- Canada

- /

- Metals and Mining

- /

- TSXV:PLA

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market has been flat over the last week but is up 20% over the past year, with earnings forecasted to grow by 16% annually. In such a robust economic landscape, identifying stocks with strong financials and growth potential becomes crucial, especially when considering penny stocks. Although often seen as a throwback term, penny stocks still offer intriguing opportunities for investors seeking smaller or newer companies that combine value and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.36M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.39 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$28.21M | ★★★★★★ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Badlands Resources (TSXV:BLDS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Badlands Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in North America, with a market cap of CA$2.71 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company focused on mineral properties in North America.

Market Cap: CA$2.71M

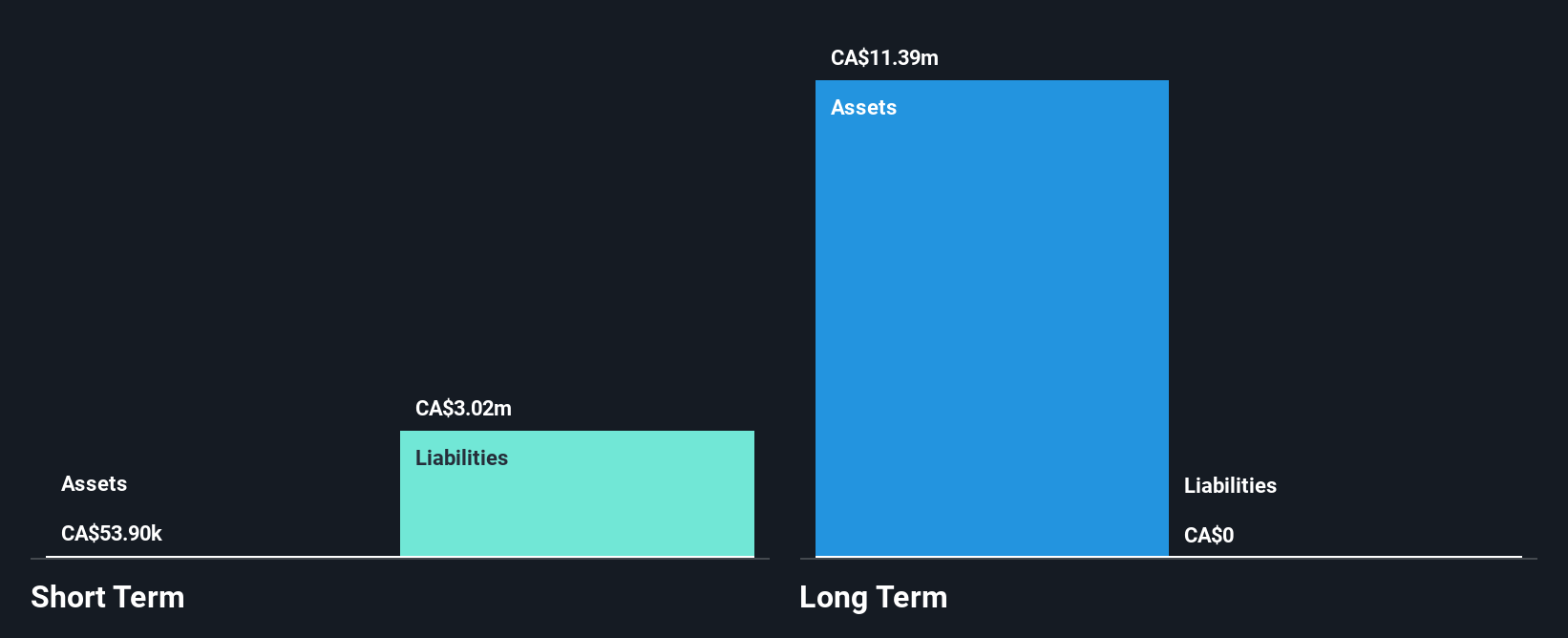

Badlands Resources Inc., with a market cap of CA$2.71 million, is a pre-revenue exploration stage company focused on mineral properties in North America. Recent exploration at the Bella Project in South Dakota identified multiple high-grade gold trends, notably the Standard and Cochrane trends, which show promising sampling results. Despite its potential, Badlands faces challenges including insufficient short-term assets to cover liabilities and no cash runway based on free cash flow as of June 2024. The company's management team is experienced with an average tenure of four years, but it remains unprofitable with a negative return on equity.

- Click here to discover the nuances of Badlands Resources with our detailed analytical financial health report.

- Examine Badlands Resources' past performance report to understand how it has performed in prior years.

Network Media Group (TSXV:NTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Network Media Group Inc. and its subsidiaries focus on developing, producing, distributing, and exploiting film and television properties in Canada and the United States with a market cap of approximately CA$1.78 million.

Operations: The company's revenue is derived from its Motion Pictures segment, totaling CA$9.37 million.

Market Cap: CA$1.78M

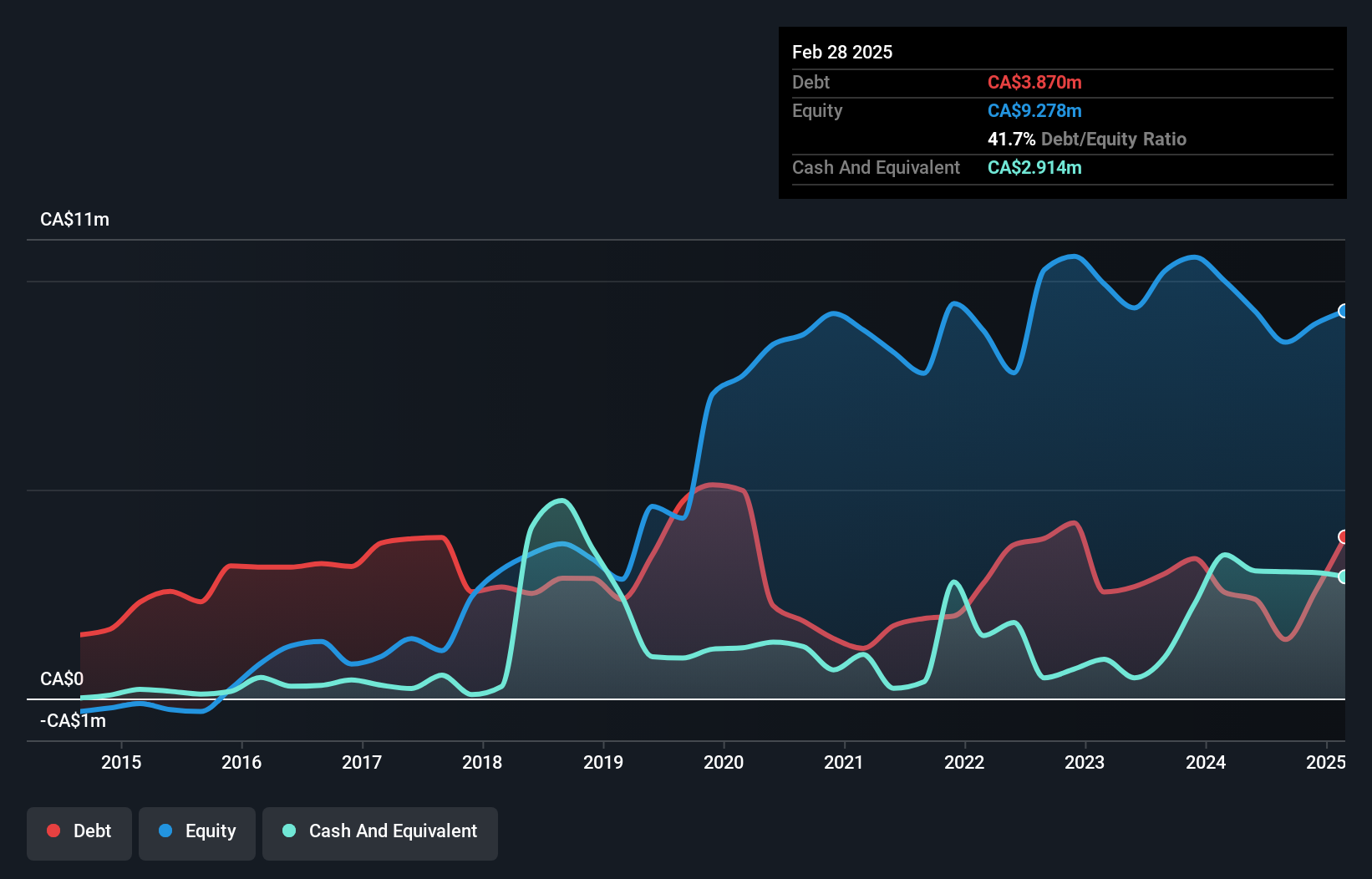

Network Media Group Inc., with a market cap of approximately CA$1.78 million, reported third-quarter sales of CA$2.84 million, showing slight growth from the previous year. However, the company remains unprofitable with increasing losses over five years at an average rate of 47.5% annually and a negative return on equity of -21.69%. Despite its seasoned management and board, Network Media's high volatility and short-term liabilities surpassing assets pose challenges. On a positive note, it maintains more cash than total debt and has improved its debt-to-equity ratio significantly over five years from 109.3% to 16.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Network Media Group.

- Learn about Network Media Group's historical performance here.

Plata Latina Minerals (TSXV:PLA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Plata Latina Minerals Corporation, along with its subsidiaries, focuses on acquiring, exploring, and evaluating mineral property assets in Mexico, with a market cap of CA$790,346.

Operations: The company does not report any revenue segments.

Market Cap: CA$790.35k

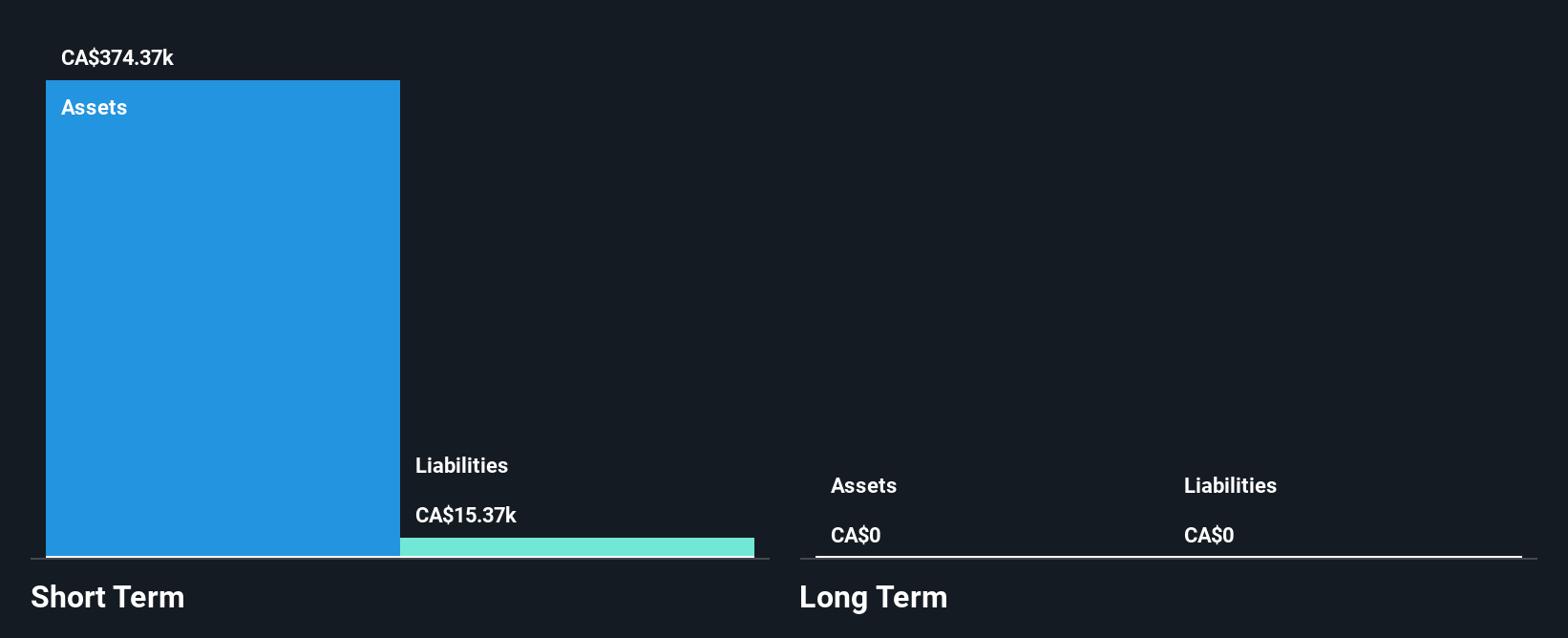

Plata Latina Minerals, with a market cap of CA$790,346, is pre-revenue and has recently turned profitable. The company benefits from a royalty agreement on its Naranjillo Property in Mexico, receiving advance payments of US$100,000 until certain conditions are met. Despite having no long-term liabilities or debt concerns, its return on equity is low at 0.6%. The board's average tenure is short at 1.2 years, indicating limited experience. Shareholder dilution has not been an issue recently; however, the stock price remains highly volatile over the past three months. Short-term assets comfortably cover liabilities by a significant margin.

- Take a closer look at Plata Latina Minerals' potential here in our financial health report.

- Assess Plata Latina Minerals' previous results with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 963 TSX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PLA

Plata Latina Minerals

Engages in the exploration and evaluation of mineral resources properties in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives