- Canada

- /

- Metals and Mining

- /

- TSXV:RBX

3 TSX Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the Canadian market navigates a noisy close to 2025, with encouraging signs of moderating wage pressures and easing inflation, investors are increasingly looking toward a constructive outlook for 2026. In this environment, growth companies with strong insider ownership can offer compelling opportunities, as such ownership often signals confidence in the company's potential and aligns management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.1% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 34.3% | 33.8% |

| Electrovaya (TSX:ELVA) | 28.1% | 37.8% |

| CEMATRIX (TSX:CEMX) | 10.6% | 58.3% |

| Almonty Industries (TSX:AII) | 11.2% | 63.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Kits Eyecare (TSX:KITS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$556.36 million.

Operations: The company generates revenue primarily through the sale of eyewear products, amounting to CA$193.40 million.

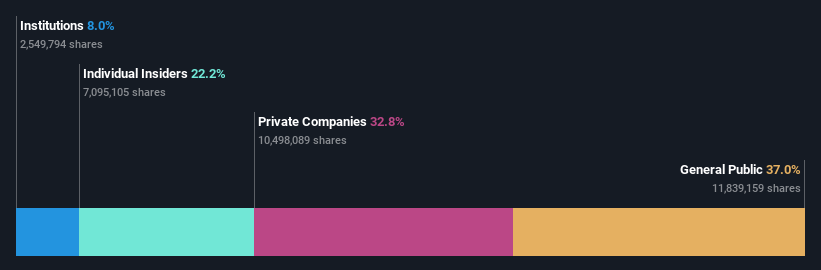

Insider Ownership: 23%

Kits Eyecare has demonstrated strong growth potential, with insiders significantly increasing their holdings over the past three months. The company's revenue and earnings are forecast to grow substantially faster than the Canadian market, supported by innovative product launches like Pangolin Gen-3 AI-enabled eyewear. Kits' strategic expansion into Toronto aligns with its omni-channel strategy, enhancing customer access and service. Financially prudent, Kits recently secured a $15 million lending facility while retiring existing debt ahead of schedule.

- Delve into the full analysis future growth report here for a deeper understanding of Kits Eyecare.

- Our comprehensive valuation report raises the possibility that Kits Eyecare is priced lower than what may be justified by its financials.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$1.35 billion.

Operations: The company's revenue is primarily derived from its gold mining operations at the Nampala site, generating CA$197.71 million.

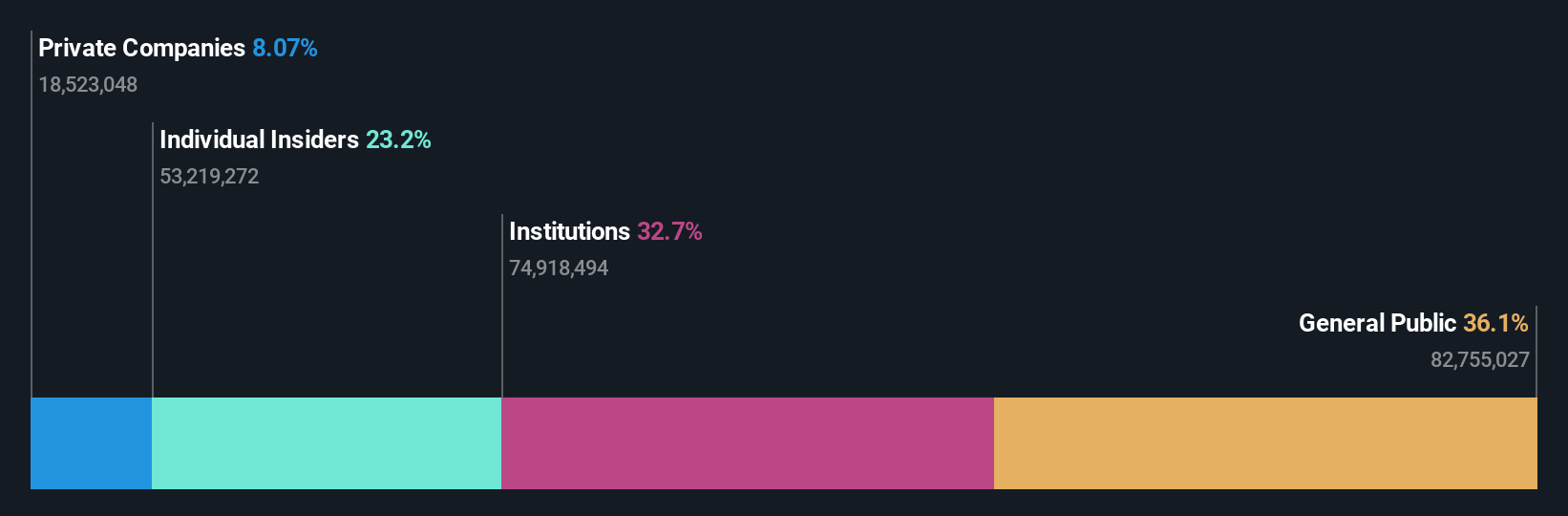

Insider Ownership: 20.6%

Robex Resources, poised for significant growth, has seen substantial insider buying recently. The company forecasts robust revenue growth at 59.2% annually, outpacing the Canadian market. Despite a current net loss of C$64.77 million for nine months ending September 2025, Robex's Kiniéro Gold Project progresses smoothly towards commercial production by early 2026. Additionally, a merger with Predictive Discovery is set to close soon, potentially enhancing shareholder value and operational capabilities in the mining sector.

- Take a closer look at Robex Resources' potential here in our earnings growth report.

- The analysis detailed in our Robex Resources valuation report hints at an deflated share price compared to its estimated value.

WELL Health Technologies (TSX:WELL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WELL Health Technologies Corp. is a digital healthcare company focused on serving practitioners in Canada, the United States, and internationally, with a market cap of CA$990.54 million.

Operations: The company's revenue segments include SaaS and Technology Services (CA$85.16 million), Canadian Patient Services - Primary WMC (CA$253.13 million), Canadian Patient Services - Specialized WDC (CA$160.98 million), WELL Health USA Patient Services - Primary WISP (CA$116.57 million), WELL Health USA Patient Services - Primary Circle Medical (CA$126.10 million), WELL Health USA Patient Services - Specialized CRH Medical (CA$250.86 million), and WELL Health USA Patient Services - Specialized-Provider Staffing (CA$190.80 million).

Insider Ownership: 22.6%

WELL Health Technologies is positioned for growth, with revenue expected to increase faster than the Canadian market. Recent strategic alliances, including a joint venture with HEALWELL AI Inc., aim to enhance clinical research capabilities. The company reported significant revenue growth and a return to profitability in the third quarter of 2025. Trading at a substantial discount to its estimated fair value, WELL's stock is projected by analysts to rise significantly, reflecting optimism about its future performance.

- Dive into the specifics of WELL Health Technologies here with our thorough growth forecast report.

- The valuation report we've compiled suggests that WELL Health Technologies' current price could be quite moderate.

Summing It All Up

- Dive into all 47 of the Fast Growing TSX Companies With High Insider Ownership we have identified here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion