- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

TSX Gems: 3 Promising Penny Stocks Under CA$700M Market Cap

Reviewed by Simply Wall St

Despite recent volatility, the Canadian stock market has shown resilience, with the TSX reaching all-time highs and maintaining a roughly 9% increase. For investors seeking opportunities beyond mainstream stocks, penny stocks—typically smaller or newer companies—remain a compelling area of interest. While the term may seem outdated, these stocks can offer affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.72 | CA$67.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.41 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.54 | CA$440.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.27 | CA$366.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$180.69M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$181.34M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.30 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 443 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

American Pacific Mining (CNSX:USGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Pacific Mining Corp. focuses on the exploration and development of precious and base metals in the Western United States, with a market cap of CA$53.68 million.

Operations: American Pacific Mining Corp. does not report any revenue segments at this time.

Market Cap: CA$53.68M

American Pacific Mining Corp., with a market cap of CA$53.68 million, is currently pre-revenue, focusing on exploration at its Madison Copper-Gold Project in Montana. Recent drilling results indicate promising mineralization beyond historical areas, suggesting potential for significant discoveries. The company is debt-free and has become profitable this year, although its Return on Equity remains low at 4.3%. The management team and board are experienced, with average tenures of 2.5 and 7.5 years respectively. Despite limited revenue generation, American Pacific's strategic exploration efforts could position it well for future growth within the mining sector.

- Dive into the specifics of American Pacific Mining here with our thorough balance sheet health report.

- Examine American Pacific Mining's past performance report to understand how it has performed in prior years.

Supremex (TSX:SXP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Supremex Inc. is a company that manufactures and markets envelopes, paper-based packaging solutions, and specialty products for a diverse range of clients in Canada and the United States, with a market cap of CA$93.33 million.

Operations: The company's revenue is derived from two main segments: CA$194.15 million from envelopes and CA$83.84 million from packaging and specialty products.

Market Cap: CA$93.33M

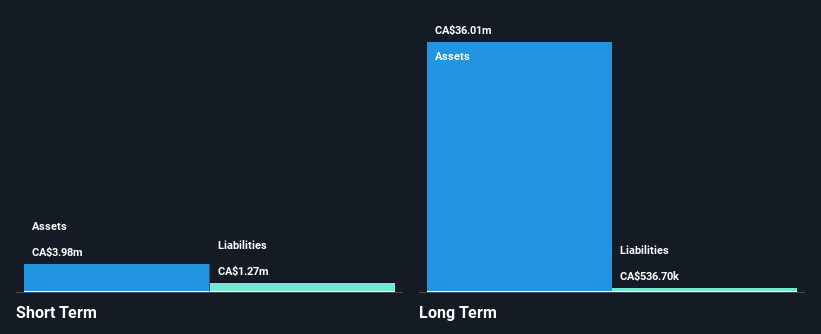

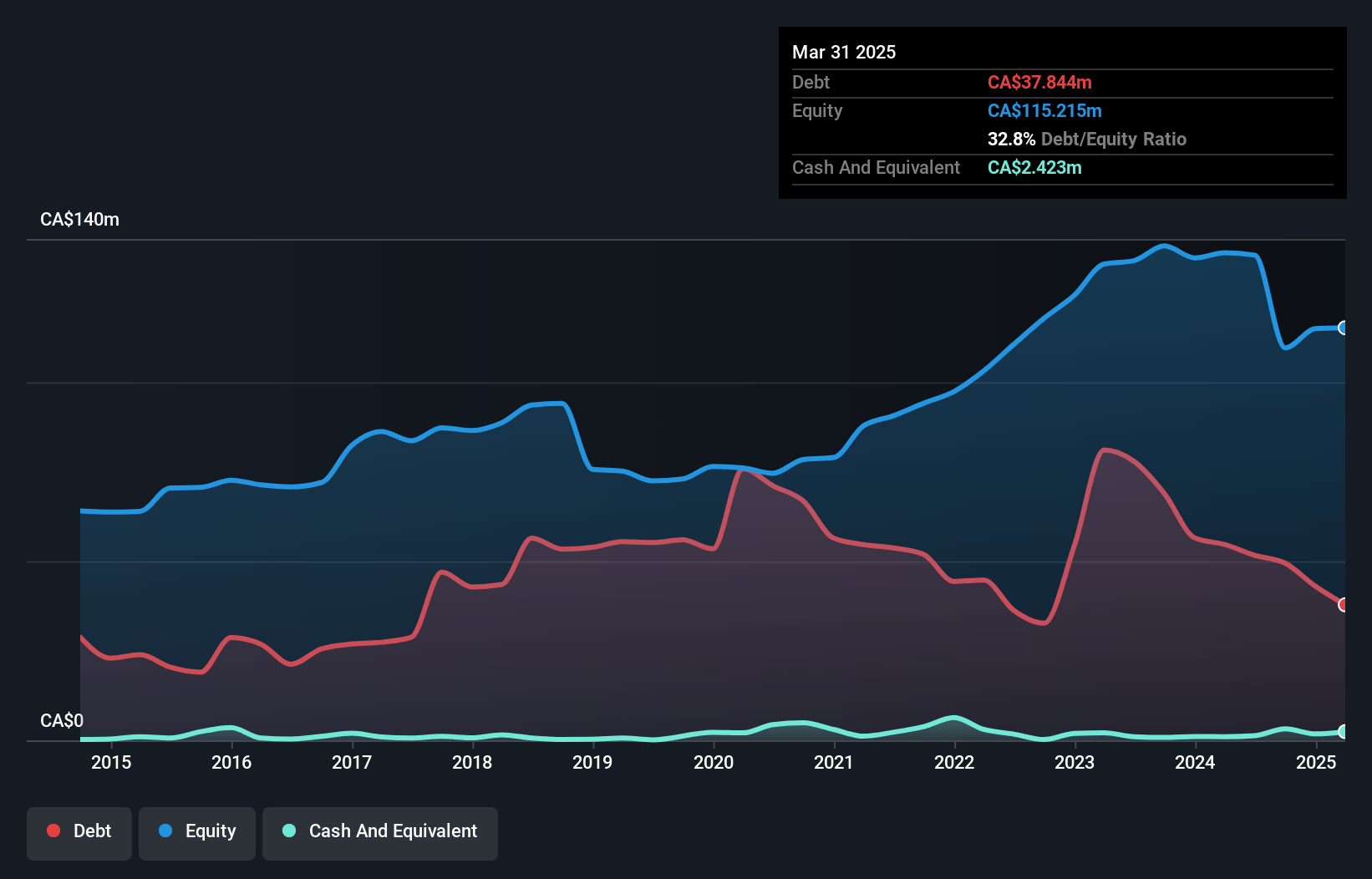

Supremex Inc., with a market cap of CA$93.33 million, is navigating challenges as it seeks strategic acquisitions in its Packaging & Specialty Products segment. Despite being unprofitable and experiencing declining earnings over the past five years, the company offers potential value trading at 70% below estimated fair value. Its debt management is prudent, with operating cash flow covering 89.7% of its debt and a satisfactory net debt to equity ratio of 30.7%. However, short-term assets do not fully cover long-term liabilities, and dividends remain unsustainable by earnings despite recent affirmations. The seasoned board adds stability amidst these dynamics.

- Click here and access our complete financial health analysis report to understand the dynamics of Supremex.

- Gain insights into Supremex's future direction by reviewing our growth report.

Standard Lithium (TSXV:SLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Standard Lithium Ltd. explores, develops, and processes lithium brine properties in the United States with a market cap of CA$655.38 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$655.38M

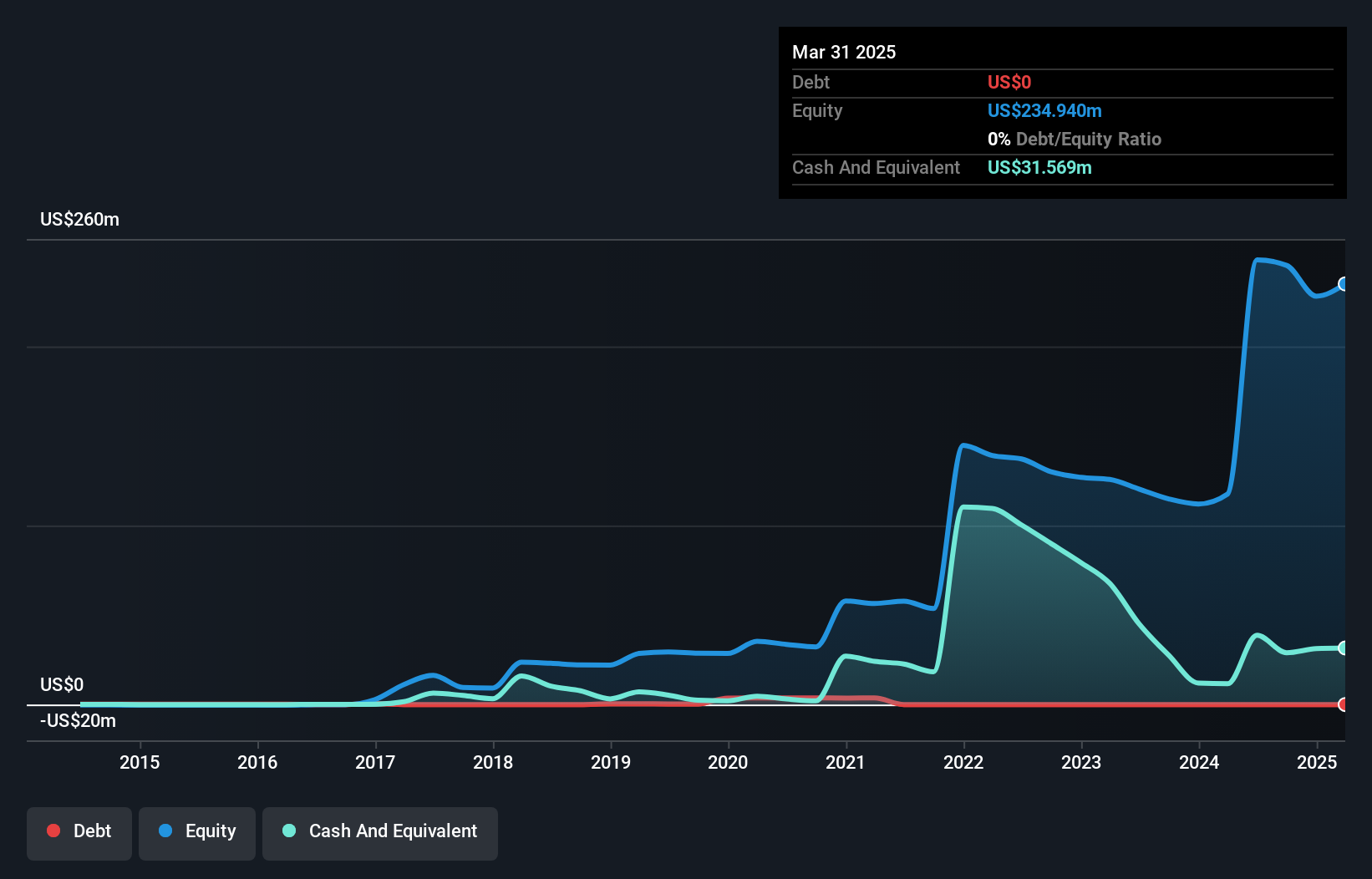

Standard Lithium Ltd., with a market cap of CA$655.38 million, is pre-revenue but shows promise through strategic collaborations and technological advancements. The company recently achieved successful production of battery-quality lithium sulfide in partnership with Telescope Innovations, a significant step for next-generation battery materials. Despite an inexperienced management team and ongoing unprofitability, Standard Lithium's financial position is bolstered by short-term assets exceeding liabilities and no debt burden. Recent inclusion in the S&P/TSX Global Mining Index highlights its growing industry recognition, while reduced losses over five years indicate progress towards profitability as earnings are forecast to grow significantly annually.

- Unlock comprehensive insights into our analysis of Standard Lithium stock in this financial health report.

- Assess Standard Lithium's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click through to start exploring the rest of the 440 TSX Penny Stocks now.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives