- Canada

- /

- Metals and Mining

- /

- TSXV:GPH

TSX Penny Stocks: 3 Picks With Market Caps Under CA$300M

Reviewed by Simply Wall St

The Canadian market, like its U.S. counterpart, is navigating a complex landscape of economic factors, including potential tariff impacts and inflationary pressures that could influence investor decisions. Amidst this backdrop, penny stocks—often representing smaller or emerging companies—offer unique opportunities for growth at attractive price points. While the term "penny stocks" might seem dated, these investments can still provide significant upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.65 | CA$58.67M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.52 | CA$59.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$386.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$259.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$159.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.64 | CA$167.51M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$503.72M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.61 | CA$65.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.09 | CA$39.5M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Graphite One (TSXV:GPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Graphite One Inc. is a mineral exploration company operating in the United States, with a market capitalization of CA$135.17 million.

Operations: Graphite One Inc. has not reported any specific revenue segments.

Market Cap: CA$135.17M

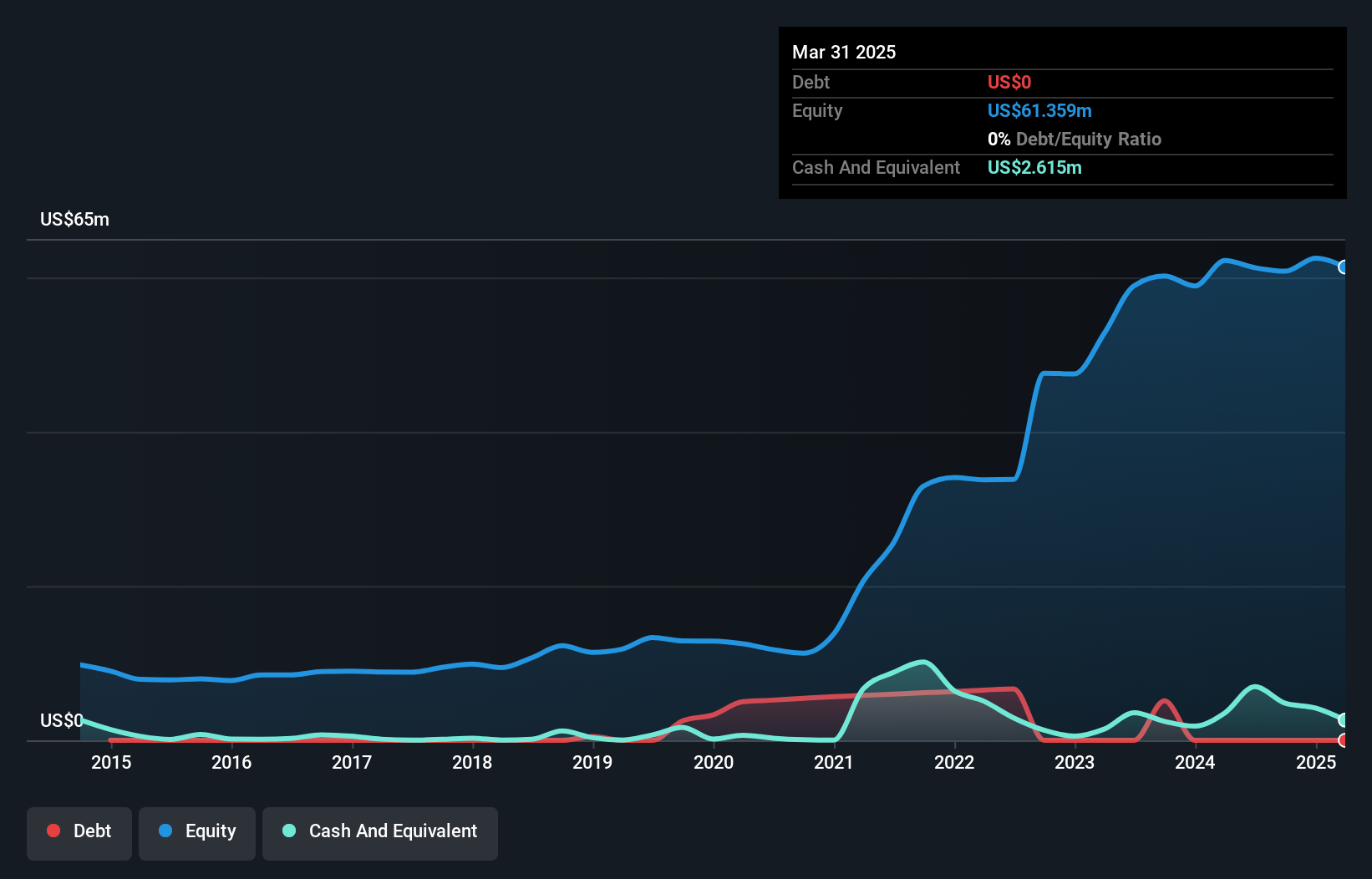

Graphite One Inc., with a market cap of CA$135.17 million, is pre-revenue and currently unprofitable. Recent announcements highlight significant updates to its Graphite Creek Project's mineral resources, with proven reserves showing substantial increases over previous estimates. The company has no debt and short-term assets exceed liabilities, but it faces cash runway challenges, having only two months' worth based on past free cash flow before raising additional capital. Management and board members have considerable experience, which may be beneficial as the company progresses toward filing a feasibility study in April 2025.

- Click to explore a detailed breakdown of our findings in Graphite One's financial health report.

- Examine Graphite One's past performance report to understand how it has performed in prior years.

New Found Gold (TSXV:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador as well as Ontario, with a market cap of CA$282.86 million.

Operations: New Found Gold Corp. does not report any revenue segments as it is primarily engaged in the exploration of mineral properties.

Market Cap: CA$282.86M

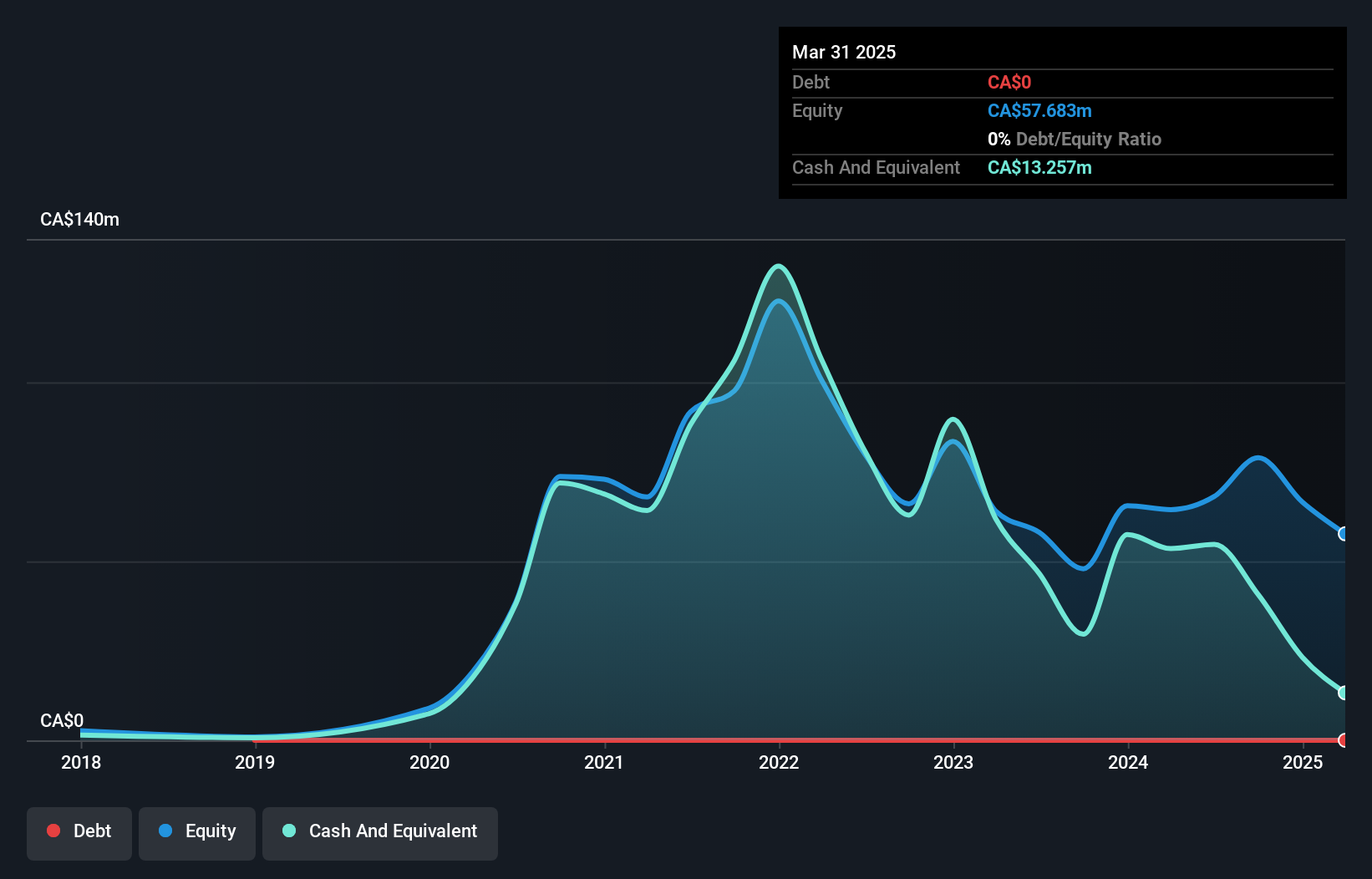

New Found Gold Corp., with a market cap of CA$282.86 million, is pre-revenue and focused on mineral exploration in Newfoundland and Labrador. The company recently announced an initial Mineral Resource Estimate for its Queensway Gold Project, highlighting significant high-grade gold zones like Keats and Iceberg. Despite being debt-free with short-term assets exceeding liabilities, New Found faces financial challenges with less than a year of cash runway. Recent management changes include the appointment of Keith Boyle as CEO, bringing extensive mining experience to support ongoing exploration efforts aimed at expanding resource potential amidst going concern doubts from auditors.

- Dive into the specifics of New Found Gold here with our thorough balance sheet health report.

- Gain insights into New Found Gold's outlook and expected performance with our report on the company's earnings estimates.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on the research, development, and commercialization of light activated photodynamic compounds for treating cancers, bacteria, and viruses across Canada, the United States, and internationally with a market cap of CA$42.30 million.

Operations: The company generates CA$1.03 million in revenue from its device segment.

Market Cap: CA$42.3M

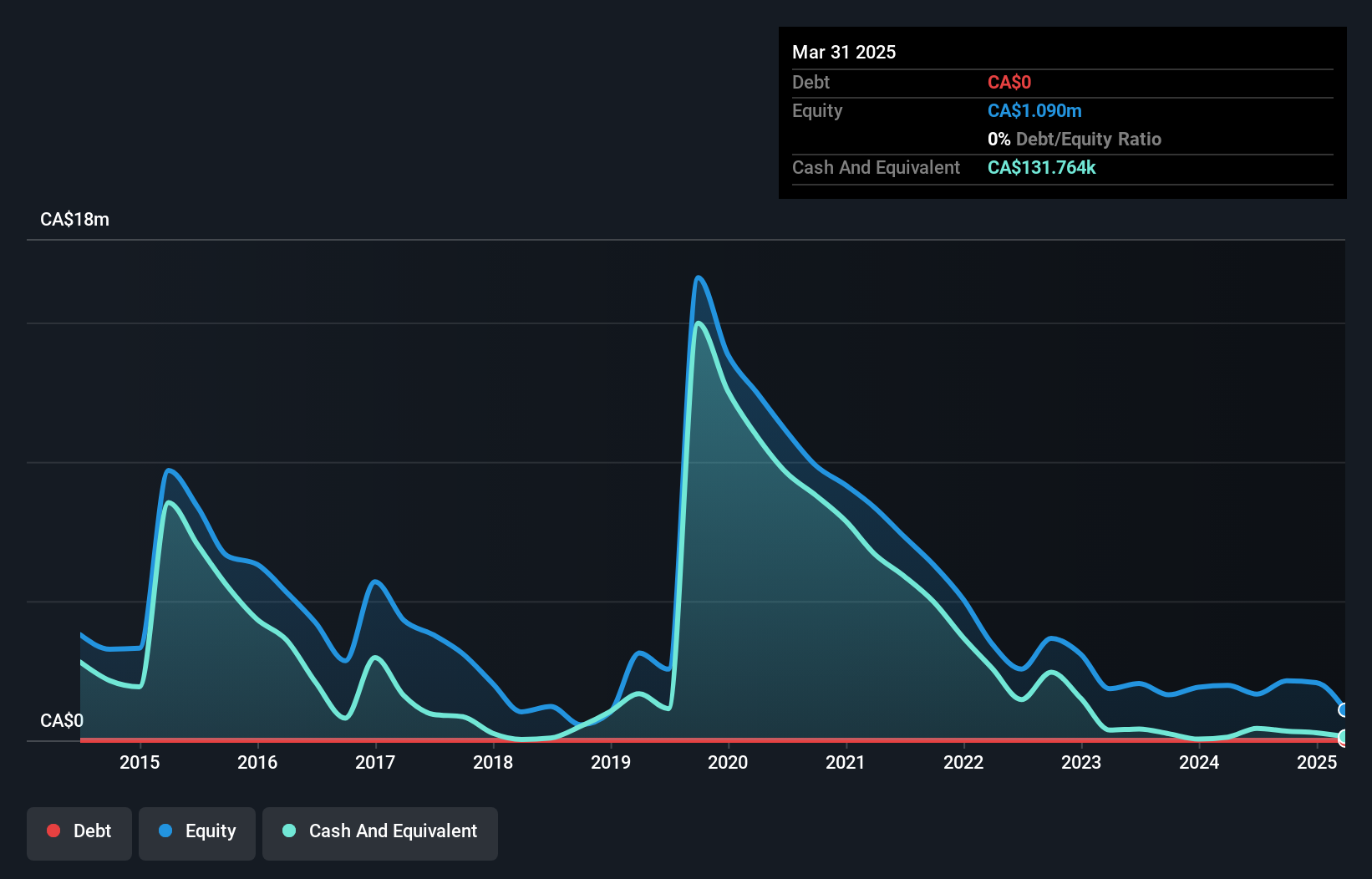

Theralase Technologies Inc., with a market cap of CA$42.30 million, is pre-revenue, focusing on innovative cancer treatments and viral therapies. Recent clinical developments include promising results from its lead compound RuvidarTM in treating non-muscle invasive bladder cancer and Herpes Simplex Virus Type 1. Despite these advances, the company faces financial hurdles with an auditor expressing going concern doubts and limited cash runway, although recent capital raising efforts provide some relief. The management team has substantial experience, yet the company's negative return on equity reflects ongoing profitability challenges as it continues to invest in research and development initiatives.

- Get an in-depth perspective on Theralase Technologies' performance by reading our balance sheet health report here.

- Assess Theralase Technologies' future earnings estimates with our detailed growth reports.

Where To Now?

- Reveal the 934 hidden gems among our TSX Penny Stocks screener with a single click here.

- Seeking Other Investments? The latest GPUs need a type of rare earth metal called Terbium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GPH

Graphite One

Operates as mineral exploration company in the United States.

Slight with mediocre balance sheet.

Market Insights

Community Narratives