- Canada

- /

- Renewable Energy

- /

- TSX:CPX

3 Top Dividend Stocks On The TSX To Watch

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by trade negotiations and economic uncertainties, investors are keenly observing sectors that offer stability and growth potential. In this context, dividend stocks on the TSX present an attractive option for those looking to balance their portfolios with reliable income streams amidst market volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.00% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.89% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.46% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 8.57% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.69% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.35% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.24% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.99% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.89% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.52% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

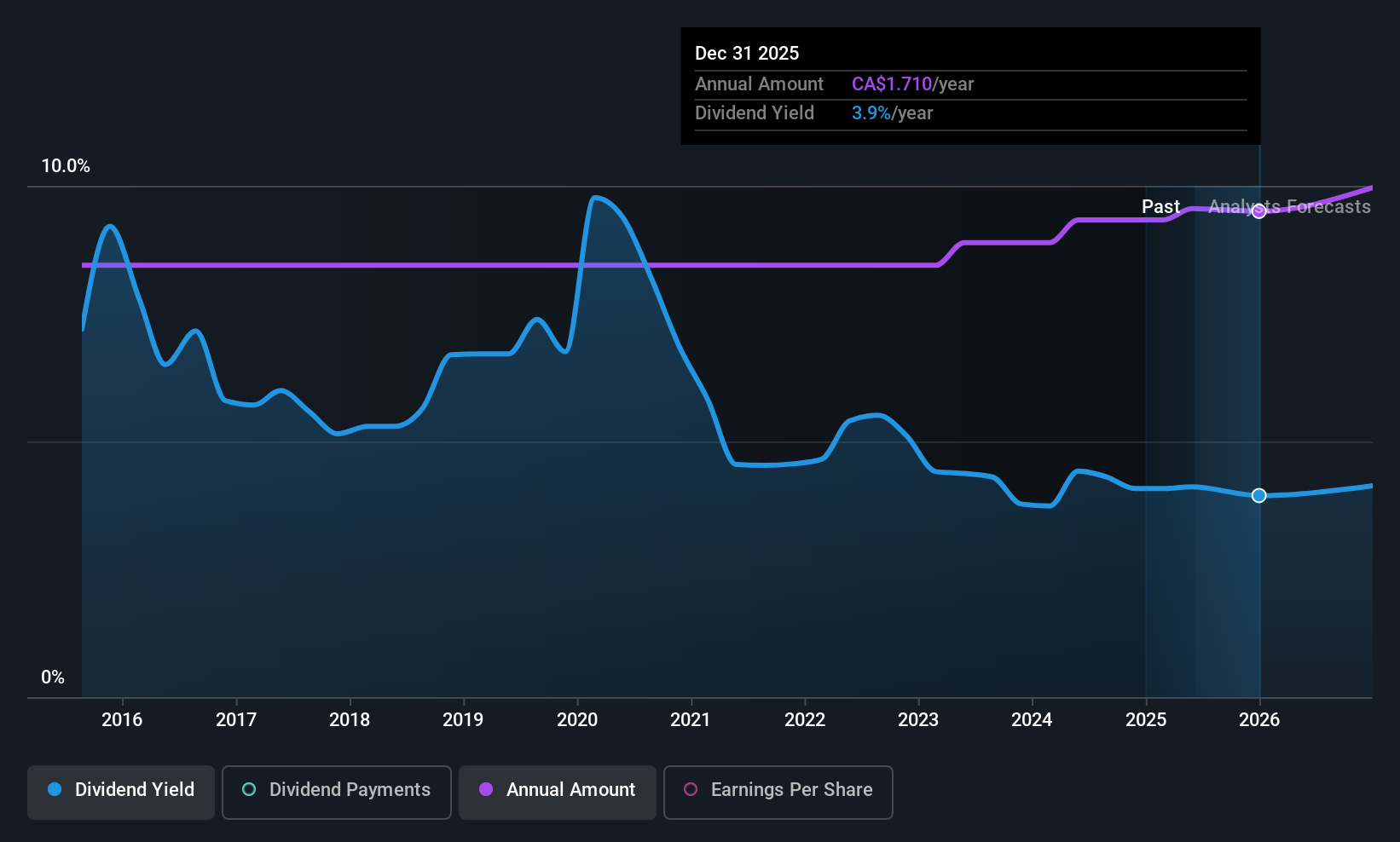

Capital Power (TSX:CPX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Power Corporation develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States with a market cap of CA$8.50 billion.

Operations: Capital Power Corporation's revenue segments include CA$1.02 billion from renewable power generation and CA$2.48 billion from thermal power generation facilities in Canada and the United States.

Dividend Yield: 4.7%

Capital Power's dividend yield of 4.74% is below the top tier in Canada, and while its payout ratio of 55.6% suggests earnings coverage, dividends are not supported by free cash flows. Despite stable and growing dividends over the past decade, high debt levels and recent shareholder dilution pose risks. The company is financing acquisitions with new debt offerings totaling US$1.2 billion to expand its natural gas facilities in the U.S., which may impact future financial stability.

- Unlock comprehensive insights into our analysis of Capital Power stock in this dividend report.

- According our valuation report, there's an indication that Capital Power's share price might be on the cheaper side.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. operates as a distributor of steel and other metal products in Canada and the United States, with a market cap of CA$2.47 billion.

Operations: Russel Metals Inc.'s revenue is primarily derived from its Metals Service Centers at CA$2.98 billion, followed by Energy Field Stores at CA$981 million and Steel Distributors at CA$388.20 million.

Dividend Yield: 3.9%

Russel Metals has consistently increased its dividend, with a recent 2.4% hike to CAD 0.43 per share, marking a cumulative rise of 13.2% since May 2023. The dividend is well-covered by earnings and cash flows, with payout ratios of 63.2% and 42.1%, respectively, though the yield of 3.89% remains below Canada's top tier. Despite lower profit margins this year, Russel's stable dividends over the past decade offer reliability for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Russel Metals.

- Our valuation report unveils the possibility Russel Metals' shares may be trading at a discount.

Thor Explorations (TSXV:THX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thor Explorations Ltd. is a gold producer and explorer with a market cap of CA$498.97 million.

Operations: Thor Explorations Ltd. generates revenue primarily from the Segilola Mine Project, amounting to $223.88 million.

Dividend Yield: 6.2%

Thor Explorations recently initiated a quarterly dividend of C$0.0125 per share, supported by strong earnings growth, with net income surging to US$34.48 million in Q1 2025 from US$12.43 million a year earlier. Despite its high dividend yield ranking in Canada's top 25%, it's too early to assess stability due to the newness of the policy. The low payout ratio of 5.1% suggests dividends are well-covered by earnings and cash flows, indicating sustainability prospects.

- Get an in-depth perspective on Thor Explorations' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Thor Explorations' share price might be too pessimistic.

Key Takeaways

- Investigate our full lineup of 26 Top TSX Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives