- Canada

- /

- Metals and Mining

- /

- TSXV:NWST

3 TSX Penny Stocks With Market Caps Over CA$10M To Consider

Reviewed by Simply Wall St

The Canadian market has been navigating a landscape marked by ongoing trade negotiations and economic uncertainties, yet it remains buoyed by investor optimism and strategic positioning. Amidst this backdrop, penny stocks—though an outdated term—continue to represent intriguing opportunities for growth at lower price points. By focusing on companies with strong financial foundations, these stocks can offer potential upside without the heightened risks typically associated with smaller firms.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.81 | CA$251.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.10 | CA$156.33M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 454 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Forum Energy Metals (TSXV:FMC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Forum Energy Metals Corp. is involved in the evaluation, acquisition, exploration, and development of natural resource properties in Canada and the United States with a market cap of CA$17.01 million.

Operations: Forum Energy Metals Corp. currently does not report any revenue segments.

Market Cap: CA$17.01M

Forum Energy Metals Corp., with a market cap of CA$17.01 million, is a pre-revenue company focused on mineral exploration. It recently announced a merger with Baselode Energy Corp., valued at CA$13.12 million, which will form Geiger Energy Corporation upon completion. The company has no debt and its short-term assets exceed liabilities, yet it faces challenges with high volatility and less than one year of cash runway based on current free cash flow trends. Recent strategic moves include an exploration agreement in Saskatchewan and the initiation of drilling programs in Nunavut, highlighting its commitment to advancing resource projects collaboratively with Indigenous communities.

- Get an in-depth perspective on Forum Energy Metals' performance by reading our balance sheet health report here.

- Assess Forum Energy Metals' previous results with our detailed historical performance reports.

NorthWest Copper (TSXV:NWST)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NorthWest Copper Corp. is involved in acquiring and exploring mineral properties in Canada, with a market cap of CA$47.26 million.

Operations: NorthWest Copper Corp. has not reported any specific revenue segments.

Market Cap: CA$47.26M

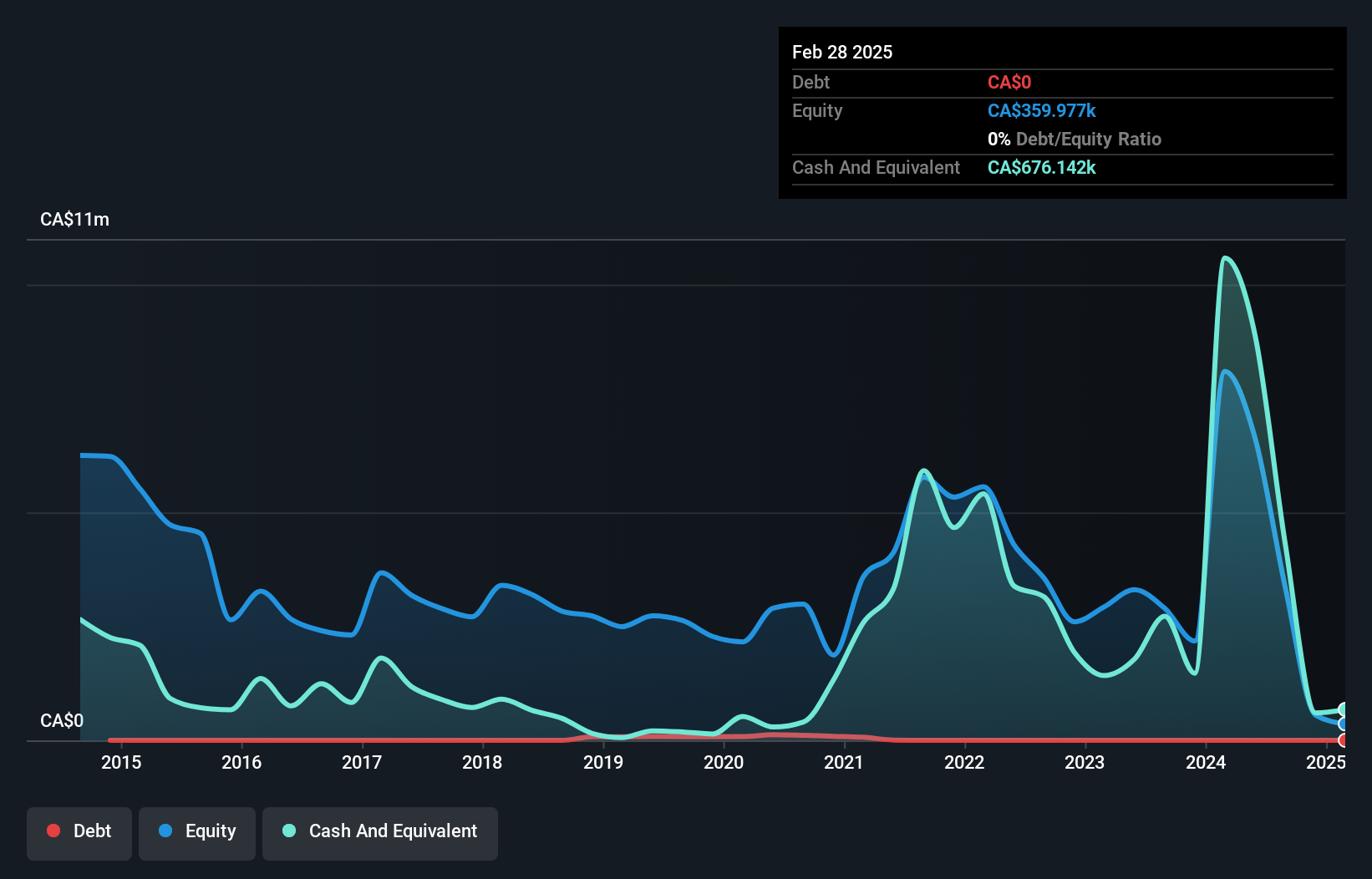

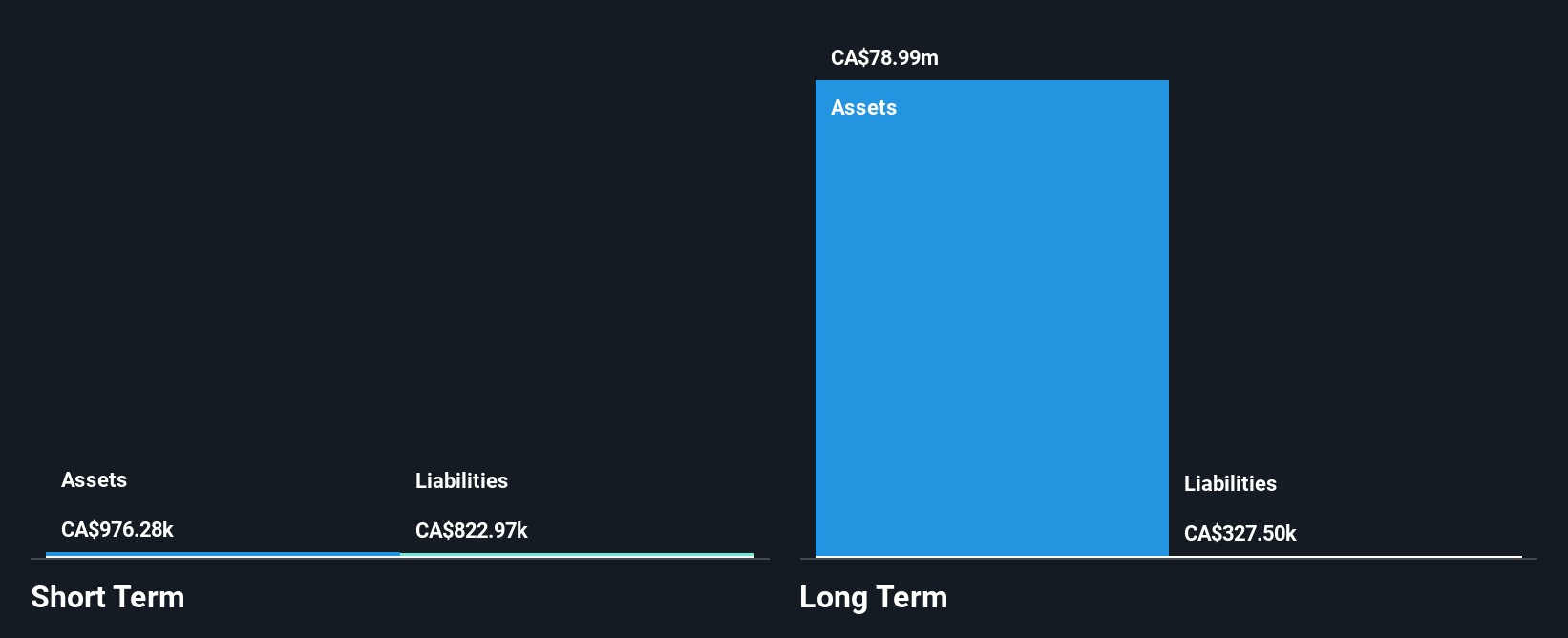

NorthWest Copper Corp., with a market cap of CA$47.26 million, is pre-revenue and focuses on mineral exploration in Canada. The company's short-term assets exceed its liabilities, and it remains debt-free, though it faces going concern doubts from auditors due to financial constraints. Recent efforts include a non-brokered private placement raising CA$500,000 to bolster finances and the development of a new 3D target model for its Kwanika project aimed at enhancing resource value. While management's tenure is brief, indicating a relatively new team, NorthWest has reduced losses over five years by 2.5% annually despite ongoing volatility challenges.

- Take a closer look at NorthWest Copper's potential here in our financial health report.

- Gain insights into NorthWest Copper's historical outcomes by reviewing our past performance report.

Soma Gold (TSXV:SOMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Soma Gold Corp. is a natural resource company focused on acquiring, exploring, and developing mineral properties in South America with a market cap of CA$118.52 million.

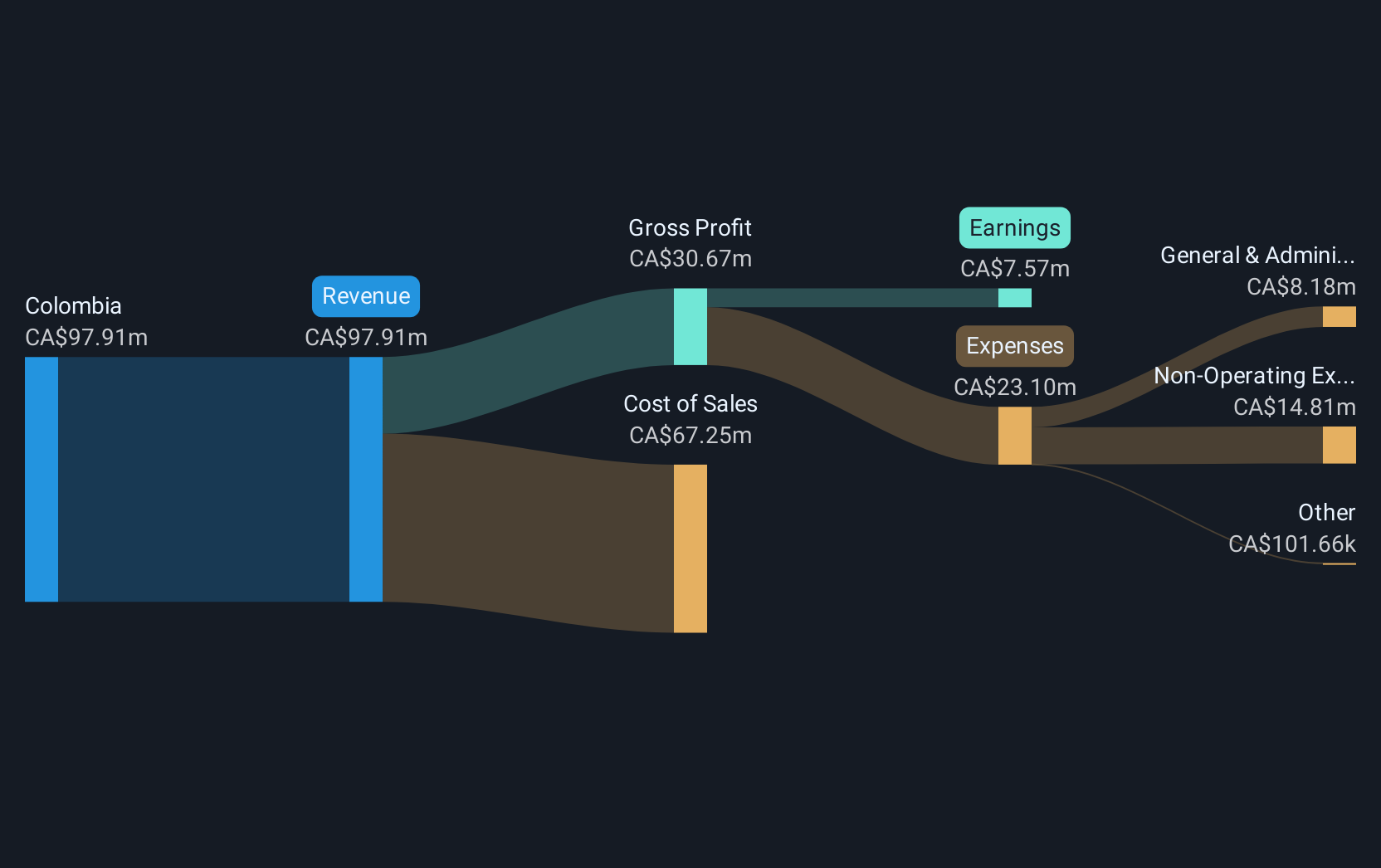

Operations: Soma Gold generates its revenue primarily from operations in Colombia, amounting to CA$97.91 million.

Market Cap: CA$118.52M

Soma Gold Corp., with a market cap of CA$118.52 million, has shown robust earnings growth, significantly outperforming the metals and mining industry. The company reported CA$27.88 million in sales for Q1 2025 and net income of CA$3.17 million, reflecting improved profit margins from the previous year. Soma's debt is well covered by operating cash flow, although its net debt to equity ratio remains high at 108%. Recent operational updates include successful drilling results at the Venus Gap zone in Colombia and strategic debt repayments from free cash flow, indicating prudent financial management amidst ongoing exploration efforts.

- Click here to discover the nuances of Soma Gold with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Soma Gold's track record.

Turning Ideas Into Actions

- Get an in-depth perspective on all 454 TSX Penny Stocks by using our screener here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NWST

NorthWest Copper

Engages in the acquisition and exploration of mineral properties in Canada.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives