- Canada

- /

- Metals and Mining

- /

- TSXV:NFG

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the Canadian economy shows signs of cooling in the labor market, with expectations for further interest rate cuts by the Bank of Canada, investors are keenly observing how these macroeconomic shifts might impact financial markets. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite being considered an outdated term. With a focus on strong balance sheets and solid fundamentals, these stocks can offer unique opportunities for growth at lower price points amidst evolving market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$182.69M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$118.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.32M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$231.56M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.21 | CA$135.82M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Decibel Cannabis (TSXV:DB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Decibel Cannabis Company Inc. is an integrated cannabis company involved in the cultivation, processing, and sale of cannabis flower products in Canada with a market cap of CA$30.98 million.

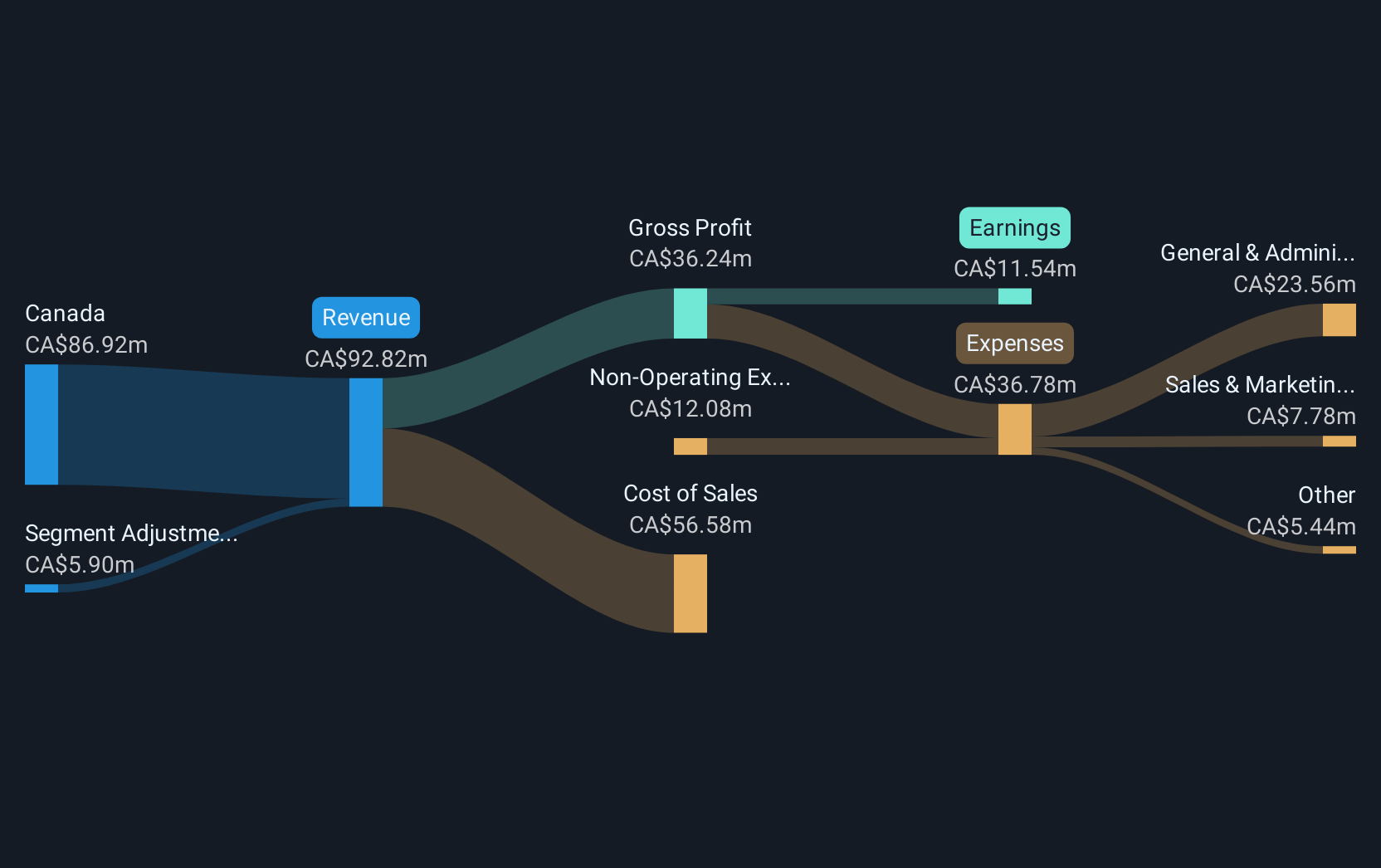

Operations: The company's revenue primarily comes from the production, distribution, and sale of recreational cannabis, totaling CA$105.60 million.

Market Cap: CA$30.98M

Decibel Cannabis Company Inc. presents both opportunities and challenges as a penny stock. With a market cap of CA$30.98 million, it operates in the cannabis sector with revenues primarily from recreational sales totaling CA$105.60 million annually. Despite being unprofitable with a negative return on equity, Decibel has reduced losses by 29.7% per year over five years and maintains sufficient cash runway for more than three years due to positive free cash flow growth of 28.8% annually. However, high debt levels and recent shareholder dilution pose risks, while international expansion into markets like the UK, Australia, Israel, and Germany could drive future growth prospects.

- Dive into the specifics of Decibel Cannabis here with our thorough balance sheet health report.

- Understand Decibel Cannabis' earnings outlook by examining our growth report.

Emerita Resources (TSXV:EMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Emerita Resources Corp. is a natural resource company focused on acquiring, exploring, and developing mineral properties in Spain, with a market cap of CA$146.09 million.

Operations: Emerita Resources Corp. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral properties in Spain.

Market Cap: CA$146.09M

Emerita Resources Corp., with a market cap of CA$146.09 million, is a pre-revenue entity focused on mineral exploration in Spain, specifically the Iberian Belt West Project. Recent Phase 2 metallurgical tests show promising results for producing commercial-grade copper, lead, and zinc concentrates from La Infanta and La Romanera deposits. These findings exceed recoveries from active mines in the region and support ongoing economic analysis for future mining operations. However, financial challenges persist as Emerita remains unprofitable with limited cash runway and recent shareholder dilution despite being debt-free. The company continues to advance its drilling efforts at El Cura to expand resource estimates.

- Unlock comprehensive insights into our analysis of Emerita Resources stock in this financial health report.

- Gain insights into Emerita Resources' historical outcomes by reviewing our past performance report.

New Found Gold (TSXV:NFG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador, and Ontario, with a market cap of approximately CA$632.31 million.

Operations: There are no reported revenue segments for this mineral exploration company.

Market Cap: CA$632.31M

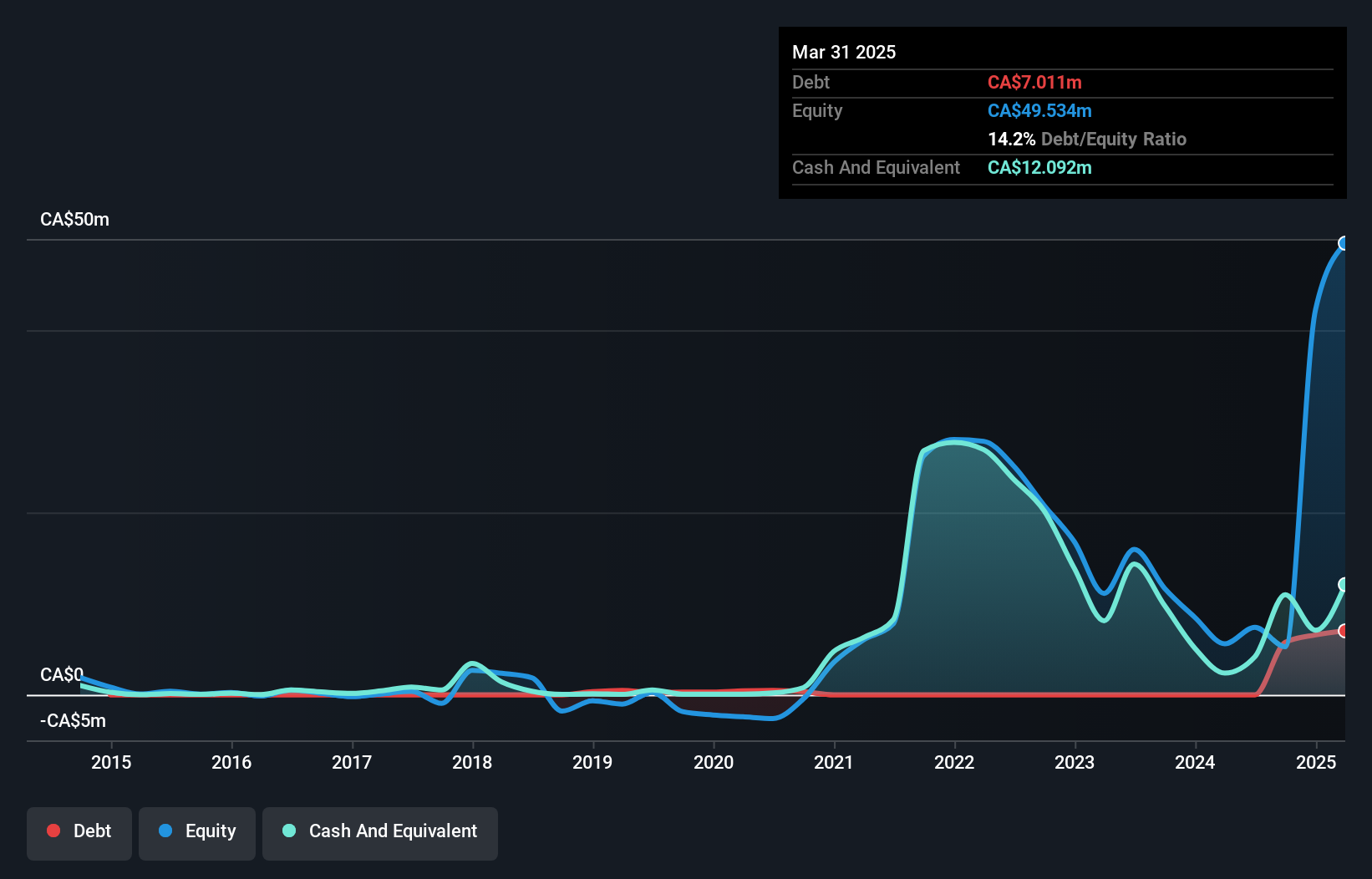

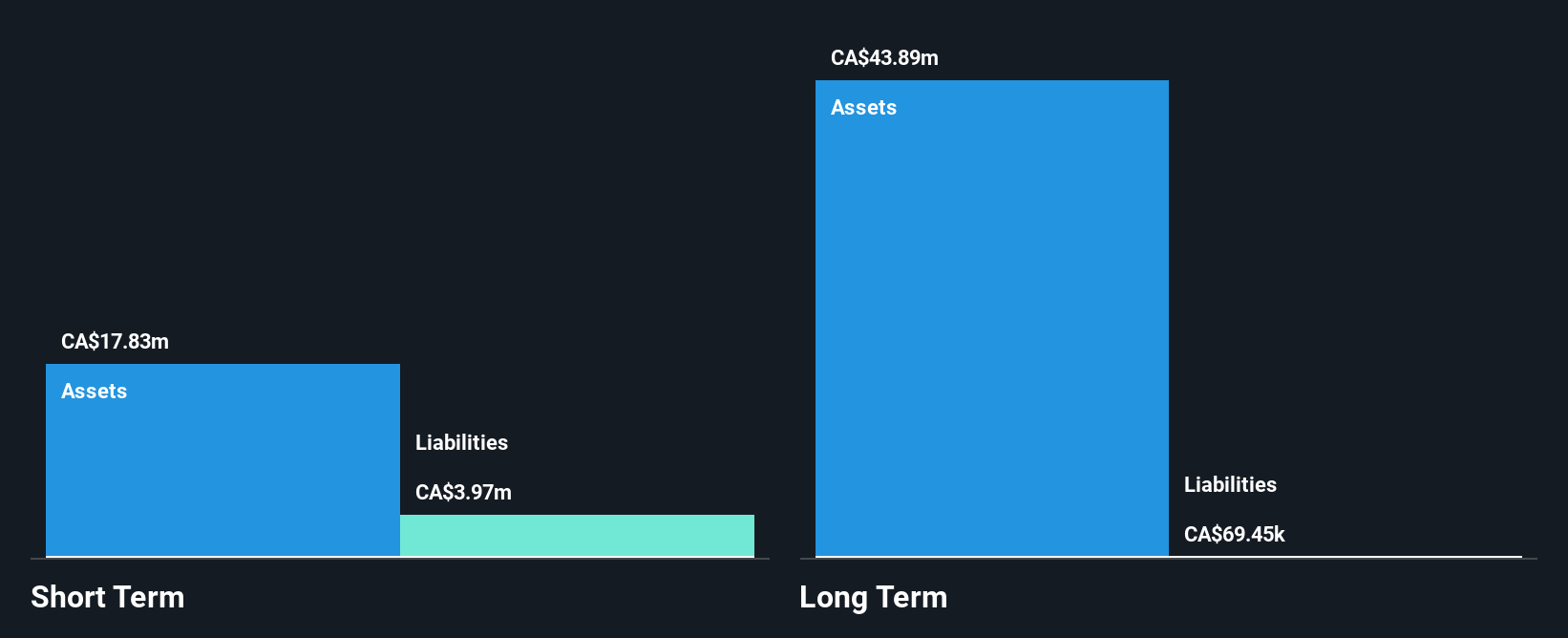

New Found Gold Corp., with a market cap of approximately CA$632.31 million, is a pre-revenue mineral exploration company focused on its Queensway Project in Newfoundland. The company has engaged SLR Consulting to deliver a maiden resource estimate and preliminary economic assessment by Q2 2025, marking an important milestone for project evaluation. Recent metallurgical testing at the Queensway Project showed high gold extraction rates averaging 96.9%, indicating potential for economically viable mining operations despite current unprofitability. Financially, New Found Gold remains debt-free but faces challenges with limited cash runway and recent shareholder dilution impacting its financial stability.

- Click here and access our complete financial health analysis report to understand the dynamics of New Found Gold.

- Review our growth performance report to gain insights into New Found Gold's future.

Key Takeaways

- Reveal the 963 hidden gems among our TSX Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Found Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NFG

New Found Gold

A mineral exploration company, engages in the identification, evaluation, acquisition, and exploration of mineral properties in the Provinces of Newfoundland and Labrador, Canada.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives