- Canada

- /

- Metals and Mining

- /

- TSXV:ODV

Osisko Development (TSXV:ODV): Valuation Check After Major Cariboo Drilling Program and Shelf Registration Update

Reviewed by Simply Wall St

Osisko Development (TSXV:ODV) just doubled down on its flagship Cariboo Gold Project, rolling out a fully funded 70,000 meter exploration program alongside fresh Lowhee Zone infill results that aim to tighten up its resource picture.

See our latest analysis for Osisko Development.

The combination of a fully funded 70,000 meter campaign, ongoing Lowhee infill drilling and the recently closed shelf registration appears to be feeding into rising optimism, with the share price at CA$5.15 and a strong year to date share price return of 123.91 percent. However, the one year total shareholder return of 106 percent still sits against a deeper five year total shareholder loss of 77.41 percent, suggesting momentum is rebuilding from a low base rather than peaking.

If Osisko Development has put high risk, high reward gold exploration back on your radar, it might be worth exploring fast growing stocks with high insider ownership for other under the radar growth stories with aligned management.

With the stock still trading at a steep discount to analyst targets despite a big rebound and aggressive drilling plans, are investors being paid for the risk here, or is the market already pricing in the next leg of growth?

Price to Book of 2.4x: Is it justified?

On a price to book basis, Osisko Development looks inexpensive at the last close of CA$5.15, with its 2.4x multiple screening as undervalued versus peers.

The price to book ratio compares a company’s market value to the accounting value of its net assets. This is a key lens for asset heavy, early stage miners where profits are still negative. For Osisko Development, this framework is particularly relevant because the investment case hinges on the long term value of projects like Cariboo rather than near term earnings.

According to Simply Wall St’s checks, that 2.4x price to book sits well below both the broader peer average of 11.7x and the Canadian Metals and Mining industry at 2.7x, implying investors are still applying a noticeable discount even as revenue is forecast to grow rapidly and analysts see upside.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 2.4x (UNDERVALUED)

However, investors still face execution risk at Cariboo and ongoing losses, so any permitting delays or weaker drill results could quickly capsize the recent optimism.

Find out about the key risks to this Osisko Development narrative.

Another View: DCF Points to Deeper Upside

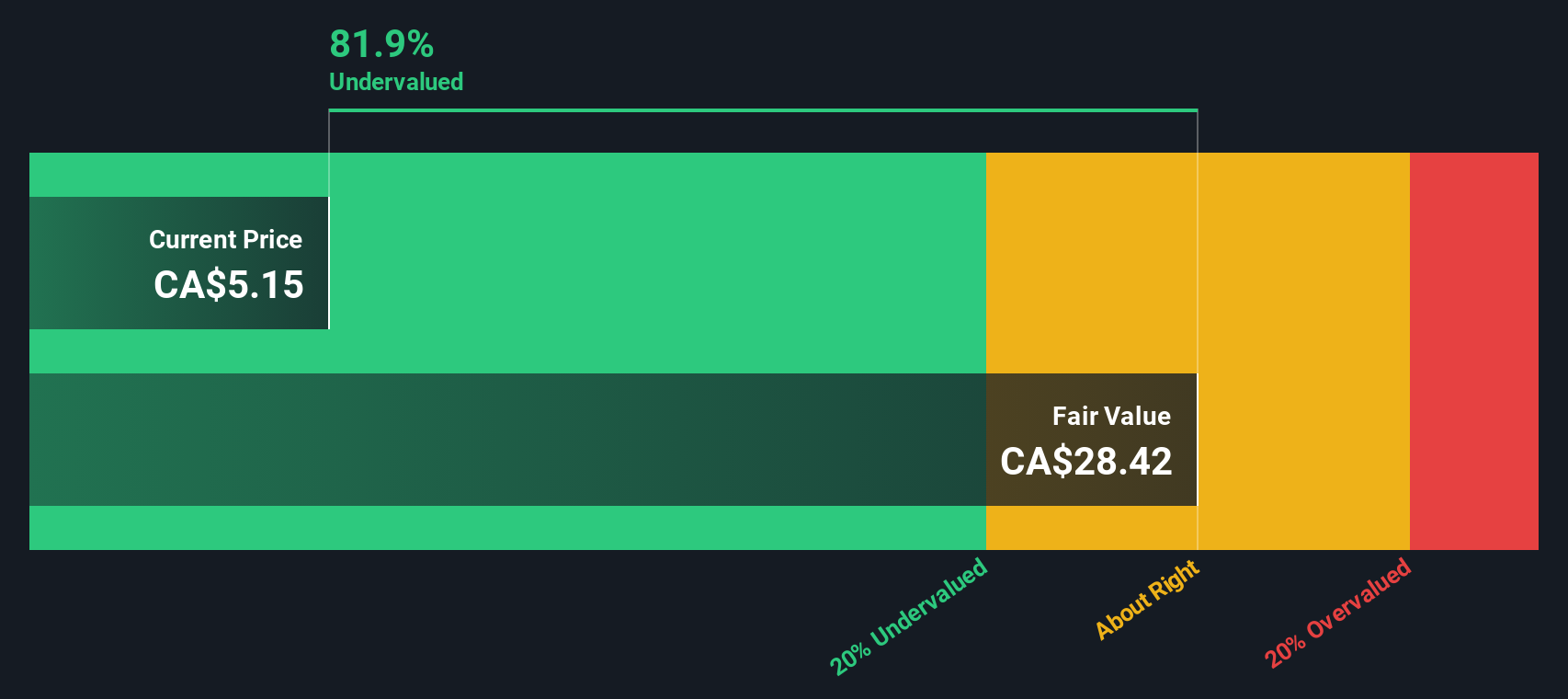

Our DCF model paints an even starker picture, suggesting fair value around CA$28.42, roughly 82 percent above the current CA$5.15 price. If both a low price to book and a steep DCF discount are right, is the market still underestimating Cariboo’s long term cash potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Osisko Development for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Osisko Development Narrative

If you see the numbers differently or want to stress test the assumptions yourself, build a custom view in minutes with Do it your way.

A great starting point for your Osisko Development research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities by putting the Simply Wall St Screener to work and lining up your watchlist with potential future winners.

- Target income streams by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with cash returns.

- Look for potential mispricings using these 918 undervalued stocks based on cash flows to spot quality businesses the market may not have fully rewarded yet.

- Explore the frontier of innovation through these 28 quantum computing stocks that could influence how entire industries develop over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ODV

Osisko Development

Acquires, explores, and develops precious metals resource properties in Canada, Mexico, and the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion