- Canada

- /

- Metals and Mining

- /

- TSXV:REG

3 TSX Penny Stocks With Market Caps Under CA$300M

Reviewed by Simply Wall St

The Canadian market has been experiencing a wave of momentum, driven by summer optimism, yet remains cautious amid ongoing trade negotiations and potential economic cooling. For investors seeking opportunities beyond the mainstream, penny stocks—though an outdated term—still hold significant appeal for those interested in smaller or newer companies with growth potential. With solid financial foundations, these stocks can offer surprising value and stability; let's explore several that stand out for their financial strength and long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.82 | CA$93.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.10 | CA$157.34M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.41M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 455 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp., a junior mining company with a market cap of CA$172.81 million, focuses on the exploration and development of mineral properties in the United States.

Operations: Hercules Metals Corp. has not reported any revenue segments.

Market Cap: CA$172.81M

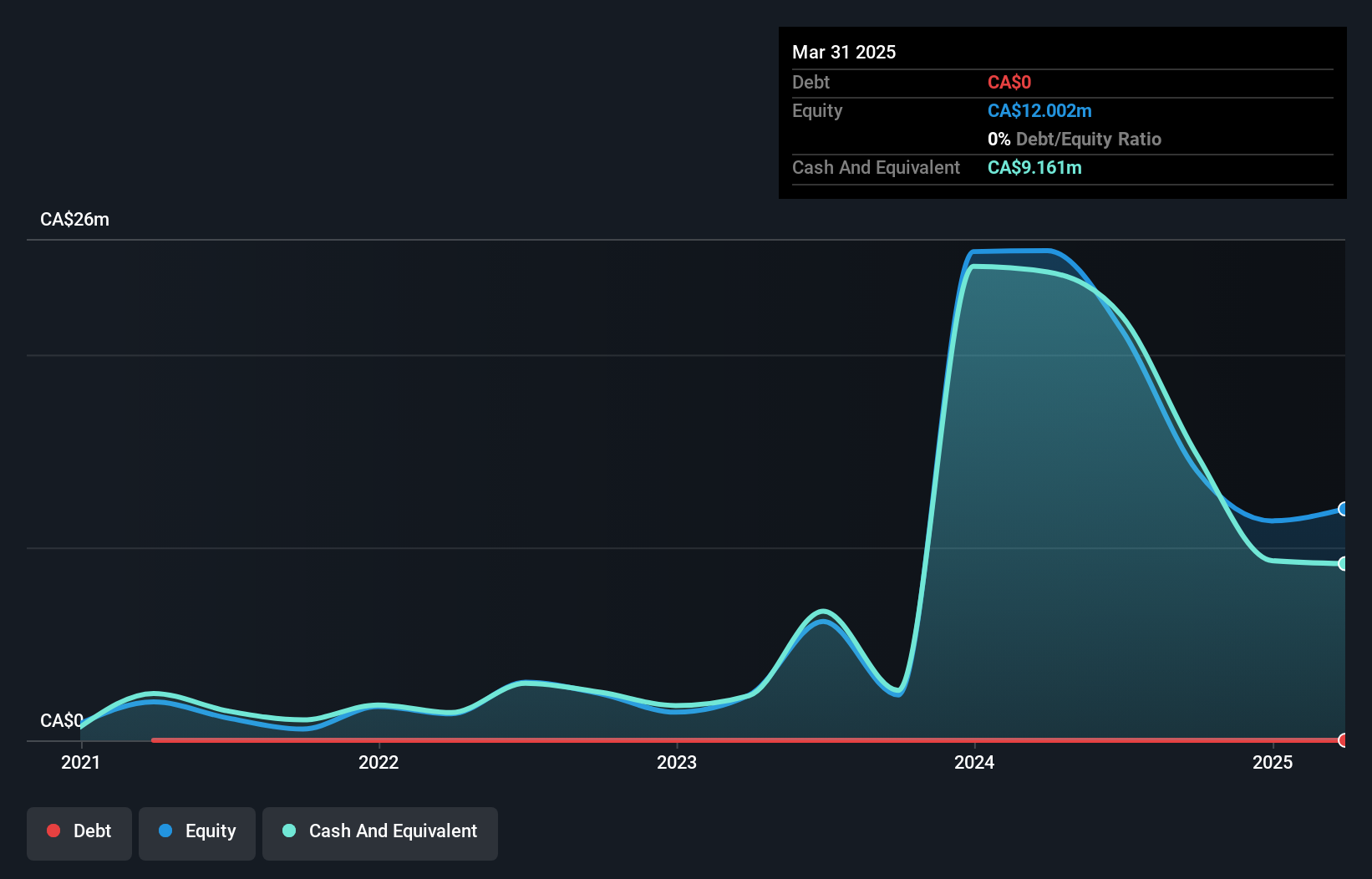

Hercules Metals Corp., a pre-revenue junior mining company, is actively advancing its exploration efforts in western Idaho. Despite being debt-free, the company faces financial challenges with less than a year of cash runway and recent auditor concerns about its ability to continue as a going concern. The 2025 drilling campaign has been intensified with five rigs validating their 3D geological model, targeting copper-molybdenum mineralization at the Leviathan site. While initial results are promising, indicating improved drilling accuracy and efficiency, Hercules Metals remains unprofitable with increasing net losses over recent years.

- Dive into the specifics of Hercules Metals here with our thorough balance sheet health report.

- Gain insights into Hercules Metals' past trends and performance with our report on the company's historical track record.

Midnight Sun Mining (TSXV:MMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midnight Sun Mining Corp. acquires and explores mineral properties in Africa, with a market cap of CA$95.83 million.

Operations: Midnight Sun Mining Corp. currently does not report any revenue segments.

Market Cap: CA$95.83M

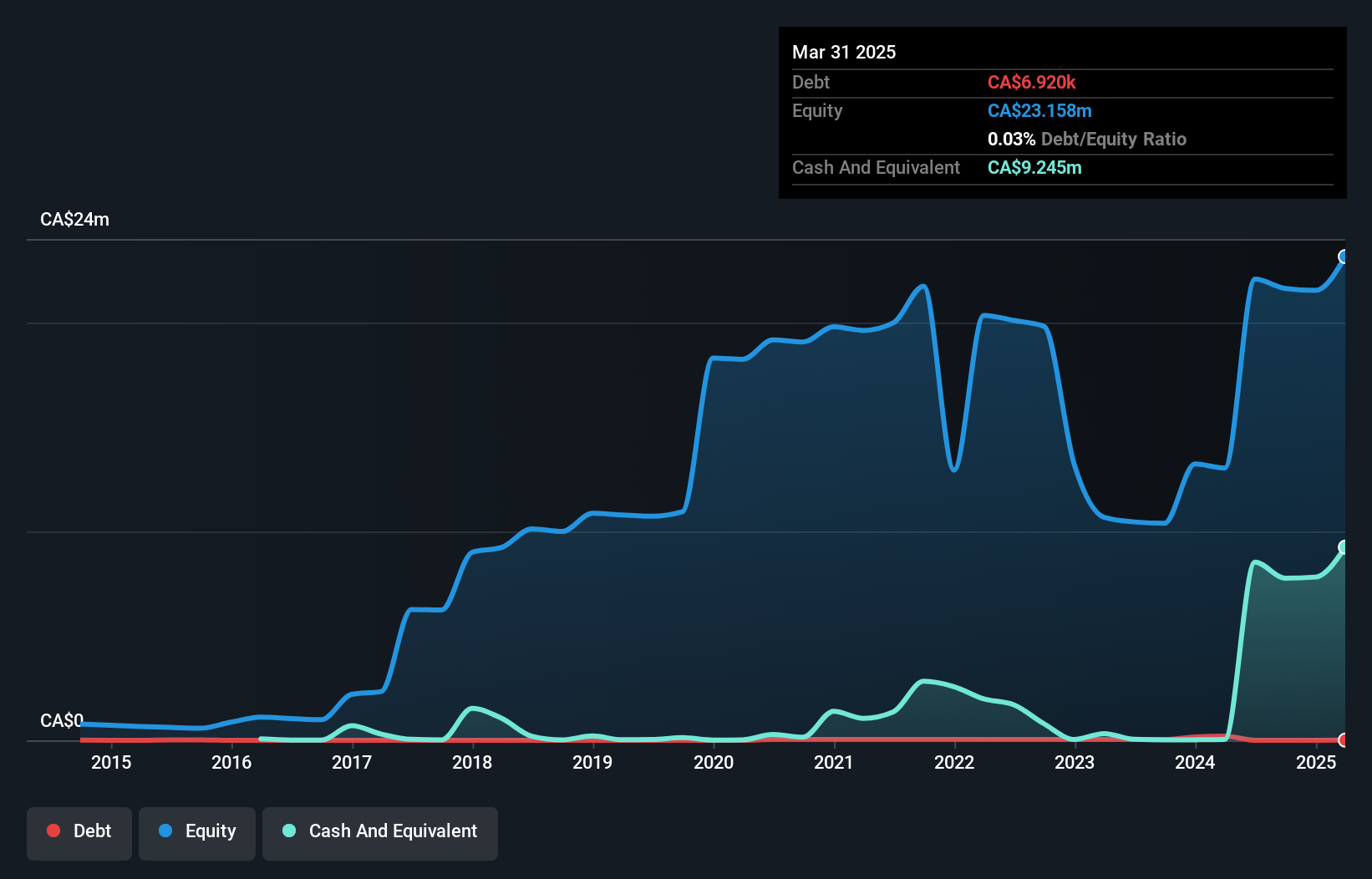

Midnight Sun Mining Corp., a pre-revenue entity, is engaged in mineral exploration primarily in Zambia. The company has initiated an extensive drilling campaign at its Solwezi Project, focusing on both oxide and sulphide copper targets. Recent developments include the appointment of Adrian Karolko as Vice President of Exploration to enhance technical capabilities. While Midnight Sun's short-term assets significantly exceed liabilities, it remains unprofitable with increasing losses over recent years. Despite financial challenges highlighted by auditor concerns about its viability as a going concern, the company maintains a sufficient cash runway for over two years based on current free cash flow.

- Take a closer look at Midnight Sun Mining's potential here in our financial health report.

- Review our historical performance report to gain insights into Midnight Sun Mining's track record.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company with operations in Canada and Peru, and it has a market capitalization of CA$296.69 million.

Operations: Regulus Resources Inc. currently does not report any revenue segments.

Market Cap: CA$296.69M

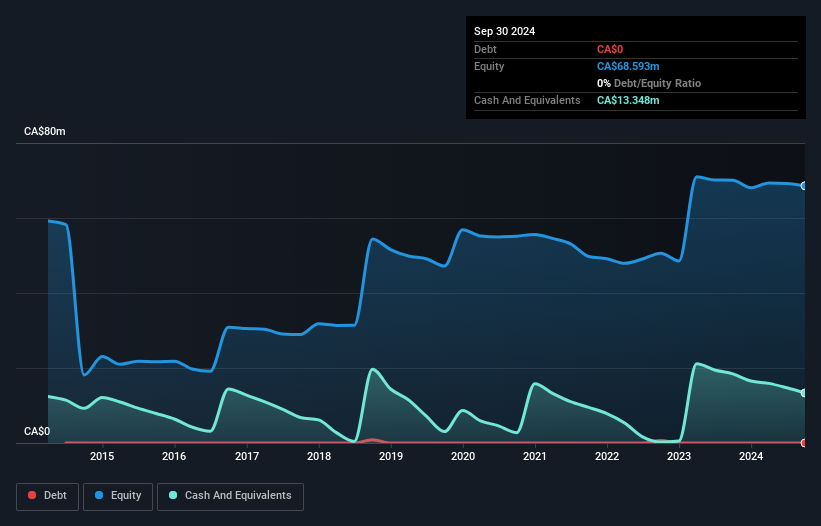

Regulus Resources Inc., a pre-revenue mineral exploration company, is actively engaged in advancing its AntaKori copper-gold project in Peru. Recent updates highlight promising results from a collaboration with Nuton LLC, showcasing encouraging copper extraction rates using bio-leaching technology. The company's financial position is stable, with short-term assets of CA$11.5 million comfortably exceeding liabilities of CA$1.4 million and no long-term debt obligations. Despite being unprofitable, Regulus has reduced losses over the past five years by 22% annually and maintains a cash runway sufficient for more than two years under current conditions.

- Click here to discover the nuances of Regulus Resources with our detailed analytical financial health report.

- Explore historical data to track Regulus Resources' performance over time in our past results report.

Where To Now?

- Investigate our full lineup of 455 TSX Penny Stocks right here.

- Ready For A Different Approach? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:REG

Regulus Resources

Operates as a mineral exploration company in Canada and Peru.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives