- Canada

- /

- Electrical

- /

- TSX:HPS.A

Exploring 3 Undiscovered Canadian Gems with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen by 1.0%, contributing to a remarkable 22% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In such a thriving environment, identifying stocks with strong potential often involves finding companies that are well-positioned to capitalize on this growth trajectory while remaining underappreciated by broader market participants.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Firan Technology Group | 15.52% | 6.50% | 32.07% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

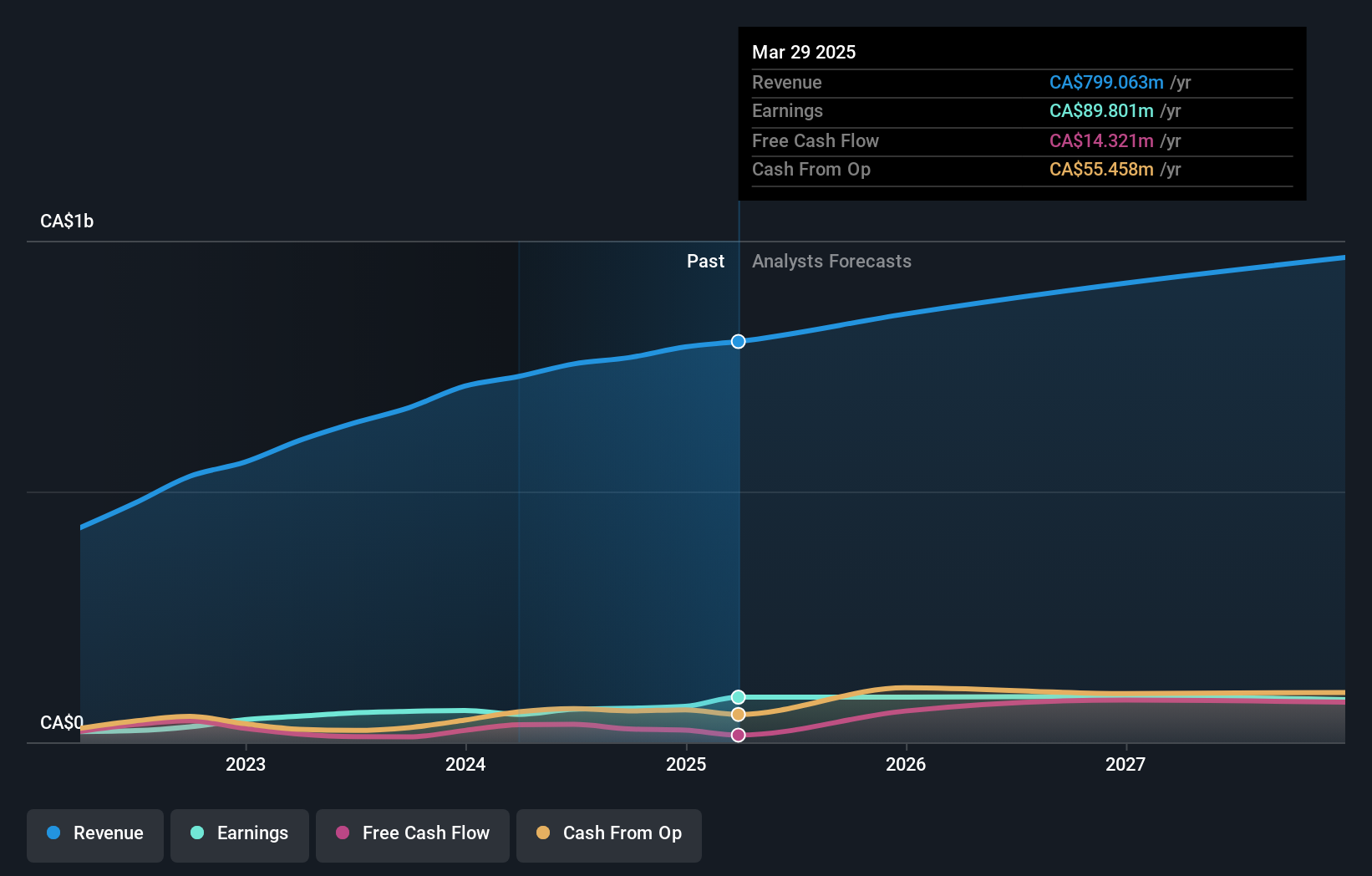

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.76 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, amounting to CA$754.37 million. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability after accounting for all expenses.

Hammond Power Solutions, a small player in the Canadian market, showcases robust financial health with its interest payments well covered by EBIT at 87.6 times and a debt to equity ratio dropping from 27.7% to 5% over five years. Recent earnings reveal sales of CAD 197 million for Q2, up from CAD 172 million last year, and net income reaching CAD 23.59 million compared to CAD 13.33 million previously. The firm also completed a follow-on equity offering worth CAD 57 million in September, signaling growth ambitions despite insider selling concerns recently observed over three months.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

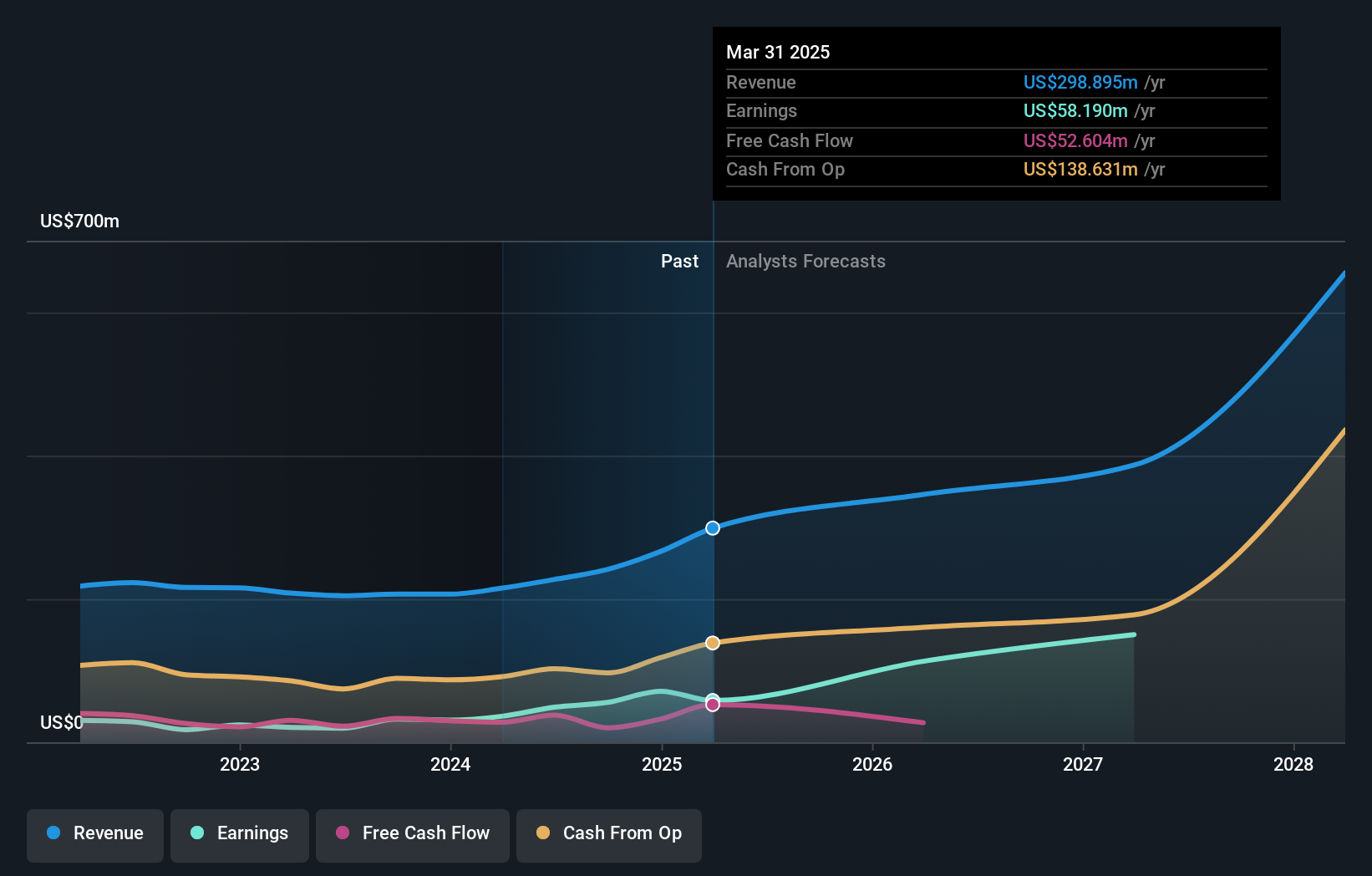

Overview: Silvercorp Metals Inc. is a company that, along with its subsidiaries, focuses on acquiring, exploring, developing, and mining mineral properties with a market capitalization of approximately CA$1.40 billion.

Operations: Silvercorp Metals generates revenue primarily from its mining operations in Guangdong and Henan Luoning, with Henan Luoning contributing significantly more at $200 million compared to Guangdong's $27.35 million.

Silvercorp Metals, a nimble player in the mining sector, stands out with its robust earnings growth of 149% over the past year, significantly surpassing industry averages. The company remains debt-free and boasts high-quality earnings. Recent developments include a renewed SGX Mine permit allowing increased production capacity to 500,000 tonnes annually. While shareholders faced dilution recently, Silvercorp is trading at nearly 89% below estimated fair value and has initiated a share repurchase program to enhance shareholder value.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

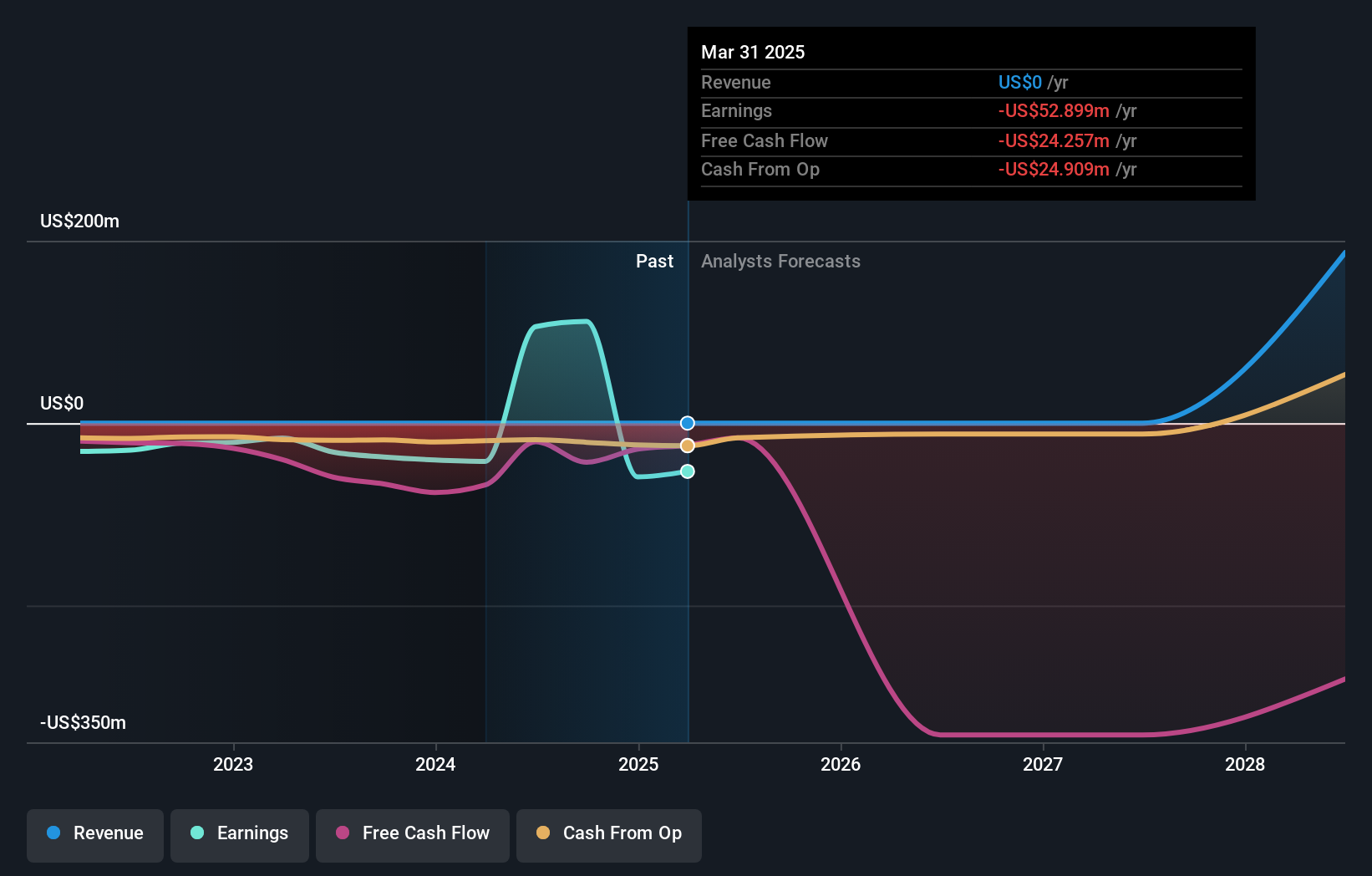

Overview: Standard Lithium Ltd. is engaged in the exploration, development, and processing of lithium brine properties in the United States with a market capitalization of CA$479.91 million.

Operations: Standard Lithium Ltd. currently does not report any revenue segments, as indicated by the absence of financial data in its revenue streams.

Standard Lithium, a nimble player in the lithium sector, has recently turned profitable with net income of CAD 147 million, a stark contrast to the previous year's CAD 42 million loss. The company's price-to-earnings ratio stands attractively at 3.6x compared to the Canadian market's 15.4x. Despite significant insider selling and shareholder dilution over the past year, its debt-free status and innovative strides in lithium extraction position it for potential growth amidst industry volatility.

Seize The Opportunity

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet with proven track record.