- Canada

- /

- Metals and Mining

- /

- TSXV:PLAN

Independent Director Dwayne Melrose Just Bought 267% More Shares In Progressive Planet Solutions Inc. (CVE:PLAN)

Whilst it may not be a huge deal, we thought it was good to see that the Progressive Planet Solutions Inc. (CVE:PLAN) Independent Director, Dwayne Melrose, recently bought CA$80k worth of stock, for CA$0.10 per share. Even though that isn't a massive buy, it did increase their holding by 267%, which is arguably a good sign.

View our latest analysis for Progressive Planet Solutions

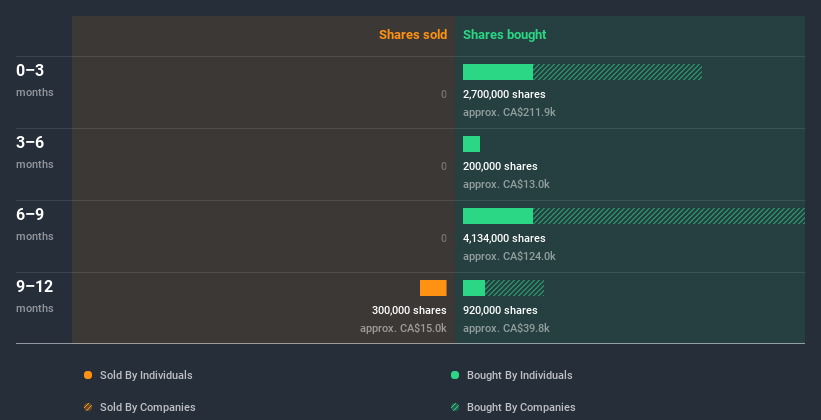

The Last 12 Months Of Insider Transactions At Progressive Planet Solutions

Notably, that recent purchase by Dwayne Melrose is the biggest insider purchase of Progressive Planet Solutions shares that we've seen in the last year. That means that an insider was happy to buy shares at above the current price of CA$0.085. Their view may have changed since then, but at least it shows they felt optimistic at the time. We always take careful note of the price insiders pay when purchasing shares. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

Over the last year, we can see that insiders have bought 2.05m shares worth CA$133k. On the other hand they divested 300.00k shares, for CA$15k. In total, Progressive Planet Solutions insiders bought more than they sold over the last year. They paid about CA$0.065 on average. We don't deny that it is nice to see insiders buying stock in the company. But we must note that the investments were made at well below today's share price. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Progressive Planet Solutions Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our data indicates that Progressive Planet Solutions insiders own about CA$521k worth of shares (which is 15% of the company). We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Does This Data Suggest About Progressive Planet Solutions Insiders?

The recent insider purchase is heartening. And an analysis of the transactions over the last year also gives us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on Progressive Planet Solutions stock. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Our analysis shows 5 warning signs for Progressive Planet Solutions (4 are concerning!) and we strongly recommend you look at these before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Progressive Planet Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:PLAN

Progressive Planet Solutions

Primarily engages in the acquisition and exploration of mineral properties in Canada and the United States.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026