TSX Penny Stocks Spotlight: Cronos Group And 2 Other Promising Picks

Reviewed by Simply Wall St

As the U.S. government shutdown creates uncertainty south of the border, Canada's market remains resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. Amid these conditions, penny stocks, though often seen as a relic from past market eras, continue to offer intriguing opportunities for investors seeking growth potential at lower price points. With a focus on financial strength and solid fundamentals, we explore several Canadian penny stocks that could be considered hidden gems in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.74 | CA$70.03M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$54.07M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.40 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$3.00 | CA$453.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$170.54M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.21 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 415 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally, with a market cap of CA$1.39 billion.

Operations: The company's revenue is primarily generated from its cultivation, manufacture, and marketing of cannabis and cannabis-derived products, amounting to $130.28 million.

Market Cap: CA$1.39B

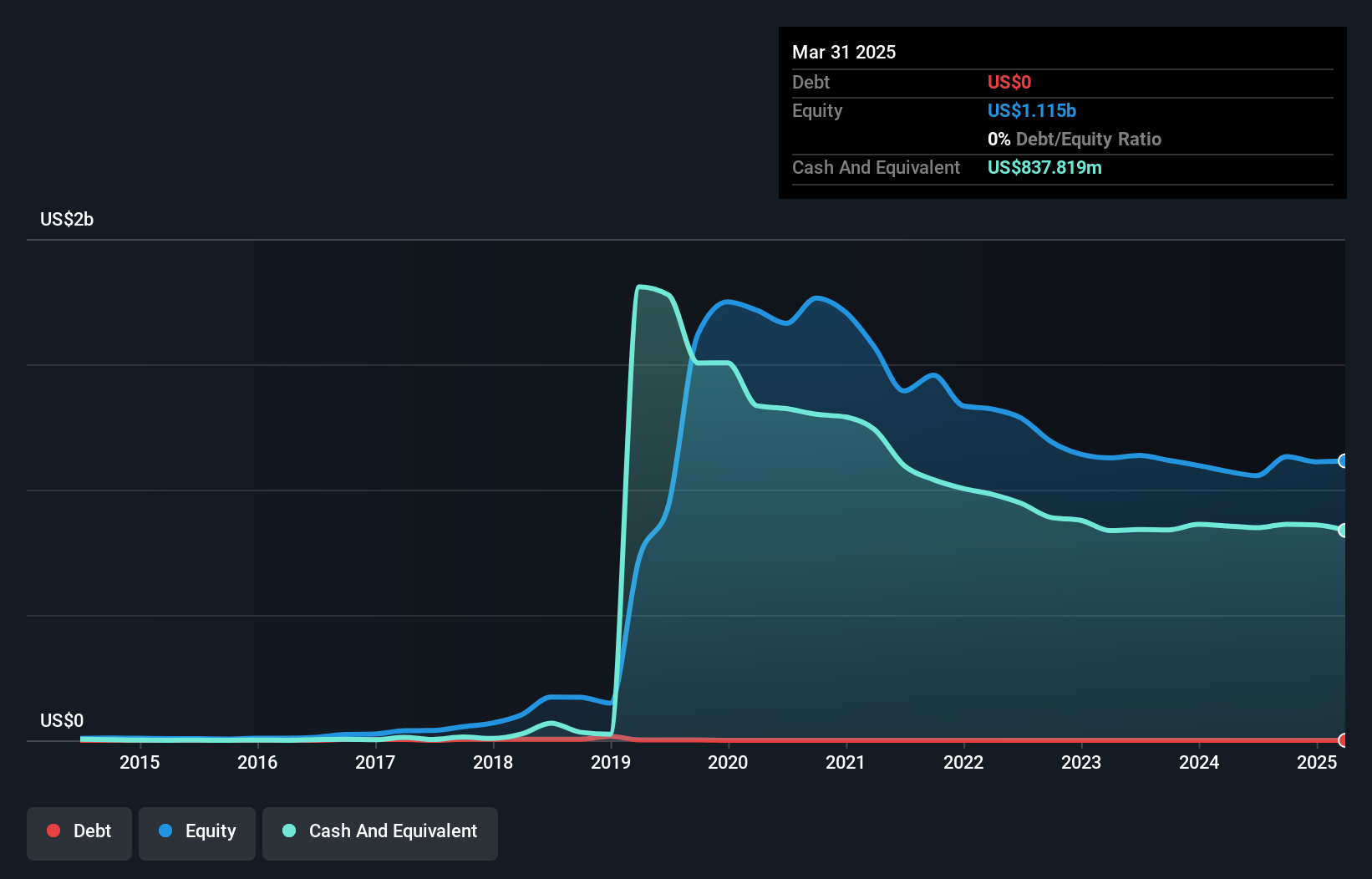

Cronos Group Inc. has recently expanded its product offerings with new multipack formats of its popular SOURZ by Spinach Fully Blasted gummies, enhancing consumer choice and convenience in the Canadian cannabis market. Despite a net loss of US$39.71 million in Q2 2025, the company reported an increase in revenue to US$33.46 million from the previous year. Cronos is debt-free with strong short-term assets exceeding liabilities, providing financial stability amid market volatility. The management team is experienced, although the board's tenure suggests relatively recent changes that may influence strategic direction moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Cronos Group.

- Understand Cronos Group's earnings outlook by examining our growth report.

Monument Mining (TSXV:MMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Monument Mining Limited is a gold producer involved in the acquisition, exploration, and development of gold and other metal properties in Canada, Australia, and Malaysia with a market cap of CA$206.86 million.

Operations: The company generates revenue of $77.62 million from its gold mining operations.

Market Cap: CA$206.86M

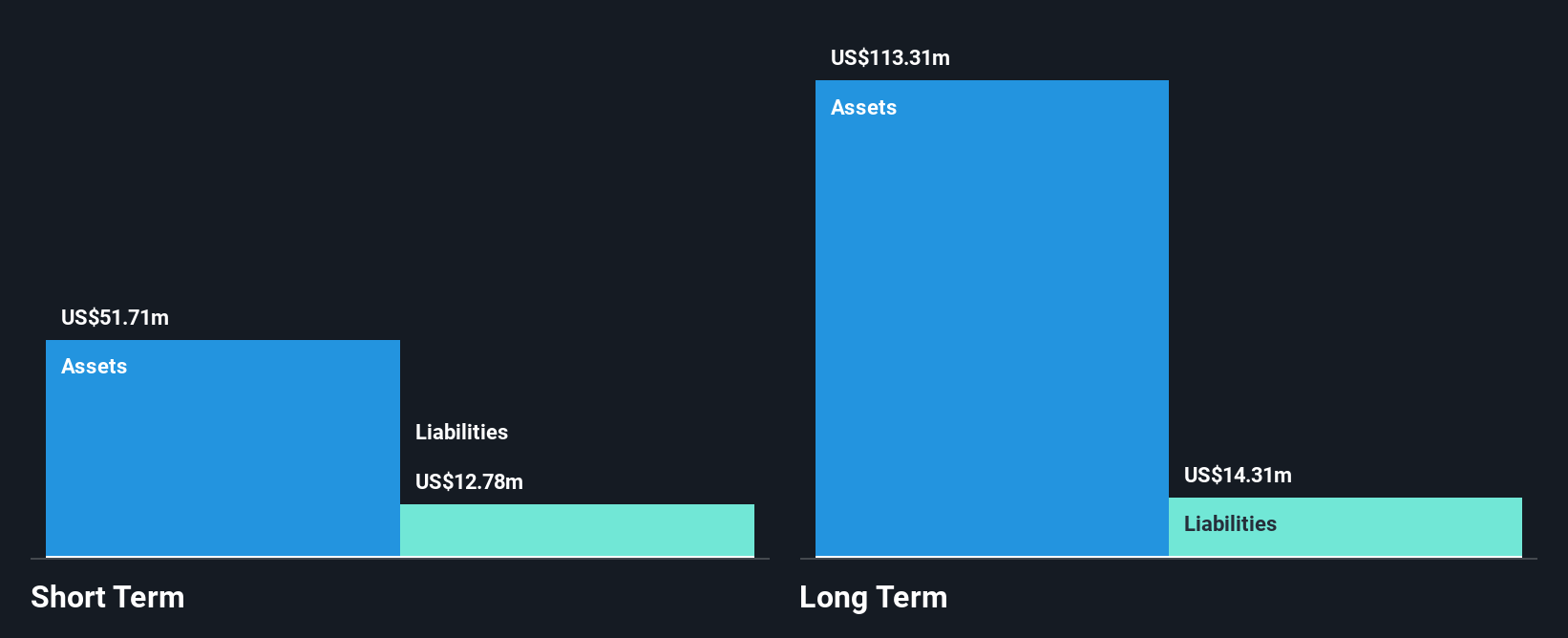

Monument Mining Limited, with a market cap of CA$206.86 million, has become profitable this year and is trading significantly below its estimated fair value. The company is debt-free, showcasing strong financial health as its short-term assets of $51.7 million surpass both short-term and long-term liabilities. Despite low return on equity at 16.6%, the board's extensive experience averaging 13.9 years provides stability in governance. With high-quality earnings and no shareholder dilution over the past year, Monument Mining's revenue is projected to grow by 8.83% annually, positioning it for potential growth in the mining sector.

- Get an in-depth perspective on Monument Mining's performance by reading our balance sheet health report here.

- Gain insights into Monument Mining's future direction by reviewing our growth report.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wealth Minerals Ltd. focuses on acquiring, exploring, and developing mineral properties in Canada, Chile, Peru, and Mexico, with a market cap of CA$45.30 million.

Operations: Wealth Minerals Ltd. has not reported any revenue segments.

Market Cap: CA$45.3M

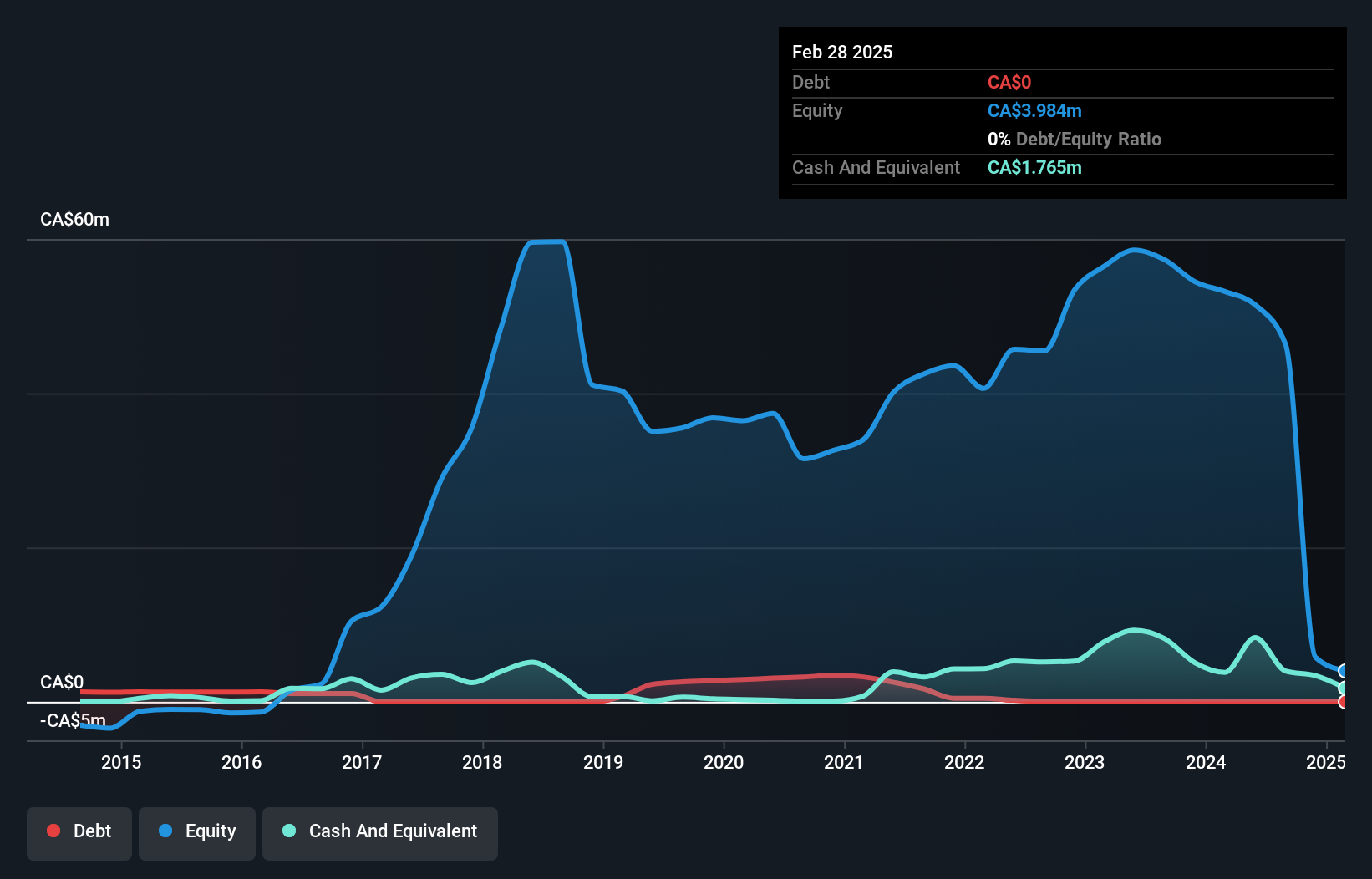

Wealth Minerals Ltd., with a market cap of CA$45.30 million, remains pre-revenue and unprofitable, highlighting its early-stage status in the mining sector. Recent private placements have bolstered its cash position, raising nearly CA$6 million through unit offerings. The company is debt-free and has short-term assets of CA$1.3 million exceeding liabilities of CA$447.1K, indicating solid financial footing despite high share price volatility over the past three months. Management and board experience averages 14.6 and 7.7 years respectively, providing seasoned oversight as Wealth Minerals advances projects like Kuska lithium in Chile with local partnerships.

- Navigate through the intricacies of Wealth Minerals with our comprehensive balance sheet health report here.

- Assess Wealth Minerals' previous results with our detailed historical performance reports.

Next Steps

- Investigate our full lineup of 415 TSX Penny Stocks right here.

- Curious About Other Options? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success