- Canada

- /

- Metals and Mining

- /

- TSXV:ROS

Is RosCan Gold (CVE:ROS) In A Good Position To Deliver On Growth Plans?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. Indeed, RosCan Gold (CVE:ROS) stock is up 169% in the last year, providing strong gains for shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky RosCan Gold's cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for RosCan Gold

How Long Is RosCan Gold's Cash Runway?

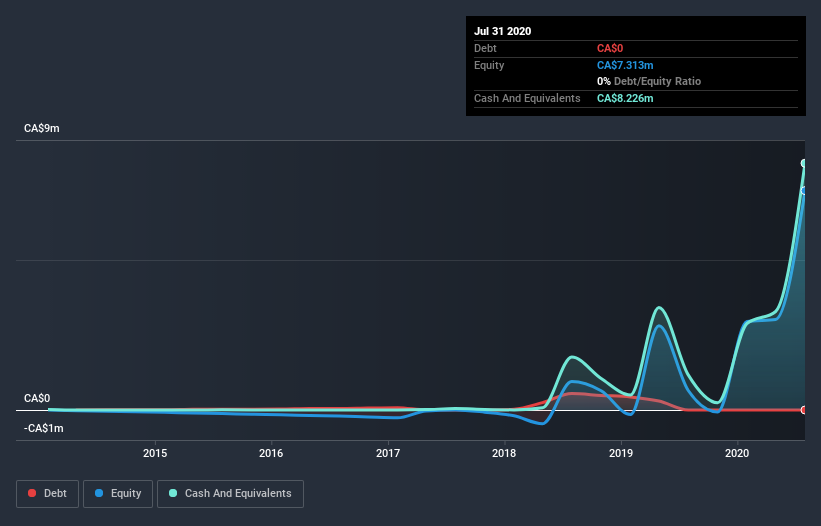

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In July 2020, RosCan Gold had CA$8.2m in cash, and was debt-free. Looking at the last year, the company burnt through CA$11m. That means it had a cash runway of around 9 months as of July 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is RosCan Gold's Cash Burn Changing Over Time?

Because RosCan Gold isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. The skyrocketing cash burn up 147% year on year certainly tests our nerves. It's fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. RosCan Gold makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For RosCan Gold To Raise More Cash For Growth?

Given its cash burn trajectory, RosCan Gold shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

RosCan Gold's cash burn of CA$11m is about 11% of its CA$99m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is RosCan Gold's Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought RosCan Gold's cash burn relative to its market cap was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Separately, we looked at different risks affecting the company and spotted 4 warning signs for RosCan Gold (of which 3 are potentially serious!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade RosCan Gold, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ROS

Roscan Gold

An exploration stage company, engages in the acquisition, exploration, and development of mineral properties in West Africa.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion