- Canada

- /

- Metals and Mining

- /

- TSXV:SAE

Companies Like Sable Resources (CVE:SAE) Are In A Position To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Sable Resources (CVE:SAE) shareholders have done very well over the last year, with the share price soaring by 411%. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether Sable Resources' cash burn is too risky. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Sable Resources

Does Sable Resources Have A Long Cash Runway?

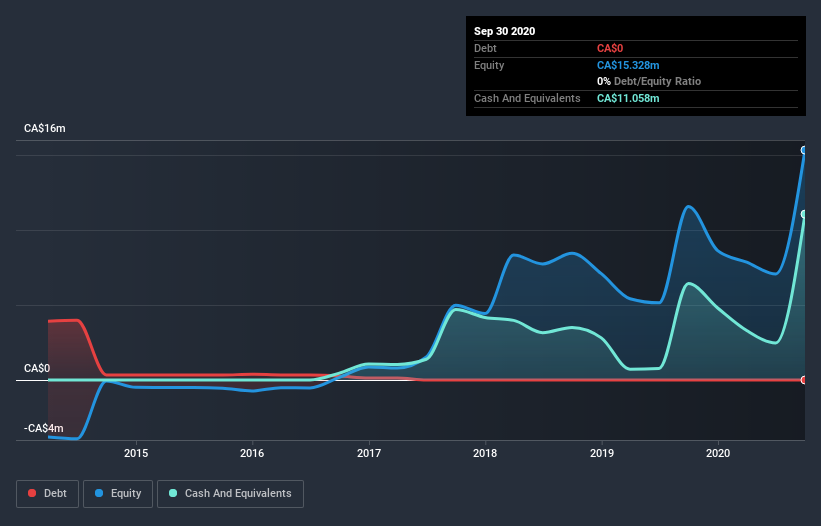

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In September 2020, Sable Resources had CA$11m in cash, and was debt-free. In the last year, its cash burn was CA$4.5m. Therefore, from September 2020 it had 2.5 years of cash runway. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Is Sable Resources' Cash Burn Changing Over Time?

Sable Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 42% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of Sable Resources due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Sable Resources Raise Cash?

While Sable Resources is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Sable Resources has a market capitalisation of CA$52m and burnt through CA$4.5m last year, which is 8.7% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Sable Resources' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Sable Resources' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its cash burn reduction wasn't quite as good, but was still rather encouraging! After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Sable Resources has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Sable Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:SAE

Sable Resources

Engages in the acquisition, exploration, and development of mineral resource properties in Argentina and Canada.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026