- Canada

- /

- Metals and Mining

- /

- TSXV:NFG

Is High-Grade Iceberg Channel Sampling Shifting the Investment Case for New Found Gold (TSXV:NFG)?

Reviewed by Sasha Jovanovic

- New Found Gold Corp. recently announced high-grade gold assay results from channel sampling at the Iceberg area of its 100%-owned Queensway Gold Project in Newfoundland and Labrador, Canada.

- This sampling revealed multiple significant gold intercepts and highlighted ongoing resource updates and hydrogeological studies advancing the project's development.

- We'll explore how these robust gold grades at Queensway influence New Found Gold's investment narrative and project advancement outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is New Found Gold's Investment Narrative?

For anyone following New Found Gold, the big picture hasn’t changed: investors must believe in the viability and long-term potential of an early-stage gold explorer with no meaningful revenue to date and a history of operating losses. This week’s channel sampling from Iceberg showed standout gold grades that, if confirmed at scale, could become a near-term catalyst by bolstering confidence in the resource and speeding the path toward updated resource estimates. As an infill drill program and hydrogeological studies progress, the biggest risk remains unchanged: significant dilution or delays if the transition from exploration to development doesn’t attract further funding or partner interest, given no clear timeline to profitability. The news is material in reinforcing project momentum, but large swings in the share price and recent fundraising remind me that execution and financing risks are still front and center for shareholders. On the flip side, the path to commercialization still carries its own hurdles investors should track closely.

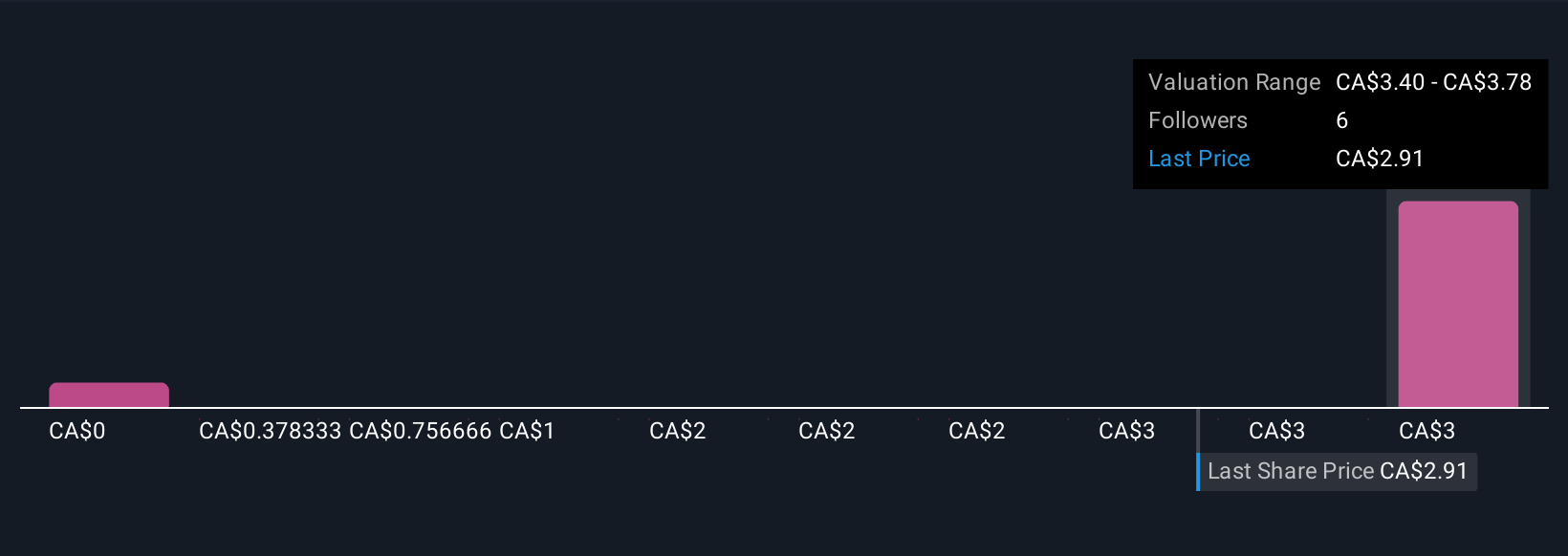

Our expertly prepared valuation report on New Found Gold implies its share price may be too high.Exploring Other Perspectives

Explore 3 other fair value estimates on New Found Gold - why the stock might be worth as much as 20% more than the current price!

Build Your Own New Found Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Found Gold research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free New Found Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Found Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Found Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NFG

New Found Gold

A mineral exploration company, engages in the identification, evaluation, acquisition, and exploration of mineral properties in the Provinces of Newfoundland and Labrador, Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.