- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

Undiscovered Gems In Canada September 2024

Reviewed by Simply Wall St

The Canadian market has been flat over the last week but is up 21% over the past year, with earnings expected to grow by 15% per annum. In this promising environment, identifying undervalued stocks with strong growth potential can offer significant opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Mandalay Resources | 11.86% | 9.48% | 37.58% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Westshore Terminals Investment | NA | -2.67% | -9.77% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Dundee | 5.93% | -38.65% | 39.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Queen's Road Capital Investment Ltd. is a resource-focused investment company that invests in privately held and publicly traded resource companies, with a market cap of CA$357.88 million.

Operations: Queen's Road Capital Investment Ltd. generates revenue primarily from the selection, acquisition, and management of investments, amounting to CA$115.10 million. The company's market cap stands at CA$357.88 million.

Queen's Road Capital Investment has shown impressive financial health, with net income of US$78.05 million for the nine months ended May 31, 2024, compared to a net loss of US$27.64 million a year ago. The company repurchased 1,261,288 shares for CAD0.75 million under its recent buyback program and trades at 9.3% below estimated fair value. With an EBIT coverage of interest payments at 94x and a satisfactory net debt to equity ratio of 5.1%, QRC presents robust financial metrics in the Metals and Mining sector.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

Overview: Silvercorp Metals Inc., along with its subsidiaries, focuses on acquiring, exploring, developing, and mining mineral properties and has a market cap of CA$1.36 billion.

Operations: Silvercorp Metals generates revenue primarily from its mining operations in Guangdong ($27.35 million) and Henan Luoning ($200 million). The company's net profit margin is a key financial metric to consider.

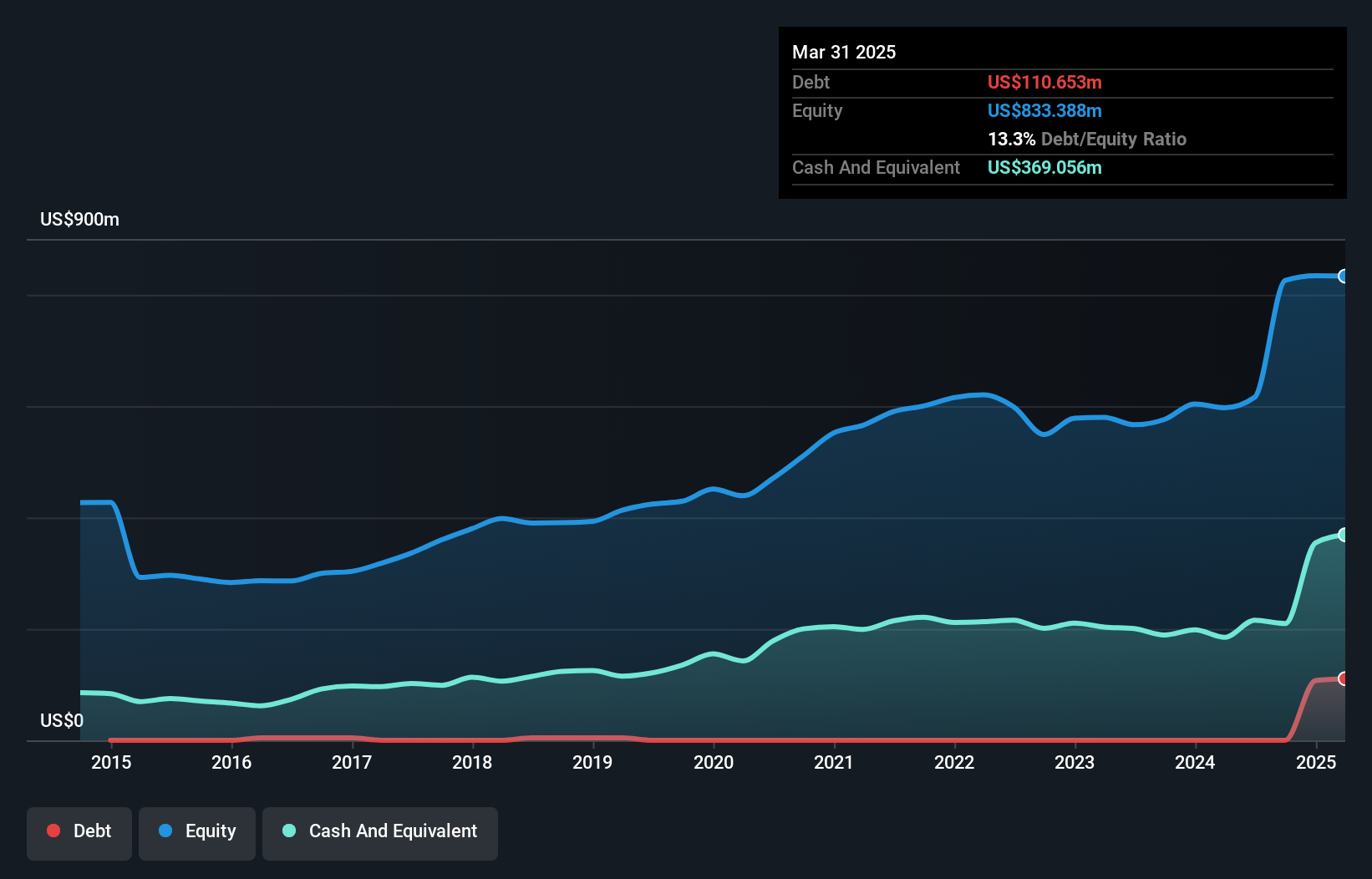

Silvercorp Metals, a Canadian mining company, has shown impressive financial growth with earnings surging by 149.4% over the past year, outperforming the industry’s 2.8%. The firm is debt-free and trading at 89.3% below its estimated fair value, making it an attractive investment opportunity. Recent developments include a share repurchase program aimed at buying back up to 8.67 million shares by September 2025 to enhance shareholder value and flexibility.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. explores for, develops, and processes lithium brine properties in the United States with a market cap of CA$417.16 million.

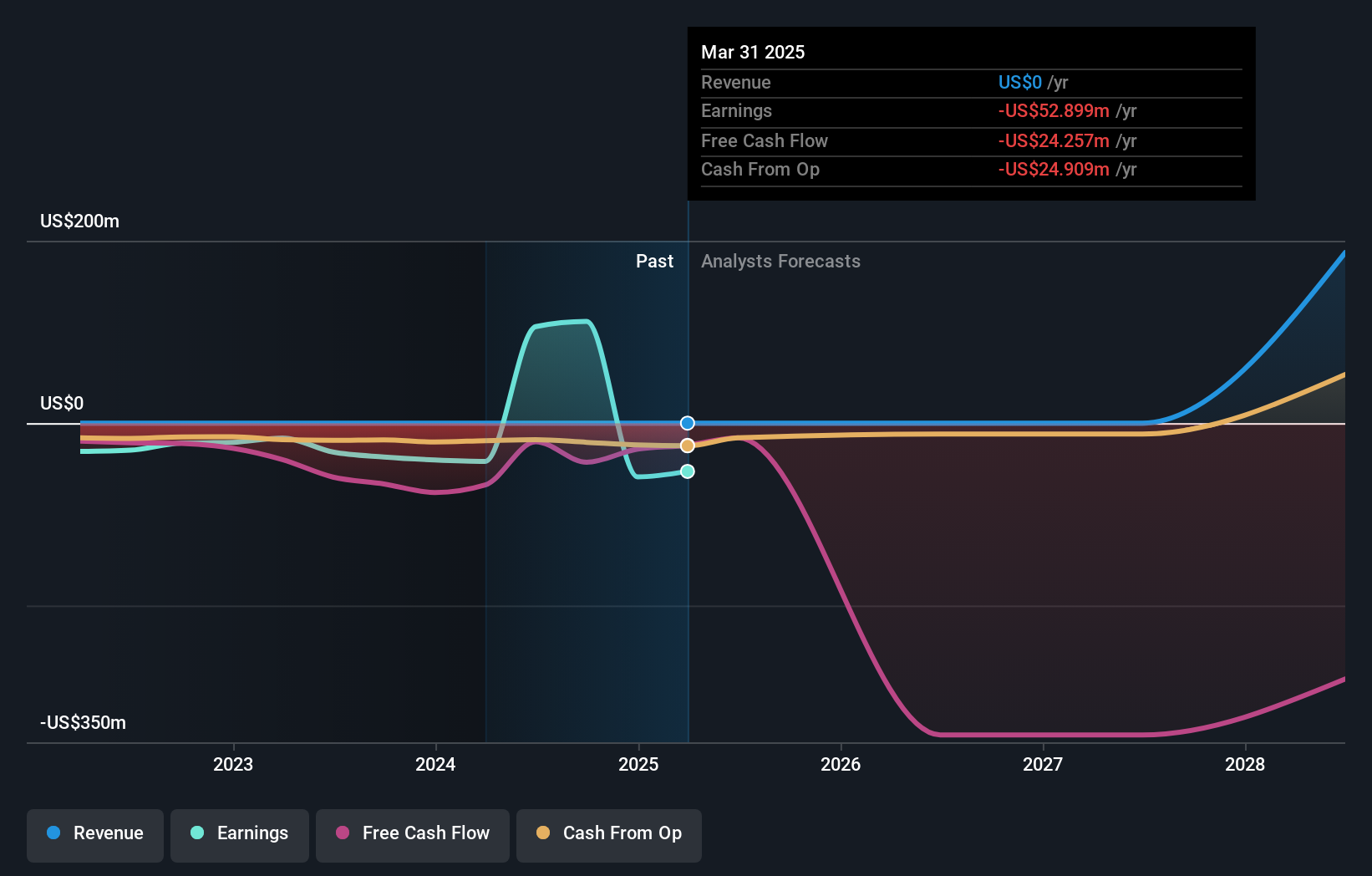

Operations: Standard Lithium Ltd. currently does not report any revenue segments, indicating no revenue generation as of the latest data available.

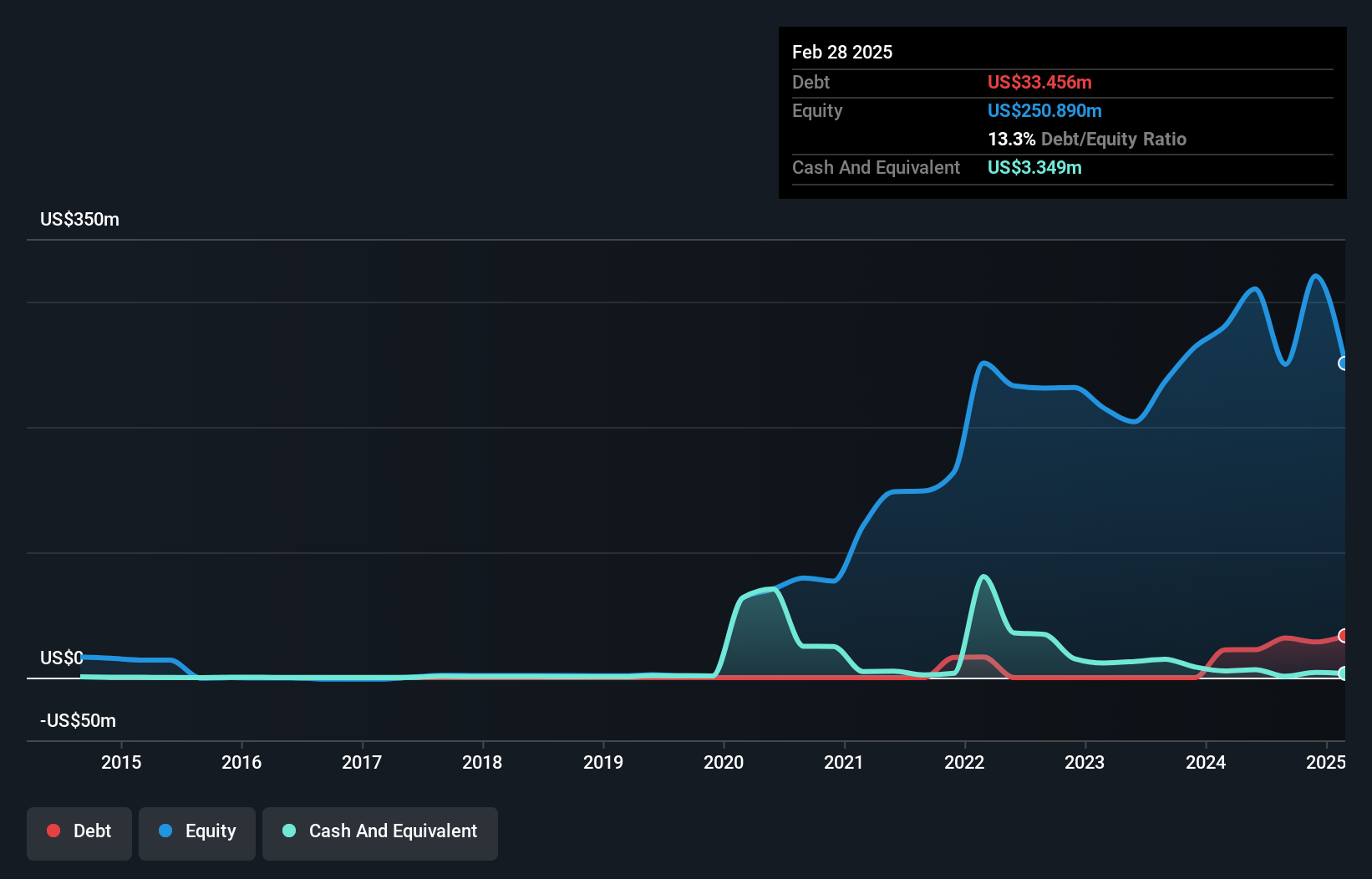

Standard Lithium has turned profitable, reporting net income of CA$147.45 million for the year ending June 2024, compared to a net loss of CA$41.99 million the previous year. Its price-to-earnings ratio stands at 2.8x, significantly lower than the Canadian market average of 15.5x. Despite high volatility and recent shareholder dilution, the company remains debt-free and is making strides in lithium production with a significant USD$225 million DOE grant for its U.S.-based project.

Turning Ideas Into Actions

- Get an in-depth perspective on all 48 TSX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives