As the Canadian market continues to show strong momentum heading into 2025, investors are keeping an eye on potential curveballs that could affect growth. In this context, penny stocks—though a somewhat outdated term—remain relevant as they often represent smaller or less-established companies with unique opportunities. By focusing on those with solid financial health and clear growth prospects, investors can uncover potential gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.24 | CA$160.38M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$281.86M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.36 | CA$120.59M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$335.5M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.89 | CA$187.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$215.73M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NEXE Innovations (TSXV:NEXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NEXE Innovations Inc. is a Canadian company that produces and markets plant-based single-serve coffee pods for use in single-serve coffee machines, with a market cap of CA$40.86 million.

Operations: NEXE Innovations generates revenue from its Industrial Automation & Controls segment, amounting to CA$0.06 million.

Market Cap: CA$40.86M

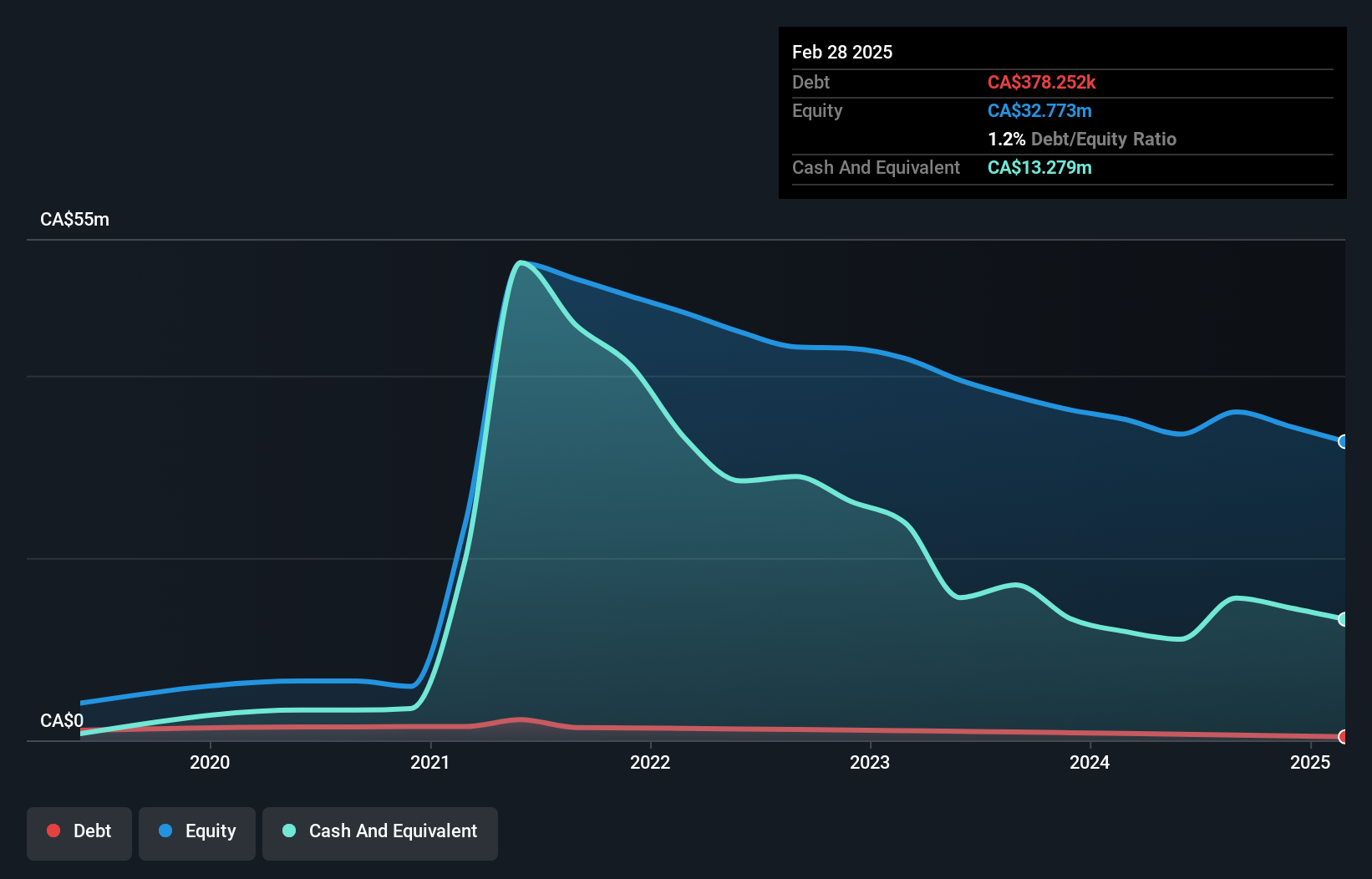

NEXE Innovations, with a market cap of CA$40.86 million, is pre-revenue, generating only CA$0.06 million from its industrial segment. Despite being unprofitable, NEXE has reduced its debt-to-equity ratio significantly over five years and maintains a strong cash runway exceeding three years. Recent developments include a partnership with ecoBeans Coffee Inc., expanding into retail and office coffee services markets in Canada, potentially opening new revenue streams. However, the company remains highly volatile compared to most Canadian stocks and reported minimal sales growth alongside ongoing net losses for the past fiscal year.

- Click to explore a detailed breakdown of our findings in NEXE Innovations' financial health report.

- Evaluate NEXE Innovations' historical performance by accessing our past performance report.

Star Royalties (TSXV:STRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Star Royalties Ltd. is a company that focuses on precious metals and carbon credits royalty and streaming, with a market cap of CA$23.22 million.

Operations: Star Royalties Ltd. has not reported any specific revenue segments.

Market Cap: CA$23.22M

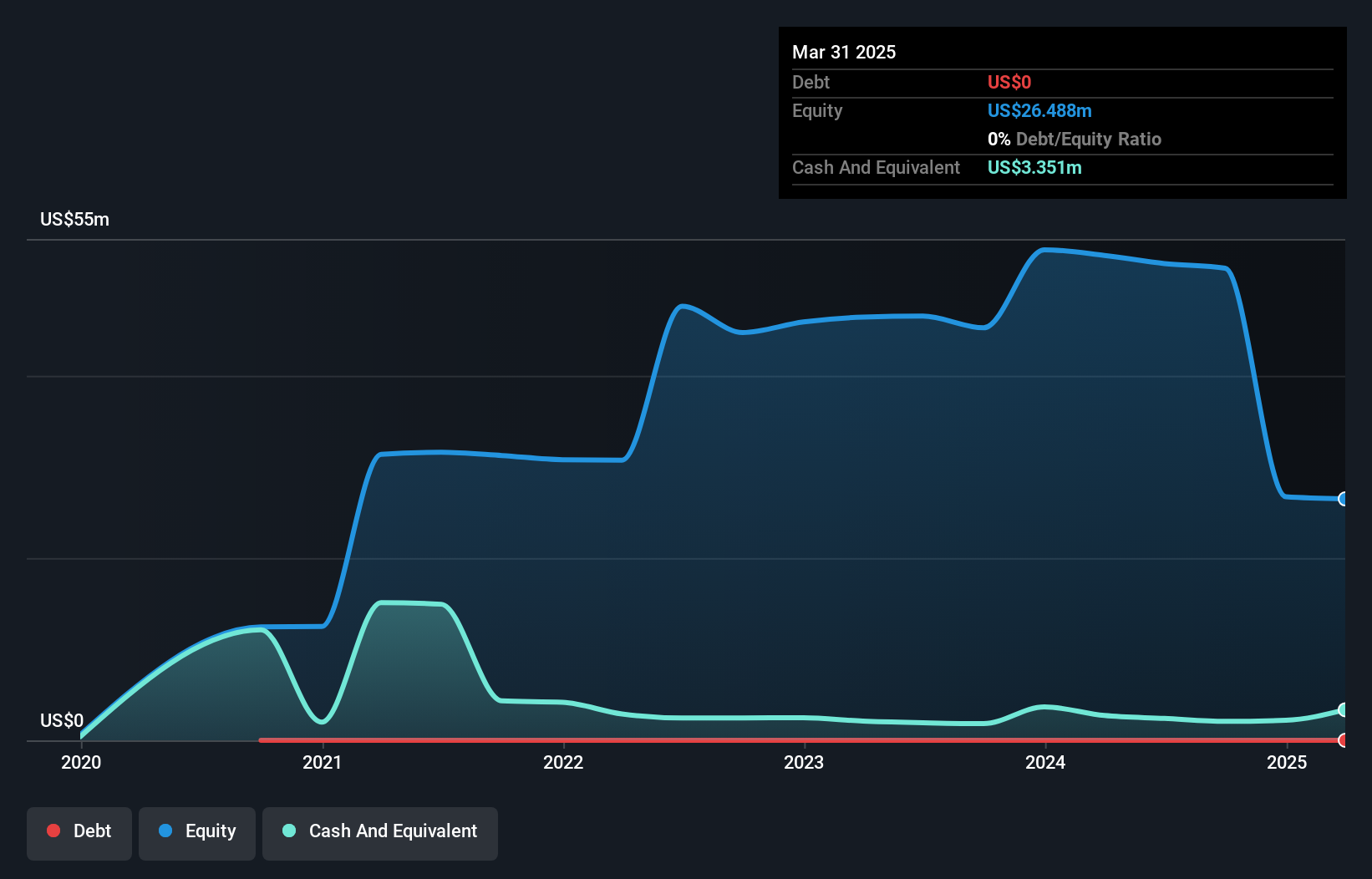

Star Royalties Ltd., with a market cap of CA$23.22 million, is pre-revenue, reporting less than US$1 million in revenue. The company has no debt and its short-term assets of $3.6 million exceed liabilities of $822.2K, indicating solid liquidity management. Despite shareholder dilution over the past year, Star Royalties became profitable this year and reported high-quality earnings. However, it posted a net loss of US$1.33 million for Q3 2024 compared to the previous year's smaller loss, reflecting ongoing financial challenges despite recent profitability improvements and stable weekly volatility at 7%.

- Take a closer look at Star Royalties' potential here in our financial health report.

- Examine Star Royalties' past performance report to understand how it has performed in prior years.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on exploring and developing gold properties in Ontario and Québec, Canada, with a market cap of CA$81.75 million.

Operations: Northern Superior Resources Inc. does not report any revenue segments.

Market Cap: CA$81.75M

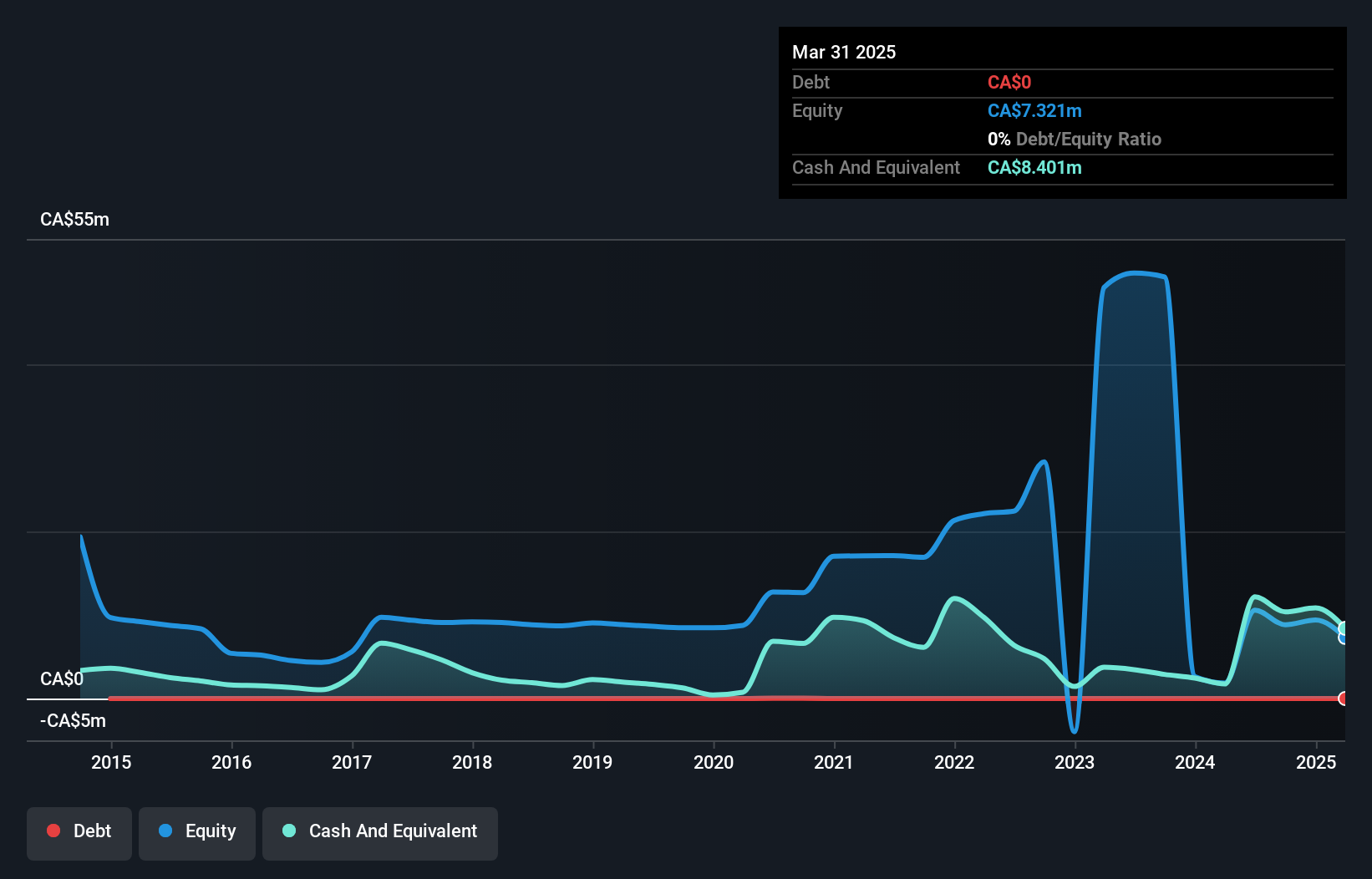

Northern Superior Resources Inc., with a market cap of CA$81.75 million, is pre-revenue and has experienced shareholder dilution over the past year. Despite being unprofitable, the company remains debt-free and boasts strong short-term liquidity, with assets of CA$13.4 million surpassing liabilities significantly. Recent drilling results at its Philibert gold property indicate promising mineralization potential, suggesting possible resource expansion in the Chibougamau Gold District. The company's ongoing 20,000-metre drilling campaign aims to further define these resources. However, it was recently dropped from the S&P/TSX Venture Composite Index, reflecting some challenges in market perception or performance.

- Unlock comprehensive insights into our analysis of Northern Superior Resources stock in this financial health report.

- Understand Northern Superior Resources' track record by examining our performance history report.

Summing It All Up

- Click through to start exploring the rest of the 959 TSX Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXE Innovations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NEXE

NEXE Innovations

Manufactures and sells plant-based single-serve coffee pods for use in single-serve coffee machines in Canada.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives