TSX Penny Stocks Spotlight: Cannabix Technologies And Two More Compelling Picks

Reviewed by Simply Wall St

As trade tensions ease with new agreements between the U.S. and its trading partners, including the U.K., and talks set to begin with China, financial markets have shown positive momentum. Amid these developments, investors are increasingly looking at penny stocks for potential growth opportunities in smaller or newer companies. Although the term "penny stocks" may seem outdated, these investments can still offer significant upside when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.81 | CA$81.93M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.24 | CA$99.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.60 | CA$372.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.03 | CA$542.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.81 | CA$449.65M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.99M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$128.41M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$14.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.30 | CA$49.19M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 902 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company that develops marijuana and alcohol breathalyzers for employers, law enforcement, workplaces, and laboratories in the United States, with a market cap of CA$71.39 million.

Operations: Cannabix Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$71.39M

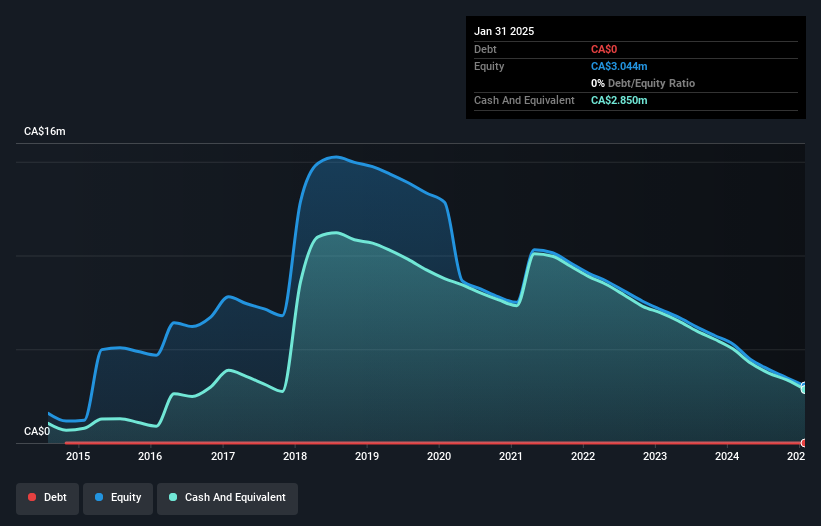

Cannabix Technologies Inc., with a market cap of CA$71.39 million, is pre-revenue and unprofitable but shows potential through strategic developments. The company recently secured its first international distribution agreement for its BreathLogix alcohol breathalyzers in Australia, New Zealand, and the Pacific Islands. Additionally, it achieved U.S. regulatory approval for its BreathLogix Workplace Series alcohol devices, opening doors to the U.S. market. Despite a negative return on equity and ongoing losses, Cannabix remains debt-free with sufficient cash runway for over a year and has reduced losses by 24.8% annually over five years while maintaining stable volatility.

- Take a closer look at Cannabix Technologies' potential here in our financial health report.

- Gain insights into Cannabix Technologies' past trends and performance with our report on the company's historical track record.

Empress Royalty (TSXV:EMPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Empress Royalty Corp. focuses on creating and investing in a portfolio of precious metal royalty and streaming interests in Canada, with a market cap of CA$59.29 million.

Operations: Empress Royalty Corp. does not report distinct revenue segments, focusing instead on its portfolio of precious metal royalty and streaming interests.

Market Cap: CA$59.29M

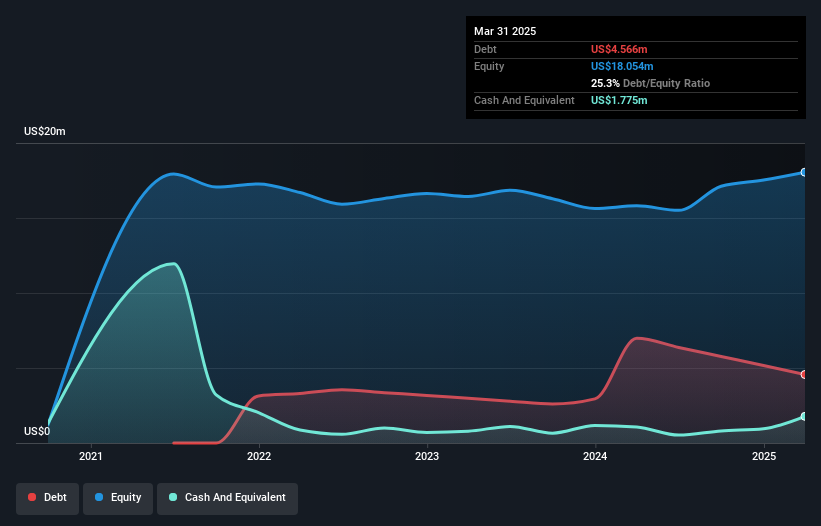

Empress Royalty Corp., with a market cap of CA$59.29 million, has transitioned from losses to profitability, reporting a net income of US$1.01 million for 2024 and US$0.44 million for Q1 2025. Despite an experienced management team and board, concerns remain about its ability to continue as a going concern, as noted by its auditor. The company trades significantly below estimated fair value and maintains satisfactory debt levels with short-term assets covering liabilities. Recent revenue guidance indicates growth driven by increased production from its silver and gold streams, yet interest coverage remains low at 2.6 times EBIT.

- Unlock comprehensive insights into our analysis of Empress Royalty stock in this financial health report.

- Understand Empress Royalty's track record by examining our performance history report.

Nickel 28 Capital (TSXV:NKL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nickel 28 Capital Corp. is a base metals company with a market capitalization of CA$54.79 million.

Operations: Nickel 28 Capital Corp. has not reported any specific revenue segments.

Market Cap: CA$54.79M

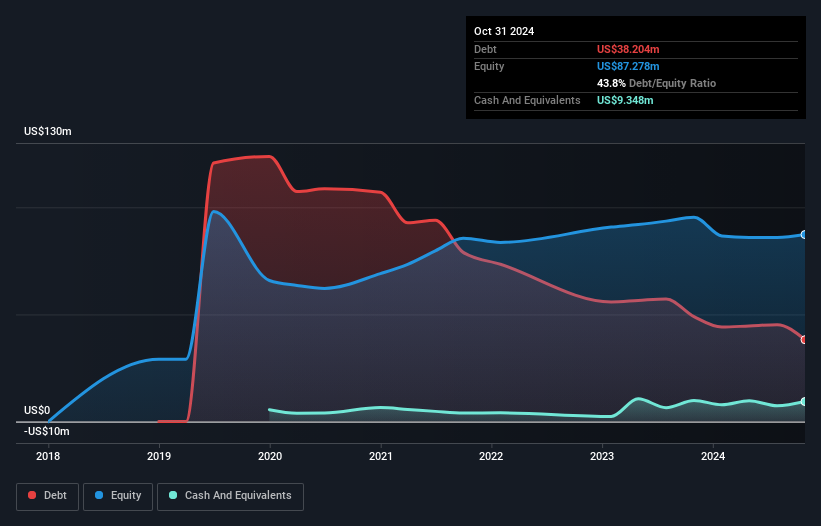

Nickel 28 Capital Corp., with a market cap of CA$54.79 million, is pre-revenue and currently unprofitable, facing challenges such as insufficient short-term assets to cover liabilities. However, it has a satisfactory net debt to equity ratio of 33.1% and has reduced its debt significantly over the past five years. Recent production results indicate decreased output compared to last year, but the company successfully resumed full production at its Ramu Nickel-Cobalt Mine after resolving mechanical issues earlier this year. Despite an inexperienced board and management team, shareholders have not faced significant dilution recently.

- Dive into the specifics of Nickel 28 Capital here with our thorough balance sheet health report.

- Gain insights into Nickel 28 Capital's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 902 TSX Penny Stocks by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:BLO

Cannabix Technologies

A technology company, develops marijuana and alcohol breathalyzer technologies for employers, law enforcement, workplaces, and laboratories in the United States.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives