- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Evaluating Santacruz Silver Mining (TSXV:SCZ): Valuation Insights Ahead of the 2025 Beaver Creek Precious Metals Summit

Reviewed by Kshitija Bhandaru

There is always a buzz when a company gets the spotlight at a major industry event, and this week Santacruz Silver Mining (TSXV:SCZ) is grabbing attention as it prepares for its presentation at the 2025 Precious Metals Summit in Beaver Creek. Scheduled for September 9, this high-profile conference brings together investors, analysts, and industry leaders in one place, creating a stage where companies can share fresh details about their strategies, growth outlook, and upcoming projects. For investors watching Santacruz Silver Mining, this event could provide new insights or updates that have the potential to influence investor sentiment.

In this context, Santacruz Silver Mining’s share price has demonstrated considerable momentum over the past month, with a gain of nearly 48%, and a striking 145% surge in the past 3 months. Over the year, the stock is up just over 5%, which is less spectacular than its recent performance but still positive in a challenging commodities environment. The upcoming summit presentation is the latest in a series of catalysts and may offer an opportunity for management to address investor curiosity about ongoing revenue growth and the company’s roadmap.

With this rapid move and heightened anticipation, one has to wonder if the current price offers an entry point for future gains, or if the market already reflects all the expected good news.

Price-to-Earnings of 10.1x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Santacruz Silver Mining appears to be undervalued compared to both its peer group and the wider Canadian metals and mining industry. The company's P/E of 10.1x is well below the peer average of 41x and the industry average of 20.4x.

The P/E ratio measures how much investors are willing to pay per dollar of earnings and is a traditional tool for comparing valuation across similar companies, especially within resource sectors where earnings quality can fluctuate. A lower P/E may signal the market currently underappreciates the company’s earnings potential or is factoring in greater perceived risk.

The significant discount suggests investors may be cautious, but it also highlights potential upside if the company delivers on growth or profitability targets in the near term.

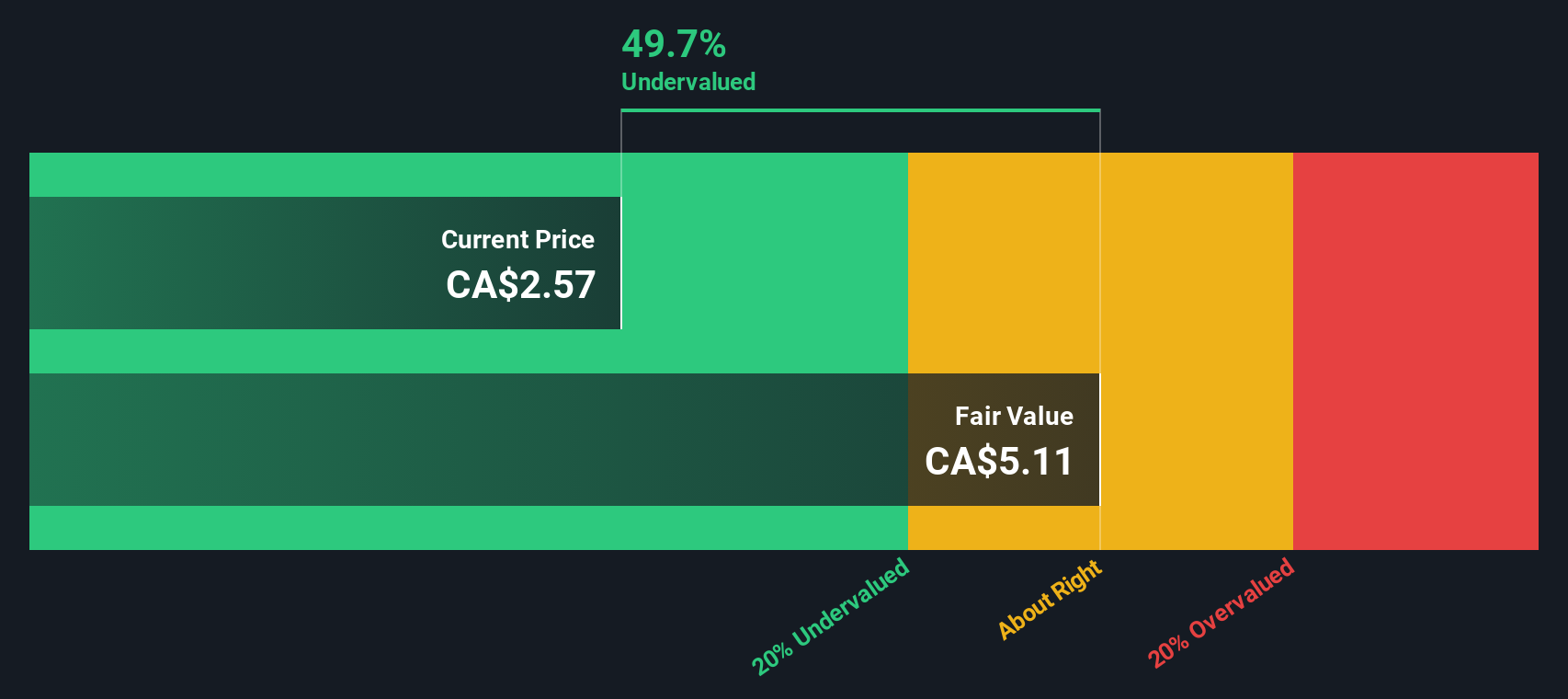

Result: Fair Value of $5.10 (UNDERVALUED)

See our latest analysis for Santacruz Silver Mining.However, with only modest annual revenue growth and a small discount to analyst price targets, any unexpected operational setbacks could reduce near-term optimism.

Find out about the key risks to this Santacruz Silver Mining narrative.Another View: DCF Model Offers Reinforcement

Looking from a different angle, our DCF model also points to undervaluation for Santacruz Silver Mining. Both approaches seemingly indicate upside. However, does this double confirmation increase confidence or mask unseen risks?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Santacruz Silver Mining to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Santacruz Silver Mining Narrative

If you see the story differently or want to dig into the numbers for yourself, it only takes a few minutes to build your own perspective. You can Do it your way.

A great starting point for your Santacruz Silver Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener puts a world of smart investing angles at your fingertips. Tap into what others might overlook by following these top themes:

- Jumpstart your search for the next tech breakout by finding innovators in artificial intelligence with AI penny stocks.

- Unlock steady income potential with companies offering high-yield payouts using our focus on dividend stocks with yields > 3%.

- Spot undervalued gems primed for growth by checking which businesses stand out for strong cash flow through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives