- Canada

- /

- Metals and Mining

- /

- TSXV:NFG

New Found Gold (TSXV:NFG): Valuation Check After High-Grade Keats Drill Results Lift Investor Expectations

Reviewed by Simply Wall St

New Found Gold (TSXV:NFG) has jumped back onto investor watchlists after unveiling high grade grade control drilling results at the Keats zone, a key part of its Queensway Gold Project in Newfoundland.

See our latest analysis for New Found Gold.

The upbeat Keats results, combined with fresh insider buying and CEO appearances at industry conferences, help explain why New Found Gold’s share price has surged recently. This short term momentum contrasts with a still mixed multi year total shareholder return profile.

If this kind of speculative upside appeals to you, it could be a good time to scan the market for other fast growing stocks with high insider ownership that might be setting up for their next move.

With New Found Gold’s shares already up strongly this year and trading only slightly below analyst targets, the key question now is whether the high grade drill results are still underappreciated or if the market is already pricing in future growth.

Price to Book of 10.1x: Is it justified?

NFG’s latest close at CA$4.18 implies a steep price to book ratio, putting a spotlight on whether investors are overpaying relative to peers.

The price to book ratio compares a company’s market value with its net assets on the balance sheet. This can matter for early stage, asset heavy explorers like New Found Gold. At 10.1 times book value, investors appear willing to pay a significant premium over the company’s accounting equity for its Queensway and other exploration upside.

Compared to a peer group average of 18.9 times book value, NFG actually screens as good value on this metric. This suggests the market is attaching a lower premium to its assets than many high flying exploration names. However, relative to the broader Canadian metals and mining industry, where the average price to book is just 2.7 times, NFG’s 10.1 times multiple still looks rich and implies expectations far above those baked into most miners in the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 10.1x (ABOUT RIGHT)

However, significant exploration and permitting uncertainty remains, and any deterioration in drilling results or funding conditions could quickly puncture today’s optimistic valuation.

Find out about the key risks to this New Found Gold narrative.

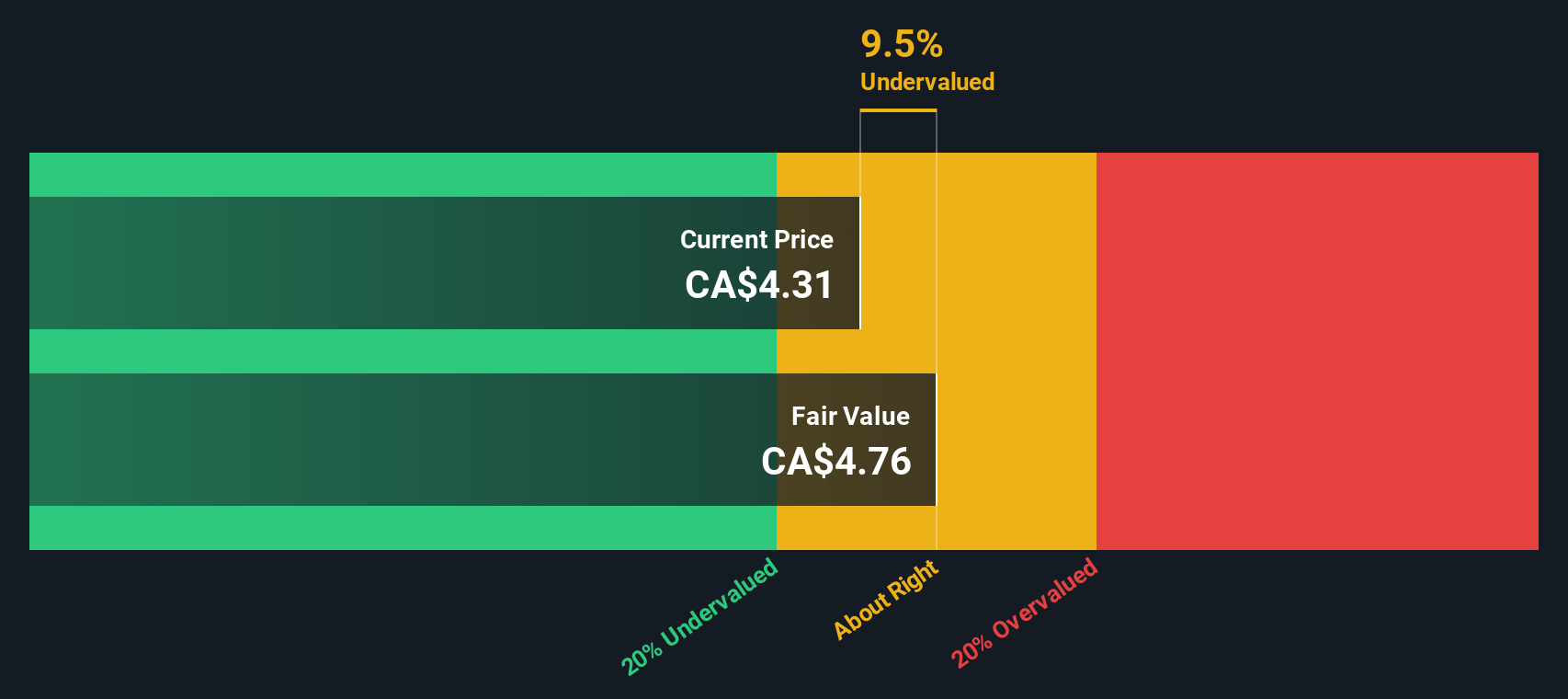

Another View on Value

Our DCF model paints a slightly different picture, suggesting New Found Gold is trading about 13.1% below its fair value estimate of CA$4.81. That implies some upside even after the rally. The key question is whether the market is rewarding drilling success or getting ahead of itself.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Found Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Found Gold Narrative

If you see things differently or prefer to dig into the numbers yourself, you can build a personalised view of New Found Gold in just a few minutes: Do it your way.

A great starting point for your New Found Gold research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screeners to work so you do not miss the next wave of compelling, data backed opportunities.

- Capitalize on potential market mispricings by targeting these 912 undervalued stocks based on cash flows that strong cash flow analysis suggests could be trading below their intrinsic worth.

- Position yourself for structural growth by focusing on these 30 healthcare AI stocks at the intersection of medical innovation and advanced algorithms.

- Tap into high yield opportunities by targeting these 15 dividend stocks with yields > 3% that can boost your income while complementing a growth oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Found Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NFG

New Found Gold

A mineral exploration company, engages in the identification, evaluation, acquisition, and exploration of mineral properties in the Provinces of Newfoundland and Labrador, Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026