- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Santacruz Silver Mining (TSXV:SCZ) Rises 7.3% After Advancing Soracaya Project Toward Production Permitting

Reviewed by Sasha Jovanovic

- On October 7, 2025, Santacruz Silver Mining announced it has initiated a preliminary mine plan and is seeking full production permitting at its wholly-owned, high-grade Soracaya Project in Bolivia.

- This milestone highlights Santacruz’s intent to solidify its presence in Bolivia through resource expansion, backed by over 29.6 km of drilling and detailed mine planning at Soracaya.

- Let’s examine how advancing towards production permitting for the silver-rich Soracaya project impacts Santacruz Silver Mining’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Santacruz Silver Mining's Investment Narrative?

For Santacruz Silver Mining, the big picture is all about translating resource potential into sustainable growth, and the October 2025 update on the Soracaya Project could shift the narrative for investors. Securing a preliminary mine plan and pursuing full production permitting signals a concrete move to widen Santacruz's Bolivian production base, aligning well with financial discipline and recent profitability improvements. This step may now increase short-term investor focus on regulatory milestones and the pace of permitting, making Soracaya’s progression a key near-term catalyst. At the same time, risks around new project execution and potential capital requirements stand out, together with recent swings in profit margins and insider selling. While prior analysis marked catalysts in operational gains and disciplined cost control, this latest news puts project ramp-up and regulatory approvals at the forefront, possibly recalibrating what matters most for the coming quarters.

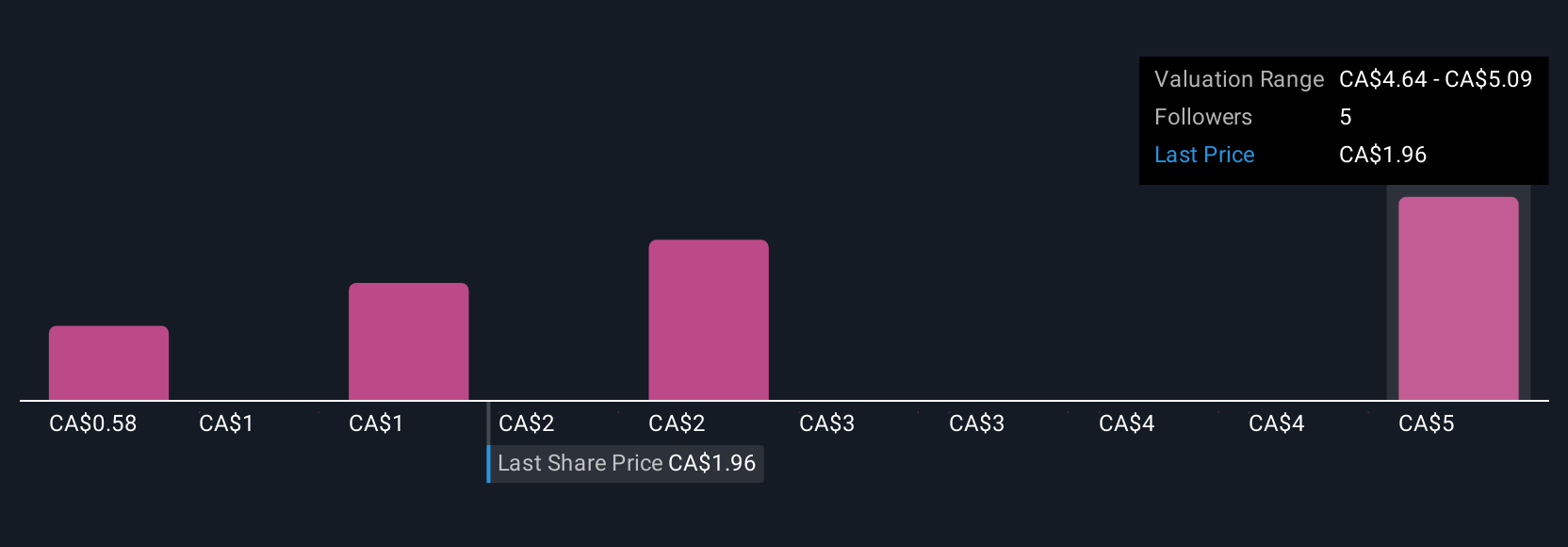

But keep in mind, project delays or regulatory hurdles could become even more impactful going forward. Santacruz Silver Mining's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on Santacruz Silver Mining - why the stock might be worth over 3x more than the current price!

Build Your Own Santacruz Silver Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santacruz Silver Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Santacruz Silver Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santacruz Silver Mining's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives