- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Do Santacruz Silver Mining's (TSXV:SCZ) Softer Earnings Amid Rising Sales Signal Emerging Cost Pressures?

Reviewed by Sasha Jovanovic

- Santacruz Silver Mining Ltd. recently reported Q3 2025 results, with sales of US$79.99 million versus US$78.24 million a year earlier, while quarterly net income eased to US$16.34 million from US$17.53 million.

- Across the first nine months of 2025, the company’s higher sales of US$223.60 million contrasted with a sharp reduction in net income to US$46.77 million, raising questions about cost pressures and profitability drivers ahead of its December 5 earnings call.

- We’ll now examine how rising sales but weaker nine‑month earnings may reshape Santacruz Silver Mining’s investment narrative for investors.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Santacruz Silver Mining's Investment Narrative?

To stay comfortable as a Santacruz Silver Mining shareholder, you really have to believe that its asset base and operating footprint can convert relatively steady top-line growth into more resilient, repeatable profits. The latest Q3 2025 update reinforces that tension: sales continue to edge higher, but nine‑month net income has fallen sharply versus last year, despite a very large share price move year to date. That combination puts short-term focus squarely on cost control, mine efficiencies and any guidance the new COO and refreshed finance team provide on margins during the December 5 earnings call. At the same time, strong recent price momentum suggests the market had been looking through prior earnings volatility, which may limit the immediate impact of this single quarter unless the call signals a more persistent squeeze on profitability.

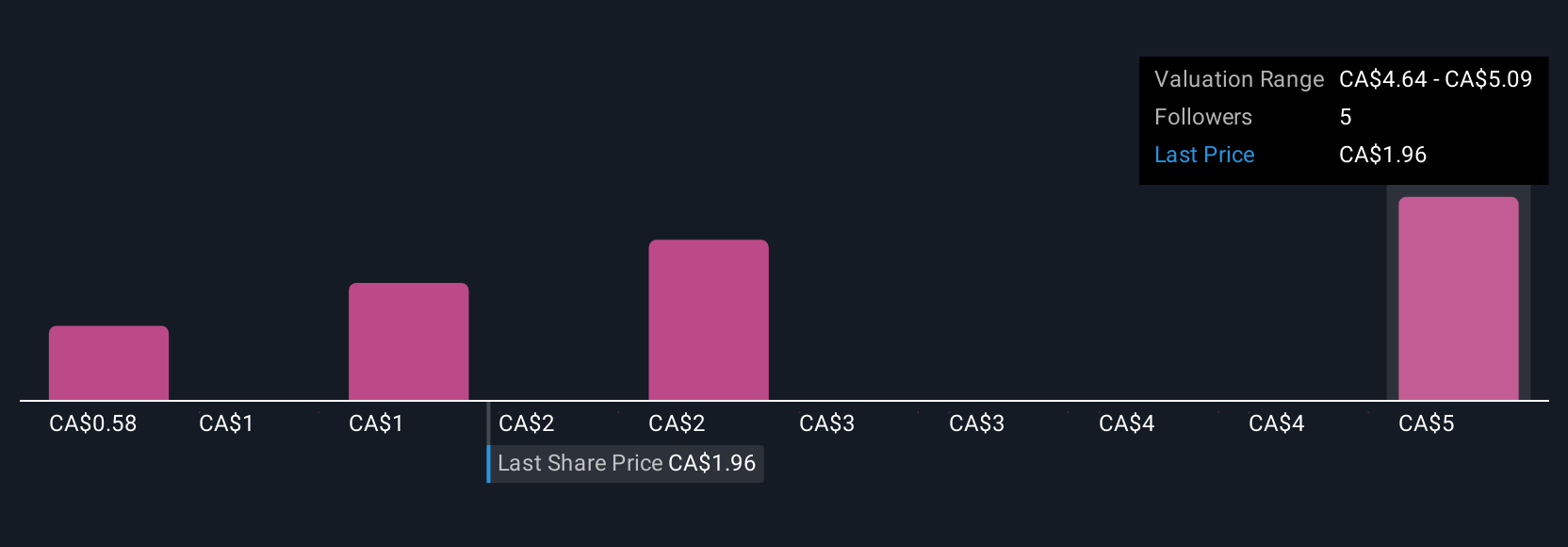

However, the earnings drop hints at a risk that recent price gains might be fragile for new buyers. Santacruz Silver Mining's shares have been on the rise but are still potentially undervalued by 42%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on Santacruz Silver Mining - why the stock might be a potential multi-bagger!

Build Your Own Santacruz Silver Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santacruz Silver Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Santacruz Silver Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santacruz Silver Mining's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026