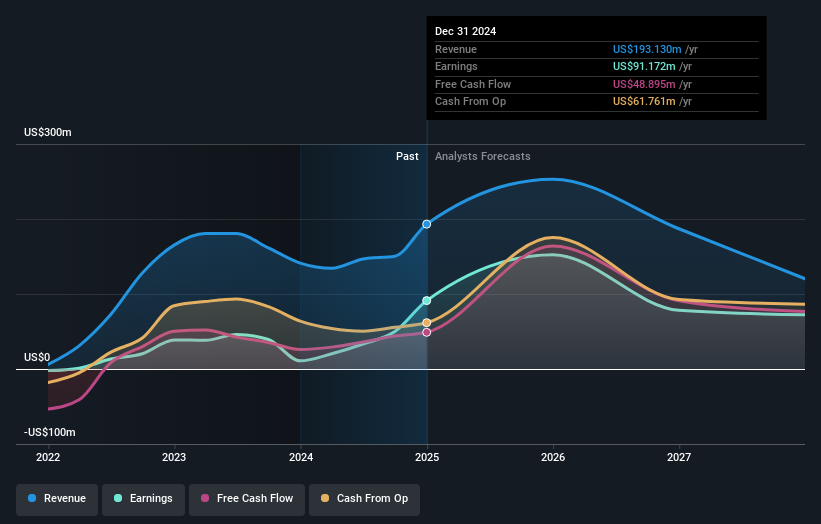

Operations: Thor Explorations generates revenue primarily from its Segilola Mine Project, contributing $223.88 million.

Thor Explorations is carving a niche in the mining sector with its West African projects, particularly the Segilola Gold project, which aims to produce 85,000 to 95,000 ounces of gold at an all-in sustaining cost between US$800 and US$1,000 per ounce. The company reported earnings growth of 457.6% last year and trades at 83.5% below its estimated fair value. Recent drilling results from Côte d'Ivoire show promising gold mineralization potential. Despite being debt-free and having positive free cash flow, Thor faces challenges like geopolitical risks and fluctuating gold prices that may impact future performance.

Where To Now?

- Unlock our comprehensive list of 44 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives